Share

|

Getting your Trinity Audio player ready...

|

Twenty years after the city and county of Fresno decided on how to divide property taxes, the city says the amount isn’t enough to cover the cost of police and fire services in the city.

So the city wants a new deal, and until the two governments can reach an agreement, future home buyers and apartment dwellers in newer areas of Fresno are being required to pay for the shortfall.

Under the most recent tax-sharing agreement between the city and county, made in 2002, the city received 38% of property taxes generated within its boundaries while the county kept 62%.

That deal expired in late 2020 and the city and county are now at odds over the city’s demand to evenly split future property tax revenues 50/50. Until a new agreement is reached, the city is using a special property tax assessment to collect more money from housing projects being built in newer areas of Fresno.

Some Homeowners to Pay $164 More in Property Taxes Every Year

In California, counties collect property taxes and use them for such things as jails, libraries, and social services. Cities receive a portion of the money to build and maintain infrastructure like roads, and to provide fire and police services to city residents.

A study commissioned by city leaders claims the current tax split with the county is not enough to cover its costs for policing and fire protection, according to Sontaya Rose, director of communications with the city.

To make up the deficit, Fresno officials are tacking an additional $164 a year in property taxes onto homes that are built, going forward, in areas of the city annexed after 2002. That money will go exclusively to the city. Fresno City Councilmembers decided to start applying the tax in November 2022.

Apartment builders are being required to pay $112 more a unit in tax, a cost that will almost certainly get passed on to tenants.

Those assessments are being made through a Community Facilities District taxing structure. There are a number of existing CFDs that the city applies when annexing land into its boundaries. The latest one is CFD 18.

These CFDs are more formally known as Mello-Roos districts, through which property owners can vote to tax themselves to finance the costs of local services they receive or infrastructure they need. But since homes in planned developments targeted by the city haven’t yet been built, only the developer gets a vote. And if the developer does not agree to establish a CFD required by the city, the project cannot move forward.

CFD 18, in particular, has come under scrutiny from the local homebuilding industry, which is questioning the city’s formula for assessing additional taxes on several new housing and apartment developments.

In fact, calculations from builders show revenue from the new homes affected by the tax would actually bring in more revenue than the city says it needs, without a special CFD assessment. Beyond that, builders say that these extra taxes add to the already high cost of housing in the state.

Brian Spaunhurst, executive officer with the Fresno Local Agency Formation Commission, estimates about 6,600 acres of residential land is impacted by the CFD 18 dispute.

Existing residential properties aren’t being charged the tax. Only housing being built in developments going forward in specific areas of the city would be subject to higher taxation.

The city is defending the use of the CFD structure.

“A tax sharing agreement matching the historical agreement (50/50 split between the city and county) would eliminate the need for the public safety CFD in the new growth areas of the City,” said city spokeswoman Sontaya Rose in an email to GV Wire.

But multiple sources say negotiations between the city and county have ground to a halt. Tax agreements for both Sanger and Huron have also expired. Other cities look to how much money Fresno receives when deciding how much to ask for themselves.

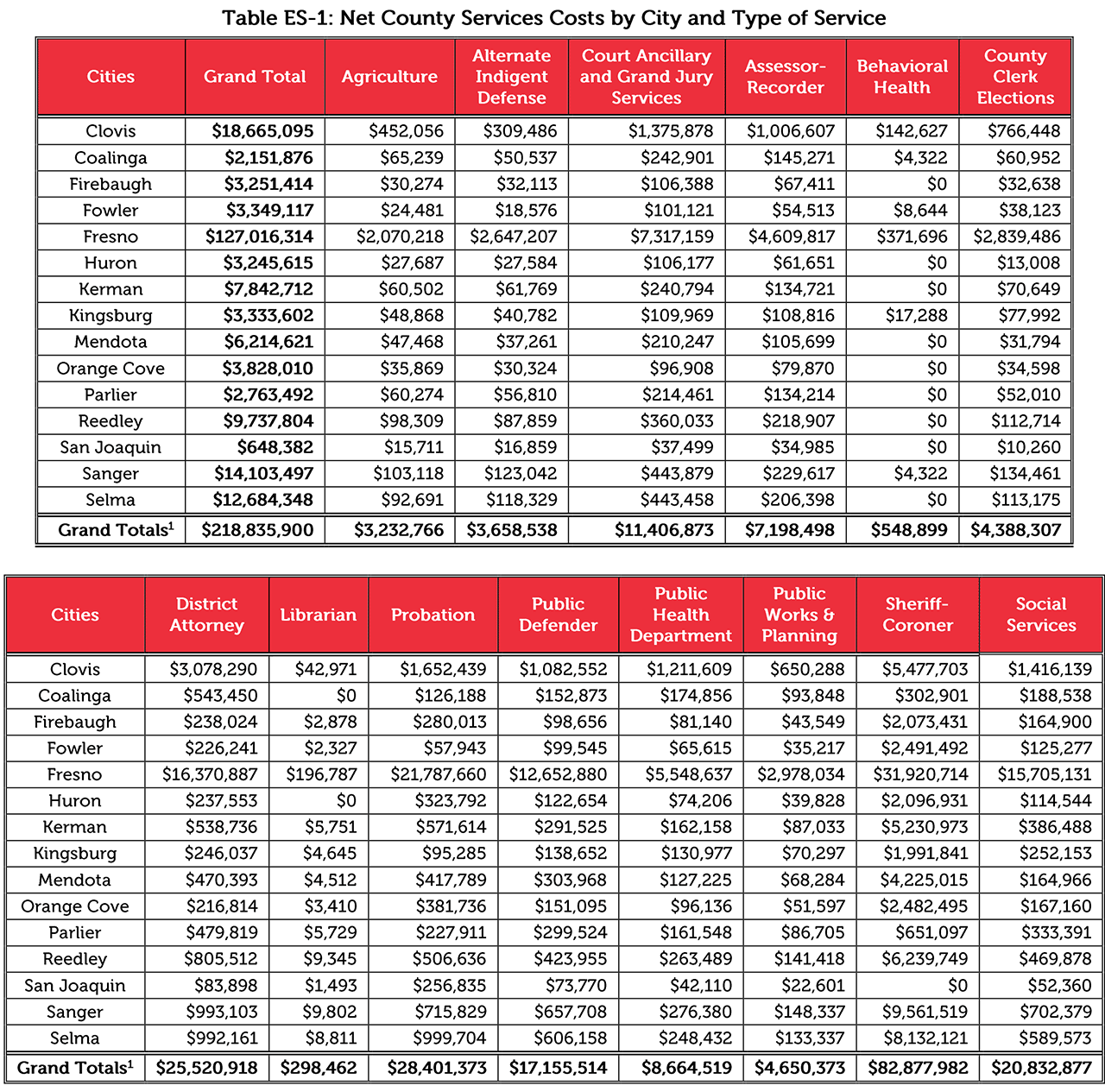

Fresno County leaders say they are opposed to dividing property taxes 50/50 with the city. Supervisor Nathan Magsig said the existing 38/62 split is adequate considering the city’s disproportionate use of county services.

“When you look at the numbers, the city of Fresno right now receives a disproportionate amount of services from the county,” Magsig said. “So, for the city to come back and say they want a 50/50 split, for me to able to support something like that, they would need to reduce the services that they currently are receiving to justify that. And they simply cannot.”

Homeowners Would Pay Enough If City Calculated Correctly: Builders

The city of Fresno pegs the average cost of a home at $399,000. That’s the value it used to determine that more tax revenue is needed to fund police and fire protection in those new areas.

But that average is based on the sale of all Fresno homes. Builders say the numbers don’t accurately reflect the price of new homes.

“The value of a new home is considerably more than a home built 10 years ago,” said Mike Prandini, president of the Building Industry Association of Fresno Madera Counties. “It’s considerably more.”

GV Wire publisher Darius Assemi is a member of the BIA in his role as president of Granville Homes.

Using a different metric from Zillow more in line with the kind of homes built at new developments — that average comes out to $503,476, according to a letter from attorney Jeffrey Reid with McCormick Barstow LLP on behalf of the BIA.

That sale price exceeds the city’s estimation by 26%. That higher median sales price would increase the city’s share of annual property taxes by $176 per home, $12 more than the $164 needed, Reid said.

The city also assumes the average household income to be $101,908, generating $200 a year in sales tax revenue based on spending models. Reid said income levels in new home developments are closer to $150,000 and would thus bring in $295 a year in sales tax, using the city’s formula.

“If you use the calculation of the value of a new home, it generates more than enough additional revenue to pay for the services, especially within the current city boundaries,” Prandini said.

Data also show new home developments generate less demand for fire services. A heat map from the city of Fresno shows the largest number of fire calls in the first half of 2023 were concentrated in Fresno’s older neighborhoods. Fresno’s fire code also requires new homes and apartments to be equipped with fire sprinklers, further reducing risk.

Multiple calls made to Fresno city councilmembers were not returned. Fresno City Councilman Garry Bredefeld did respond but declined to comment.

Apartment Builder Won’t Build in Fresno Anymore

Apartment units would be assessed differently under CFD 18. Apartment builders would be on the hook for paying $112 a unit. Those added taxes would filter down into rents, said Rick Ginder, principal at Ginder Development.

Ginder is one of the most prolific apartment builders in Fresno, building in the city since 1983.

While the dollar amounts by themselves may not seem like much in the overall scheme of things, Ginder said policies like the CFD-18 proposal led to his decision to not build in Fresno anymore.

“It’s just another issue that I have trying to build apartments in Fresno. So, it’s just one more thing that makes it hard, makes it expensive. Everybody wants housing, but you know we pay so much in impact fees and school fees,” Ginder said. “This new policy … just adds one more thing to make it harder.”

Fresno officials keep asking for more while not providing enough service, he said. Also, apartment and home builders have been told the city’s planning and development department is understaffed so inspections are delayed, which cost money, he added.

Inspections for fire sprinklers at a new development took six to eight months to finish. Ginder said he can’t deal with that anymore.

“They charge us fees and they’re not staffed adequately to do inspections when you need them,” Ginder said. “And that doesn’t happen in other jurisdictions. So I build in Merced, I build in Tulare County and I’ll just keep doing stuff there and you know, not in Fresno.”

Magsig: Fresno Share of Services Necessitate 32% Share

Fresno County funds library services, the sheriff’s office, the Fresno County Jail, the Fresno County Department of Social Services, the ag commissioner’s office, and more.

Fresno city property owners generate 64% of the county’s property and sales tax income, according to a 2020 study from the county. But its tax contribution only makes up 42.3% of its demand.

Magsig said a 50/50 split give the city of Fresno a subsidy that the other 14 cities in the county don’t receive.

“For me, the current tax sharing agreement formula that the city has been using in the past is 100% adequate, just based up on the amount of usage that the city of Fresno uses of county services,” Magsig said.

RELATED TOPICS:

Categories

Trump Says Netanyahu Should Be Pardoned for Corruption

Judge Temporarily Blocks Hegseth from Punishing Kelly for Video

Fresno County Doesn’t Have a Hotel Tax. That Could Change

Homeland Security Shutdown Draws Nearer as Democrats Block Funding