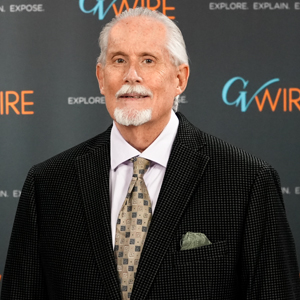

A federal grand jury charged David Hardcastle, 61, of Fresno with six counts involving conspiracy to commit wire fraud and substantive wire fraud. (GV Wire Composite/Paul Marshall.

- Federal grand jury charges David Hardcastle, 61, of Fresno with six fraud counts.

- An alleged co-conspirator, Andrew Adler, 31, of Greenwich, Connecticut, has cut a plea deal.

- The alleged fraud involves $20 million in hard money loans made before the collapse of Bitwise Industries.

Share

|

Getting your Trinity Audio player ready...

|

A federal grand injury indicted a Fresno man for allegedly defrauding investors via $20 million in hard money loans to the failed tech startup Bitwise Industries.

The grand jury charged David Hardcastle, 61, with six counts involving conspiracy to commit wire fraud and substantive wire fraud.

Acting U.S. Attorney Michele Beckwith announced the indictment on Monday.

The indictment was unsealed after Hardcastle’s arrest Monday morning.

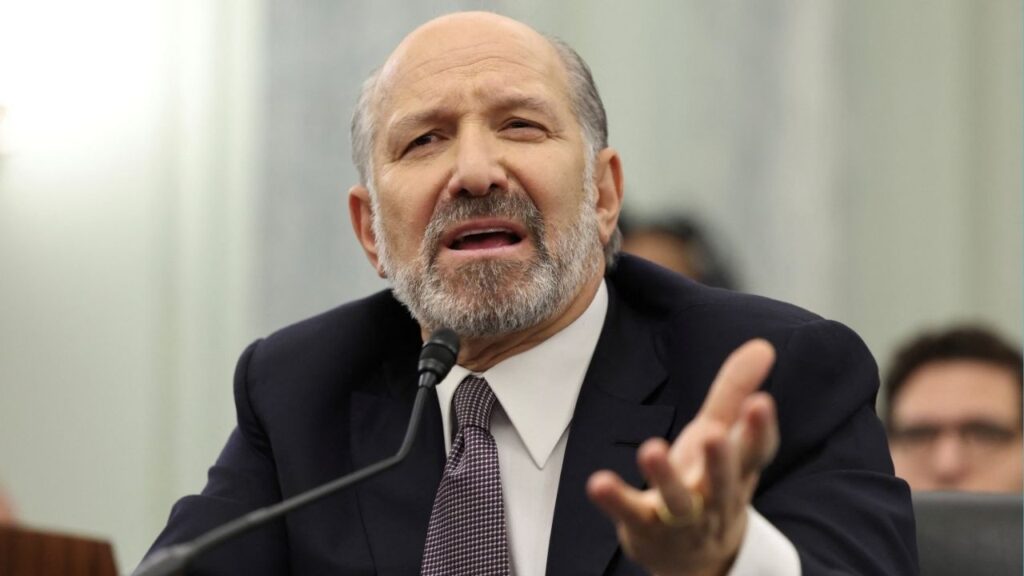

Beckwith also said that Andrew Adler, 31, of Greenwich, Connecticut, entered into a plea agreement in which he will plead guilty to conspiracy to commit wire fraud. Adler is scheduled to enter his guilty plea in court next month.

Related Story: Disgraced Former Congressman TJ Cox Pleads Guilty to Fraud

Court Documents Outline the Alleged Fraud

According to court documents, from December 2022 through May 2023, Hardcastle and his business partner Adler gave Fresno-based Bitwise approximately $20 million in hard money loans through their special purpose entity Startop Investments LLC.

They then syndicated the loans to other investors. In doing so, they altered the original loan documents to make it appear that Bitwise was obligated to pay significantly less interest on the loans than was true. They also forged the signature of Bitwise’s Co-CEO, Jake Soberal, on the altered documents. This made the loans appear less risky and more appealing to the investors, prosecutors said.

Hardcastle and Adler received tens of thousands of dollars in origination fees for the loans and stood to make millions more in secret profits from the higher, undisclosed interest rates had the loans been fully repaid.

One of the loans to Bitwise included a secure interest reserve of approximately $700,000. The investors were unaware of this reserve. Hardcastle and Adler then used these reserve funds to make an unrelated investment in another company that they operated without the investors’ authorization, and the money was not available to repay the investors when Bitwise collapsed in May 2023.

Related Story: Former Bitwise CEOs Receive Stiff Federal Prison Sentences

Bitwise Collapses, Co-CEOs Sentenced

Bitwise did not repay the loans before collapsing. As a result, the loan investors lost nearly all of their money.

In a previous case, Soberal received a sentence of 132 months, or 11 years, on Dec. 17 for orchestrating a fraud that cost Bitwise investors $115 million. Bitwise co-CEO Irma Olguin Jr. was sentenced to 108 months, or nine years. Soberal and Olguin cooperated with the government and made plea deals after being charged.

The FBI investigated the case against Hardcastle and Adler. The prosecutors are Assistant U.S. Attorneys Joseph Barton, Henry Carbajal III, and Cody Chapple.