Share

WASHINGTON — Stuck in the grip of a viral pandemic, the U.S. economy grew at a 4% annual rate in the final three months of 2020 and shrank last year by the largest amount in 74 years.

For 2020 as a whole, a year when the coronavirus inflicted the worst economic freeze since the end of World War II, the economy contracted 3.5% and clouded the outlook for the coming year. The economic damage followed the eruption of the pandemic 10 months ago and the deep recession it triggered, with tens of millions of Americans left jobless.

Thursday’s report from the Commerce Department estimated that the nation’s gross domestic product — its total output of goods and services — slowed sharply in the October-December quarter from a record 33.4% surge in the July-September quarter. That gain had followed a record-shattering annual plunge of 33.4% in the April-June quarter, when the economy sank into a free-fall.

The pandemic’s blow to the economy early last spring ended the longest U.S. economic expansion on record — nearly 11 years. The damage from the virus caused GDP to contract at a 5% annual rate in last year’s January-March quarter. Since then, thousands of businesses have closed, nearly 10 million people remain out of work and more than 400,000 Americans have died from the virus.

The government’s report showed that consumer spending, which accounts for about 70% of the economy, slowed sharply last quarter to a 2.5% annual gain from a 41% surge in the July-September quarter, when the economy had staged a powerful initial comeback. Last quarter’s economy was instead driven in part by business investment and housing, which has been a star performer during the past year, reflecting record-low mortgage rates and a demand for more household space. Housing grew at a sizzling 33.5% annual rate, business investment at a 13.8% rate.

The Estimated Drop in GDP for 2020 Was the First Such Decline Since a 2.5% Fall in 2009

Government spending, though, shrank at a 1.2% rate last quarter, after an even bigger 4.8% drop in the July-September quarter. State and local governments have started to resort to layoffs to deal with falling tax revenues during the recession.

The estimated drop in GDP for 2020 was the first such decline since a 2.5% fall in 2009, during the recession that followed the 2008 financial crisis. That was the deepest annual setback since the economy shrank 11.6% in 1946, when the economy was demobilizing after World War II. The government’s report Thursday was its first of three estimates of growth last quarter; the figure will be revised twice in the coming weeks.

The outlook for the 2021 economy remains hazy. Economists warn that a sustained recovery won’t likely take hold until vaccines are distributed and administered nationwide and government-enacted rescue aid spreads through the economy — a process likely to take months.

On Thursday, the government reported that applications for unemployment benefits declined last week but remained at a historically high 847,000, evidence that companies keep cutting jobs as the pandemic continues to rage. Before the virus erupted in the United States in March, weekly applications for jobless aid had never topped 700,000, even during the Great Recession.

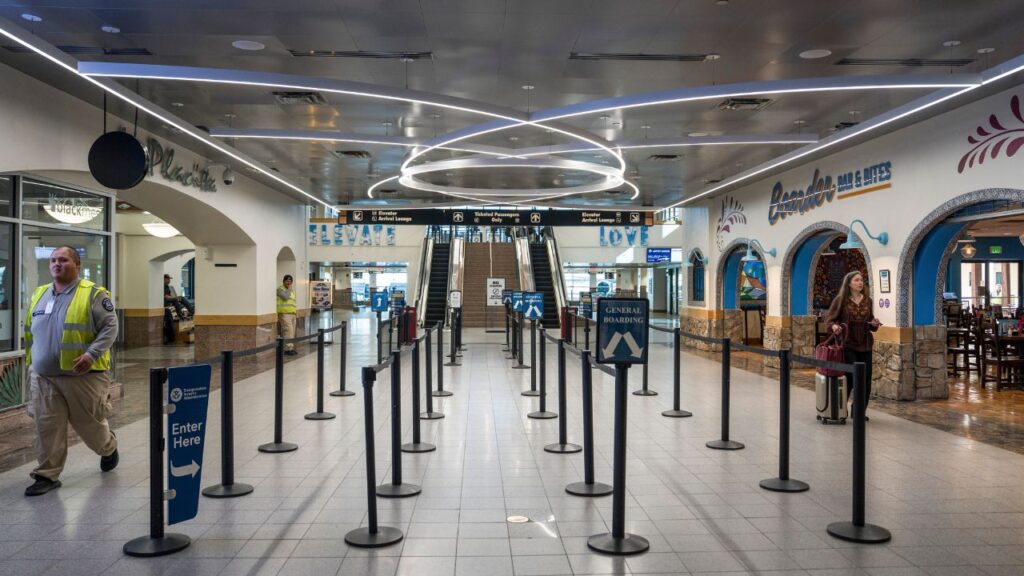

The Federal Reserve took note of the economic threats after its latest policy meeting ended Wednesday. The Fed kept its benchmark interest rate at a record low near zero and stressed that it would keep pursuing its low-rate policies until a recovery is well underway. The Fed acknowledged that the economy has faltered in recent months, with hiring weakening especially in industries affected by the raging pandemic, notably restaurants, bars, hotels and others involved in face-to-face public contact.

Hiring in the United States has slowed for six straight months, and employers shed jobs in December for the first time since April. The job market has sputtered as the pandemic and colder weather have discouraged Americans from traveling, shopping, dining out or visiting entertainment venues. Retail sales have declined for three straight months.

Many Economists Warn That Without Further Support, the Economy Risks Succumbing to Another Recession

Last month, the government enacted a $900 billion rescue aid package, and President Joe Biden is pushing for lawmakers to follow up by approving his $1.9 trillion plan for further economic help. Biden’s proposal has met resistance, though, from many Republicans who contend that the cost is too high and some of its benefits misplaced.

Many economists warn that without further support, the economy risks succumbing to another recession. They note that much of the aid for individuals from the $900 billion package is set to expire in mid-March.

“The economy is still struggling,” said Mark Zandi, chief economist at Moody’s Analytics. “How strong the economy is later this year will depend on how the virus evolves and the effectiveness of the vaccines and mitigation efforts.”

Zandi predicted that the economy will expand at a 4.4% annual rate in the current quarter and achieve annual growth rates later this year above 5%. But he cautioned that his forecast is based on the enactment of further federal economic relief, and he expects Biden initially to win congressional approval for only about half his $1.9 trillion proposal.

About 5 million jobs, Zandi estimates, will never return, forcing the unemployed in such industries as restaurants and bars to find work in other sectors.

“We have lost so many low-paying service jobs at restaurants, hotels and in transportation,” said Sung Won Sohn, an economics and business professor at Loyola Marymount University in Los Angeles.