Share

The Fresno City Council parted with a troubled asset when it found a buyer for a parking structure and accompanying commercial space on the south end of Fulton Street in downtown Fresno.

For years, the structure known as the “spiral garage” for its prominent design, had been falling into a state of disrepair. The city estimated it would cost millions just to bring it up to code. The commercial space occupying the first floor and basement of the adjoining building hadn’t seen a full-time occupant since the Gottschalks department store left three decades ago.

“Once it hits appraised value, then you need to send that to a public auction and let the market dictate the actual value. You probably missed a million dollars or more.”— Developer Terance Frazier

“Once it hits appraised value, then you need to send that to a public auction and let the market dictate the actual value. You probably missed a million dollars or more.”— Developer Terance FrazierUnanimous City Council Vote

The Club One offer was presented to the council, and with a 6-0 vote in December, the garage and commercial space were sold.

Despite the city receiving what appeared to be a premium price of $1.7 million, not everyone is celebrating.

Multiple developers questioned the sales process used by Fresno officials. A city councilman ponders if an auction would have yielded an even higher price.

Over $16 Million to Build Today

The city of Fresno constructed the garage in the late 1960s, shortly after Fulton Street became Fulton Mall. Minutes from the 1968 council meeting approving the garage estimated it would cost $2.2 million to build.

That would be $16.1 million in 2018 dollars, according to the federal government’s Consumer Price Index Inflation Calculator,

The sale of the spiral garage property was conducted under provisions of the city’s Asset Management Act, authored by Lee Brand in 2014. Back then, he was a business-oriented councilman. Now, he’s the mayor.

The act allows a third-party real estate firm to manage sales of city properties. Two Fresno-based companies, Cushman & Wakefield and Pacific Commercial Realty Advisors, teamed up to win the contract to provide that service.

Appraisal Sets Value at $1.6 Million

An appraisal was performed and submitted to the city in February 2018. It said the garage is in a state of disrepair requiring $2 million in fixes. That’s on top of another $2.43 million in repairs needed for the commercial space.

It valued the entire property, with its 585-space garage and 50,000 square feet of commercial space, at $1.64 million.

When it was put up for sale, four potential buyers expressed interest. The high bid was from Brixton Capital on behalf of Club One Casino.

Club One Promises Renovations

On the day of the Dec. 6 vote, Club One’s president Kyle Kirkland told the city council that his company would invest up to $15 million to rehab the property. He said it would be a 24-month project.

The purchase agreement called for Club One to allow the Fresno Grizzlies access to the garage during baseball season. The Grizzlies’ ownership group had made a competing offer for the property.

The deal, known as a Disposition and Development Agreement, also includes a timeline requiring Club One to make specified improvements by Dec. 2020. Escrow is expected to close June 30.

If the city or Club One fails to live up to the agreement, either party can terminate the contract.

Would Auction Bring Higher Price?

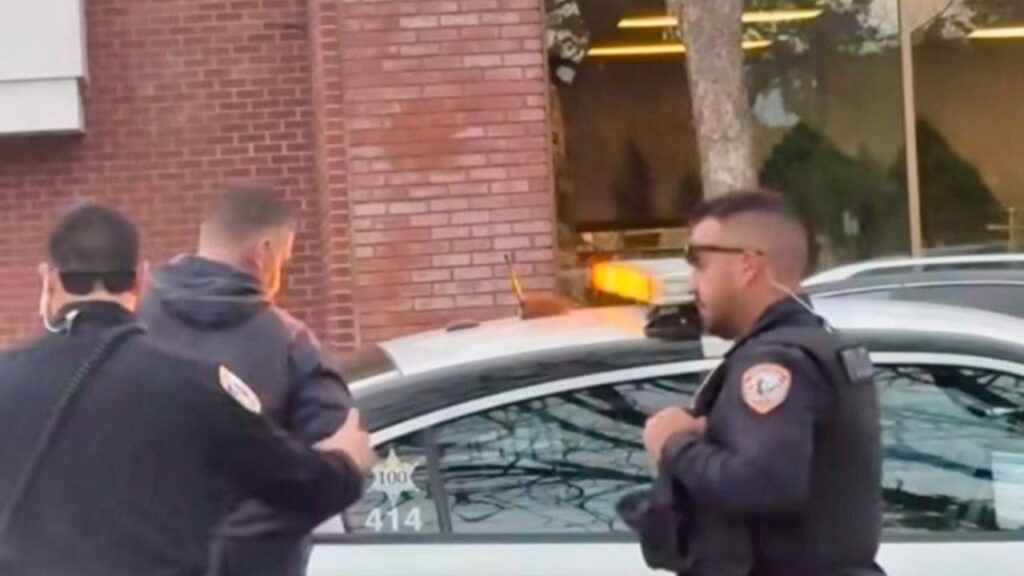

Three other companies, TFS Investments, Summa Development Group, and Fresno Sports & Events sent offer letters to the city. Two have raised questions about the sales method.

“I don’t like the way the process took place with the spiral garage,” TFS Investments CEO Terance Frazier said.

TFS offered “appraised value” in its March 23 letter to Brand. Frazier said his company was not given access to the appraisal report, thus he did not offer a specific dollar figure. He also believed the city was only selling the commercial space at the time. It was one of four city properties TFS expressed interest in purchasing in the letter.

Giving the similarity between bids, Frazier says that the city should have auctioned the garage.

“Once it hits appraised value, then you need to send that to a public auction and let the market dictate the actual value,” Frazier said. “If you take that property and put it to the market, at $1.6 million, watch how much money would come in. You probably missed a million dollars or more by, hey, I’ll just give it to this one person.”

“The one with the most money isn’t always the best user. The city needs to consider the impact to the community and what’s the benefit to Fresno, not just economic concerns.”—Will Dyck, Summa Development Group

No Opportunity to Match or Exceed Offer

Summa Development Group President Will Dyck expressed similar concerns.

“I wish I knew how the city makes its internal decision,” Dyck said. “If I knew how they did it, I’d be a much wealthier man.”

Dyck questioned the way the city sold the property, as well. He offered a letter of intent on behalf of investment partner Bitwise Industries.

“It was never sent out (as a) formal RFP (request for proposal), so there never was a bidding war. The city solicited invitations to have discussions. We started talking and all the sudden the building was sold and going to council for approval. We never had the opportunity to match or exceed the offer,” Dyck said.

“The one with the most money isn’t always the best user. The city needs to consider the impact to the community and what’s the benefit to Fresno, not just economic concerns.”

‘Not Fair to the Taxpayer’

“The process of selling public assets through an unsolicited process is not fair to the taxpayer. The taxpayer will not have confirmation that they got the best return on investment.”—Councilman Miguel Arias

“The process of selling public assets through an unsolicited process is not fair to the taxpayer. The taxpayer will not have confirmation that they got the best return on investment,” Arias said.

“We don’t really know what the taxpayers could have received in the open market because there wasn’t any public bid for the facility,” Arias said.

Other council members, though, say the process was fair and square.

Brandau: ‘They Paid Full Price’

“A group came in and met (the appraisal) price and was able to fulfill it and bought it at the appraisal price. As far as we’re concerned, they paid full price,” Councilman Steve Brandau said.

Like Brandau, Garry Bredefeld voted in favor of the sale.

“If their (other bidders’) offer was less than what was received by the city of Fresno, I’m not sure of the argument,” Bredefeld said. “If they wanted to pay more than what we accepted, they were certainly free to do that. And certainly, if they wanted to pay more than $1.7 million, I can assure you the city would have listened to that offer.”

In addition to Frazier’s offer to pay “appraised value,” city documents showed that Dyck increased his proposition to full price after reviewing the appraisal document.

Brand Praises Deal

Brand, through his communications office, referred to his prior statements in the media at the time the council approved the sale.

“Parking is a valuable revitalization tool that the city can use to help spur development,” Brand told the Fresno Bee. “This garage, in particular, has historically low utilization and revenue so selling it actually saves the city money, improves our overall parking program, and helps to create an exciting new anchor to Fulton Street.”

Brand’s office did not respond to further inquiries about the sale process or complaints about it.

City Picking Winners and Losers?

Frazier wanted the garage and retail space to complement his planned $20 million South Stadium project across the street on Fulton.

“It seems like they are picking who they want to work with and who they don’t want to work with. I don’t know if that’s the right answer for the city, for taxpayers, to be picking winners and losers. I don’t think that’s fair to the taxpayers. I think they need to get whatever of the value of the property is.”

Arias echoed those sentiments.

“When you go through an unsolicited process, and you’re not clear how you reached appraised value, it leaves plenty of room for City Hall insiders to pick winners and losers,” Arias said.

For Frazier, missing out on the transaction stings.

“I put my money where my mouth is. I think I’m doing that. So, when I see the city selling off its assets, it’s pretty heartbreaking that they won’t even come to the guy who is fully invested and has been buying stuff downtown, remodeling stuff downtown. It hurts.”

Challenging the Appraisal

Frazier scoffed at the $1.64 million appraisal conducted by Gregg Palmer of James. G. Palmer Appraisals Inc.

“That’s a joke. There’s no way. The 50,000 square-foot building is probably worth more than that.”

He said that other downtown properties have sold for $30-$40 per square foot.

Frazier says parking garages usually run $30,000 to $50,000 per stall to build. Other building industry experts GV Wire spoke to give similar ranges. The appraisal settled on $15,500 per space.

With 585 stalls, at Frazier’s low-end estimation, a replacement garage would cost $17.5 million.

“How can you say that this parking structure by itself is not worth over a million bucks? That’s crazy considering I just tried to purchase an empty parking lot across from High-Speed Rail for $2.4 million,” Frazier said.

Arias also disagreed with the valuation.

“I think it’s significantly undervalued,” Arias said. “A parking garage of that size would cost us $25-30 million to replicate.”

Others Say Price Was Fair

“The price is reflective of the current state of the structure. If anything, it might be a little high. Questioning the price of the sale ignores the fact we desperately need a user like Club One at that location.”—Bitwise’s Jake Soberal

“(The appraisal) looks fairly in line. It’s still difficult to get a good value determination since there is so much in question as to the stability of the structure and what mitigation costs will need to be incurred,” a real estate agent who isn’t involved in the sale, told GV Wire.

Dyck also agrees that the appraisal price was fair.

“I don’t have an issue with the purchase price and I have no ill will towards the Club One Casino. I hope that it is wonderful and a good anchor tenant for the end of the Fulton Mall,” Dyck said.

However, Dyck also said that had his bid been selected it would have added new businesses to downtown, as opposed to relocating an existing one.

Jake Soberal, CEO of Bitwise, also agrees with the $1.7 million price tag.

“The price is reflective of the current state of the structure. If anything, it might be a little high. Questioning the price of the sale ignores the fact we desperately need a user like Club One at that location,” Soberal said.

Categories