Share

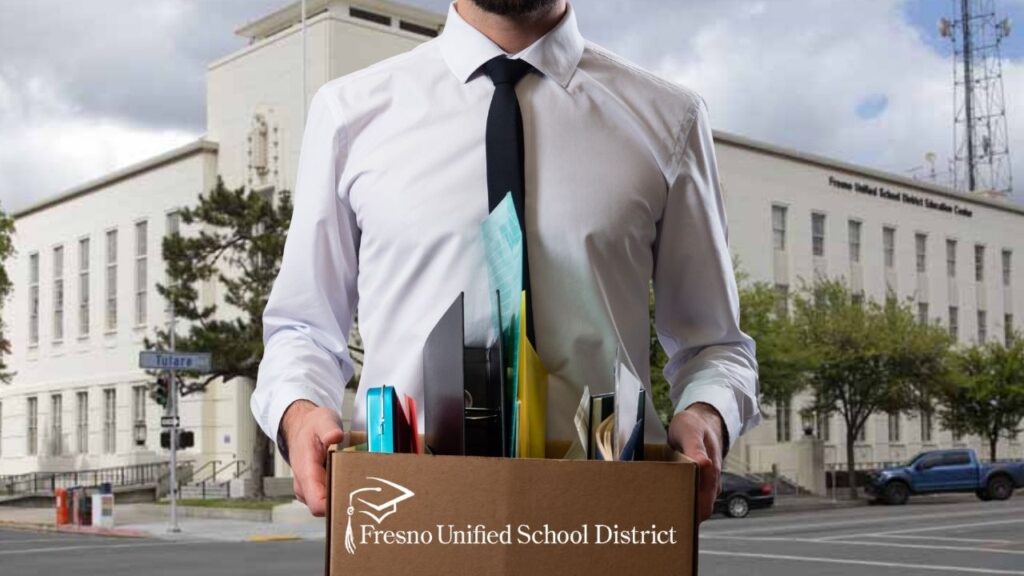

A side letter in the new labor contract between Fresno Unified School District and the Fresno Teachers Association calls for a joint study of potential ballot measures — including a parcel tax — to help the district “reduce class sizes, improve student achievement and enhance programs that expand the learning opportunities to students at all levels.”

The question of whether to place a parcel tax on the ballot rests with the seven-member Fresno Unified Board of Trustees. Implementation of a parcel tax requires two-thirds’ approval by voters. That poses a much stiffer challenge than the 55% approval demanded in California for school construction bonds.

According to the website ed100.org:

“Relatively few districts have attempted to pass a parcel tax because it must pass by a 2/3 vote, which is difficult to achieve. More than half of the parcel tax elections held since 1983 have passed, but the districts that passed them represent less than 10% of the student population of California. Most are in the San Francisco Bay Area.”

Responding to a query from GV Wire, teacher Jon Bath, chair of the FTA bargaining team, said that the district and the union “are exploring opportunities to support student achievement by reducing class sizes.”

The district and union negotiated until the wee hours of Jan. 17 to forge an agreement and avoid a strike. The side letters, district and union leaders said, were an important part of concluding more than 18 months of negotiations.

Mills Says 2018 Too Early to Consider Parcel Tax

Fresno Unified Trustee Carol Mills said Wednesday that she “would not be in favor of asking the community to support a parcel tax in 2018.”

Mills said that many property owners are unsure of how the Republican federal tax-reform package will affect them. Among the reforms was a cap on the ability to write off mortgage interest and state and local taxes. This provision is expected to increase the federal tax bite for California’s high earners and some homeowners.

“Californians need to find out how tax reform affects them first,” said Mills, who left open the door to put a parcel tax on the 2020 ballot.

Moreover, Mills said, based on Gov. Brown’s 2018-19 budget projections, Fresno Unified should have sufficient funding to accommodate the raises in the new teachers’ contract and address other issues such as class-size reductions. She estimated that Fresno Unified would receive $47 million in additional funding. About $28 million of that would go to salary increases.

Ashjian Opposes Parcel Tax

Trustee Brooke Ashjian said that he would oppose placing a parcel tax on the ballot.

“We shouldn’t levy people’s properties to make payroll,” Ashjian said. “The district is fully funded this year. This is the beginning of the tax man coming.”

More Side Letter Details

The side letter directs the joint team to explore at least three areas before writing its report:

- “Comparability of class sizes throughout FUSD and with other districts.”

- “Feasibility of class-size reductions and overage in light of facilities and teacher shortages.”

- “Viability of programs to enhance student safety and improve the learning environment.”

The side letter does not stipulate a timeline for the parcel tax feasibility study.

In addition, the side letter notes that “the District and FTA acknowledge that the proceeds generated following the successful passage of many special tax measures have been used to provide resources supporting all facets of public education, including, but not limited to, reducing class sizes, recruitment and retention of qualified teachers for hard-to-fill subject areas, establishing a Master Teacher Program, providing incentives to staff in challenging assignments and schools, etc.”

Sacramento Schools Look to 2020 for Parcel Tax after 2016 Defeat

In Sacramento, school supporters placed a $75 parcel tax on the November 2016 ballot. The measure narrowly fell short, garnering 65.3% approval, according to The Sacramento Bee. Sacramento City schools pitched it as the best way to restore art, music and counseling programs cut during the recession.

A contract between that district and its teachers, which was reached in November just ahead of planned teachers strike, includes a plan to put a measure on the 2020 ballot to provide supplementary funding for arts, music and sports programs, The Sacramento Bee reported.

Finally, here is what ed100.org says about parcel taxes:

“Passing a local tax measure is hard. To succeed, local campaigns in support of schools must engage whole communities in public education issues, challenges, and opportunities. It’s door-to-door, handshake-to-handshake work. If you are thinking about it, start with a visit to the registrar of voters in your county to understand the process.”

Categories

Fresno County Authorities Seek Help Locating Missing Woman