Share

A state bill promising billions in tax breaks for California businesses challenged by the pandemic unanimously passed the Senate on Monday.

Passage came after the Biden administration assured officials that the proposal would not jeopardize the state’s federal coronavirus aid.

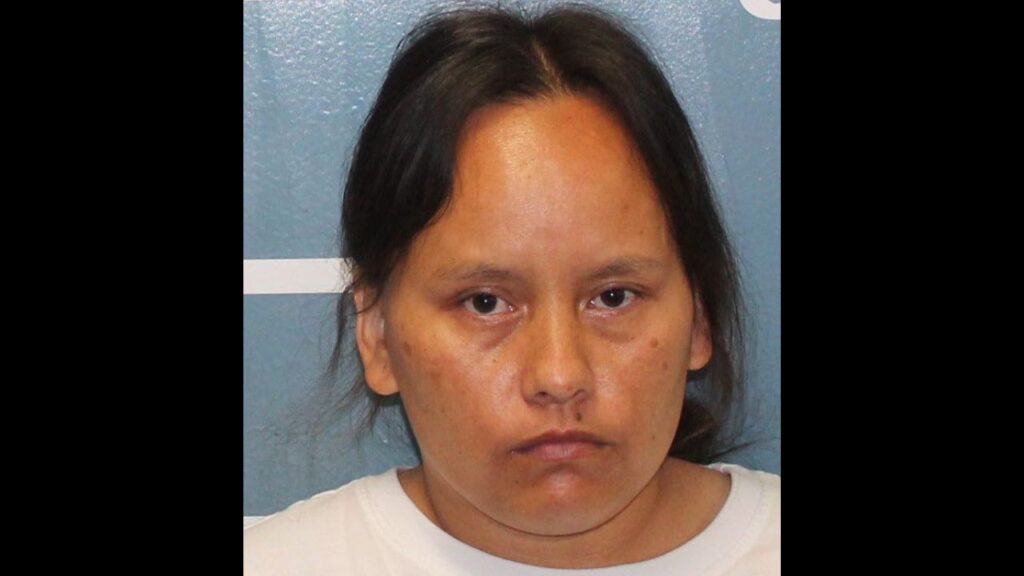

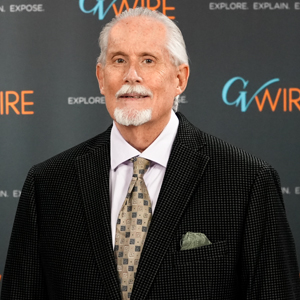

State Sen. Andreas Borgeas, a Fresno Republican, has championed help for businesses struggling to stay afloat during the pandemic. He praised his colleagues for passing legislation, Assembly Bill 80, that included elements of a bill he authored, Senate Bill 265.

Borgeas: ‘Big Win’ for State Businesses

Borgeas called Monday’s vote “a big win” for California’s businesses.

“I appreciate legislative leaders including key provisions of SB 265 into the emergency budget bill to help struggling businesses,” Borgeas said in a news release. “However, much work remains to include businesses left out of AB 80, and California needs full tax conformity to allow for full deductibility for all businesses. Those who applied for and received pandemic relief funds need every dollar to stay afloat.”

The federal government has given California companies $97 billion in loans during the pandemic, the majority of which don’t have to be repaid. Congress allows business owners to deduct expenses associated with those loans on federal taxes. But business owners in California still owe state taxes on that aid.

Lawmakers contemplated dropping the state tax provision earlier this year. But they put it off because they were afraid the proposal could cost the state billions in federal coronavirus aid. However, U.S. Treasury officials assured the state it could pass the bill without penalty.

Assembly Will Take up Bill Soon

The bill now heads to the state Assembly, where Speaker Anthony Rendon called it “one of the biggest proposed tax cuts in California history.” The state Department of Finance says the tax break will cost the state between $4.4 billion and $6.8 billion over the next six years.

Rendon’s office said that the Assembly plans to scrutinize the bill and then take it up “as soon as possible.”

“The large number of coauthors on this bill indicate its wide support in the Legislature,” he said.

Not All Businesses Benefit

However, not all businesses would benefit if the bill becomes law. The tax break is restricted to companies that are not publicly traded and those reporting a loss of at least 25% of gross receipts during at least one quarter in 2020.

“While it does exclude some businesses, it’s a very small number,” said state Sen. Nancy Skinner, a Democrat from Berkeley and chair of the Senate Budget and Fiscal Review Committee.

(Associated Press contributed to this report.)

RELATED TOPICS:

Categories