Futures-options traders work on the floor at the American Stock Exchange (AMEX) at the New York Stock Exchange (NYSE) in New York City, U.S., August 22, 2025. (Reuters/Brendan McDermid)

Share

|

Getting your Trinity Audio player ready...

|

Wall Street’s main indexes fell to their lowest in a week on Thursday, as fresh economic data and remarks from a Federal Reserve official tempered optimism around further rate cuts.

Initial claims for state unemployment benefits dropped 14,000 to a seasonally adjusted 218,000 for the week ended September 20, data from the Labor Department showed. Economists polled by Reuters forecast 235,000 claims for the latest week.

“The real question will be: now that the jobless data is less bad than originally anticipated, does that mean the Fed might not cut (rates) in October and December, but possibly just wait until December,” said Sam Stovall, chief investment strategist at CFRA Research.

Investors scaled back their expectations of a 25-basis-point rate cut in the Fed’s October meeting to 83.4%, from about 92% on Wednesday, according to the CME FedWatch Tool.

The U.S. central bank lowered interest rates by 25 bps last week, its first cut since December, and had signaled more reductions ahead.

But Chicago Fed President Austan Goolsbee said on Thursday he was uneasy with cutting rates too quickly, flagging risks about inflation flaring up.

At 09:58 a.m. ET, the Dow Jones Industrial Average fell 195.89 points, or 0.42%, to 45,926.27. The S&P 500 lost 56.81 points, or 0.86%, to 6,581.00, while the Nasdaq Composite was down 268.81 points, or 1.19%, at 22,228.72.

The S&P 500 technology stocks fell 1.2%, with Nvidia and Broadcom down 1.3% and 2.8%, respectively.

The moves led to a 2.2% decline in the broader semiconductor index, and weighed on the tech-heavy Nasdaq.

Communication services stocks fell 1.1%, pressured by Alphabet and Meta Platforms, down 1.7% and 1.4%, respectively.

The pullback underscores the fragility of the September rally, revealing how sensitive markets remain to even subtle shifts in economic indicators and Fed messaging.

With valuations still high, equities are vulnerable to any signs that the Fed may slow its pace of easing rates. That makes the upcoming economic data crucial in shaping market sentiment.

Investors are now focused on Friday’s release of the Personal Consumption Expenditures index, the Fed’s preferred inflation measure, which could determine expectations for the path of interest rates.

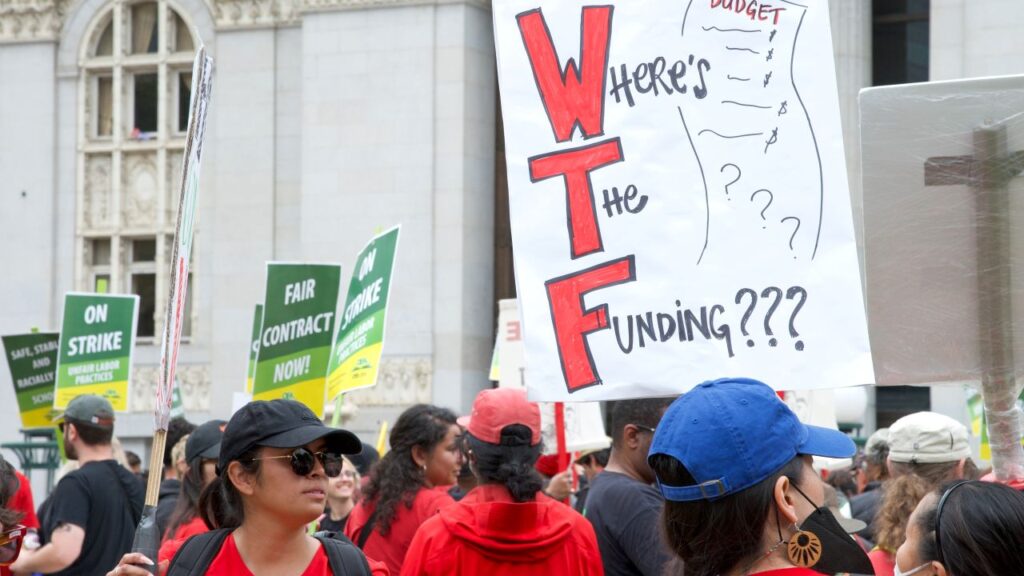

Potential Government Shutdown

A potential government shutdown in Washington, where budget negotiations have so far failed to yield an agreement, only aggravated the worries.

Analysts warned that a prolonged shutdown could disrupt data releases critical for assessing economic trends, injecting fresh volatility into an already uncertain backdrop.

Among stocks, Carmax hit more than a five-year low, sliding to the bottom of the S&P 500, after the used-car retailer reported lower second-quarter profit due to waning demand. Its shares were last down 22.3%.

Oracle slipped 4.7% following a regulatory filing that showed the company was aiming to raise $18 billion in debt.

Intel rose 2.4%, a day after Bloomberg News reported that the chipmaker has approached Apple about securing an investment.

Brokerage firm Seaport Research Partners upgraded Intel’s stock to “neutral” from “sell”.

IBM rose 2.8% to top the benchmark index, after its partnership with HSBC for trial use of quantum computers to aid bond trading yielded promising results.

Declining issues outnumbered advancers by a 3.48-to-1 ratio on the NYSE and by a 4.42-to-1 ratio on the Nasdaq.

The S&P 500 posted eight new 52-week highs and eight new lows, while the Nasdaq Composite recorded 24 new highs and 50 new lows.

—

(Reporting by Niket Nishant and Sukriti Gupta in Bengaluru; Editing by Shilpi Majumdar)