For the first time, Fresno County departments, including the sheriff's office and the district attorney's office, presented publicly to supervisors how financial changes affected budgets. (GV Wire Composite/Paul Marshall)

- Fresno County staff presented supervisors on Monday with a $5.3 billion budget.

- President Trump's Big Beautiful Bill will limit many county services, including CalFresh and Medi-Cal.

- Supervisors want to fill vacancies in the district attorney's office, which is having trouble attracting prosecutors.

Share

|

Getting your Trinity Audio player ready...

|

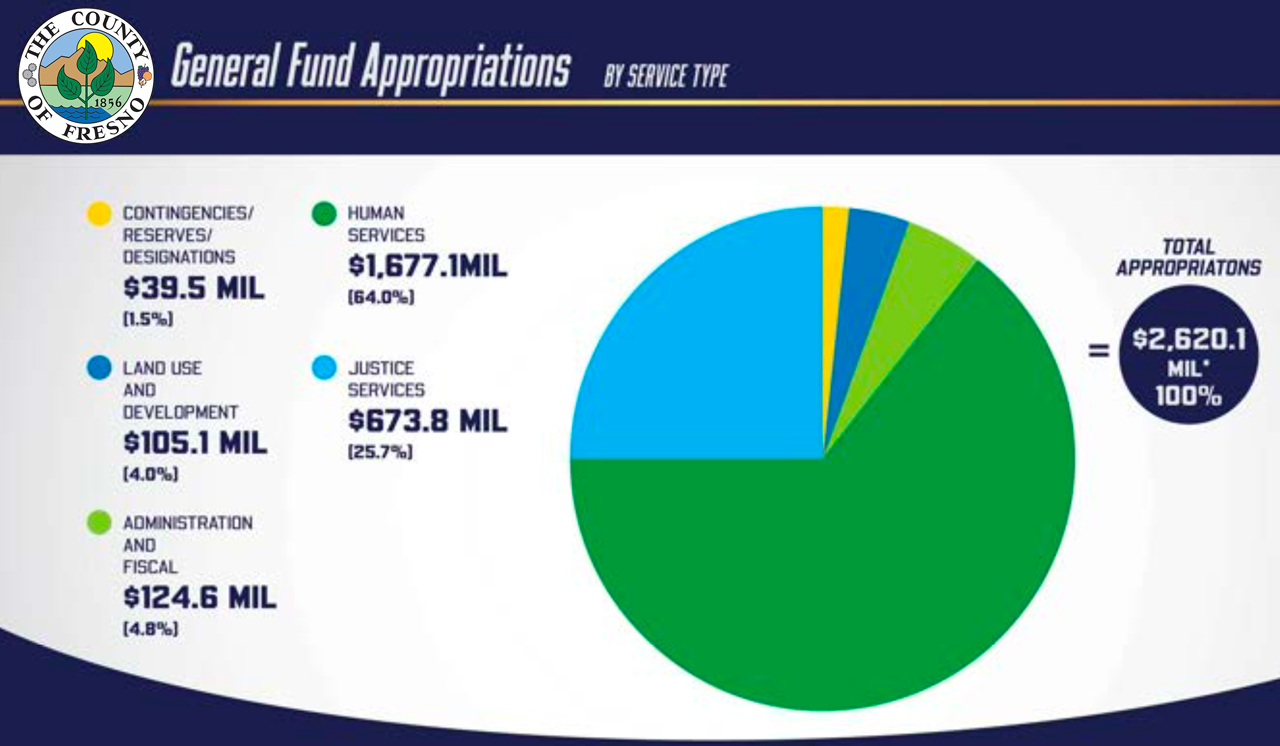

On Monday, Fresno County Supervisors unanimously approved a proposed $5.3 billion budget.

This year, the county’s biggest departments presented to supervisors publicly how financial changes will affect operations and people receiving social services.

County department heads had to deal with sales tax declines and payroll costs outpacing increased property tax revenues, said County Administrative Officer Paul Nerland.

Supervisors earlier this year instructed them to cut 5% from their budgets.

Already, departments have limited hiring, Nerland said. President Donald Trump’s Big Beautiful Bill also brought widespread changes to social services.

Meanwhile, supervisors want to fill vacancies in the district attorney’s office — a department struggling to attract prosecutors.

To free up additional money, county staff budgeted for higher increases in property tax revenue and reduced contributions to workers compensation and other insurance contributions. Nerland said surpluses in those areas allowed them to reduce contributions to the fund.

Even with those anticipated gains, increases in contract costs and salary increases put the county in a tight spot.

“Things are so tight because the cost increases have exceeded that revenue growth for this next budget,” Nerland said.

Sales Tax Revenue Declining After COVID Boom

Fresno County had been in top 10 counties for fastest growing revenue for sales tax, but it has since been flattening, Nerland said. Amazon distribution centers greatly boosted sales tax revenues when they first arrived. Proposition 172’s half-cent sales tax boosted revenues to $111.8 million in 2021-22 from $86.4 million the year before. The next year, the county got $119 million in sales tax.

Amazon’s addition of micro distribution centers throughout the state, however, has eaten away market share and those revenues, Nerland said. This year, the county is anticipating $112.9 million, roughly the same as last year. Those diminishing receipts impact the sheriff’s office, the district attorney’s office, and the probation department.

“Those few discretionary dollars that fund public safety are put under pressure when this is not growing,” Nerland said.

This year, the county implemented initiatives to go after catalytic converter thefts and copper wire thefts.

“It will continue to be important to seek other revenue opportunities to support these increases in costs such as ensuring that the general fund is sufficiently capturing discretionary interest.” said county budget director Paige Benavides.

Uncompensated Care Could Reduce Services at Hospitals and Clinics

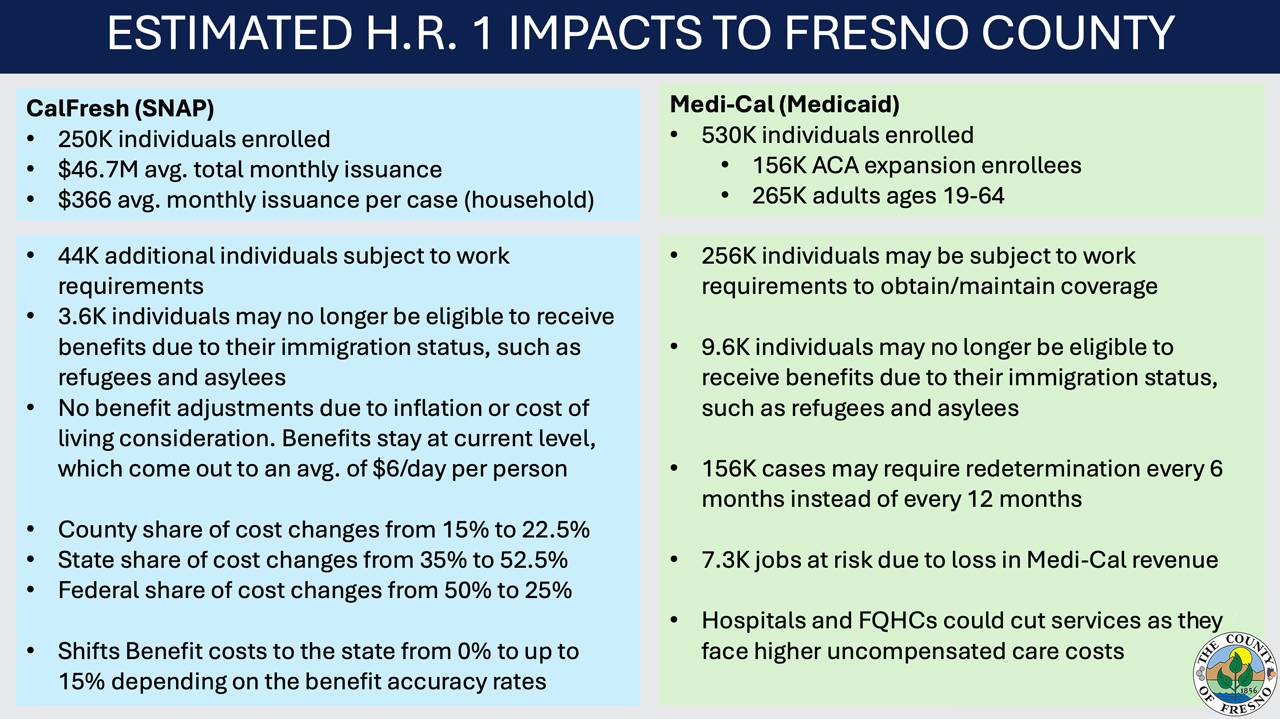

At the Fresno County Department of Social Services, the Big Beautiful Bill changed eligibility and federal and state contributions, said director Sonja Bugay.

And while payments to the county have decreased, changes to federal law mean more reporting requirements more often, she said.

“What we’re seeing is that our state revenue will be reduced, our federal revenue will be reduced, and our workload and eligibility staff is going to be higher,” Bugay said.

Much of that work is evaluating who of the 530,000 receiving Medi-Cal and 250,000 receiving CalFresh will be eligible after work requirements kick in. The county’s population is estimated at 1,020,768.

In January 2027, work requirements will begin. Medicaid has never had work requirements before and those are still being determined, Bugay said.

Estimates are that half of the 530,000 on Medicaid could be subject to work requirements to keep or get coverage.

Thus, hospitals and clinics could cut services as they face higher uncompensated care costs.

Work Requirements for CalFresh/SNAP Benefits Begins January 2026

CalFresh work requirements will begin first, Bugay said.

Of the 250,000 receiving SNAP, 44,000 may need to find jobs to keep their coverage. About 3,600 people may lose coverage because of their immigration status. Bugay said all of those people have some sort of legal status whether it be refugee status or parolee.

H.R. 1 limited benefits to citizens and legal permanent residents, eliminating many refugee populations.

Beginning January 2026, able-bodied adults without children younger than 14 — H.R. 1 reduced that from 18 years old — will have to find jobs to keep coverage.

The definition of “able-bodied adult” is still being determined, Bugay said.

“What it does mean is that people will have to prove they are employed 80 hours, what we anticipate to be, 80 hours a month,” Bugay said.

County and state contribution will increase as federal share decreases from 50% to 25%.

“As we get detailed regulations across the board we will know what ultimate impacts will be on CalFresh and Medicaid populations in our county,” she said.

People receiving benefits can still appeal any loss of entitlements. Bugay said in the last year-and-a-half the number of appeals has doubled.

Prop. 36 Rollout Slow, Prosecutors Impacted by California Laws

While 2024’s Prop. 36 gave tools to the Fresno County District Attorney’s Office to prosecute criminals, assistant district attorney Steve Wright said Sacramento laws continue to make it harder to go after criminals. At the same time, low pay for prosecutors and increased caseloads make it difficult to fill vacancies.

“This wave of refusing to hold criminals accountable for their actions has done several things — one thing it’s done is create more crime,” Wright said.

After accounting for the roughly $20 million brought in by the district attorney’s office, net cost to run the department is expected to grow to $35.5 million — about a $1.2 million increase from last year, Wright said.

The governor is reducing prison populations and closing prisons, letting criminals out early, Wright said. That means more criminal activity committed by people not being held accountable, he said. It’s also added work for prosecutors trying to keep criminals in prisons.

Proposition 36, approved by voters in 2024, gave leeway to prosecutors to pursue felony charges to many nonviolent offenders. Wright said implementation of the rule has been slow, but some of that has been due to many officers not used to having that ability.

“We as an office have been trying to get out to some of the smaller agencies and the Fresno-Madera chief’s meetings and put out some training, some education to get the officers on the street more updated on what the law is,” Wright said.

Recruiting Prosecutors Is Difficult

Recruitment for the district attorney has also been difficult.

The district attorney’s office currently has 13 vacancies. That’s resulted in increased caseloads and many administrators such as Wright having to go to court rather than carry out day-to-day tasks. The public defender’s office also reported difficulties recruiting with 20 vacancies of their own.

“We are a part of public safety and we are part of ensuring that people’s freedom and liberty — that are at stake — that government does what it needs to do in holding them accountable,” said Public Defender Antoinette Taillac. “And we do have people that are innocent, and that is horrible when someone is innocent and in jail. And we go all out for those cases.”

Both departments said they use job fairs to finds candidates.

The district attorney’s office conducted exit interviews with attorneys and swelling caseloads and lower pay regularly come up, Wright said. The district attorney recently lost four experienced prosecutors to the Fresno City Attorney’s office, which pays $30,000 to $50,000 more a year and allows two days of telework a week.

Fresno City Attorney Andrew Janz, however, told GV Wire three of the four attorneys didn’t receive a raise.

GV Wire uncovered a direction from District Attorney Lisa Smittcamp saying it would no longer assist the Fresno City Attorney’s office with cases as the city attorney is adequately staffed.

The public defender’s business manager, Angel Lopez, said promotion opportunities and lower salaries than in other nearby counties puts their office at a disadvantage.

Wright did not have a dollar figure for how much would be needed to make the district attorney’s office competitive. Supervisor Garry Bredefeld said Smittcamp should meet with Nerland this coming year to find out what that dollar figure should be, “otherwise we’re just going to continue to see this,” Bredefeld said.

Board President Buddy Mendes said had those positions been filled, the district attorney’s office would have had to account for larger budget expenses.

“When you have areas where you can go work somewhere else for a whole lot more money and less stress, I think it’s incumbent upon (supervisors) to make it much more competitive for people to work in the DA’s office,” Bredefeld said.

Sheriff’s Office Expects a 204% Increase in Overtime

The Fresno County Sheriff’s Office expects a 20% increase in costs for the upcoming year, climbing to $202.8 million, said Fresno County Sheriff John Zanoni.

The spike stems from higher contractor costs and overtime expenses to meet demand. The sheriff has $26.3 million budgeted for overtime costs — a 204% increase from the year before.

Many of those overtime overruns come from demands to respond to emergencies such as wildfires, flooding, and major investigations into gangs.

Zanoni said the figure more realistically anticipates overtime costs.

“I believe that is a realistic number,” Zanoni said. Bargaining units have worked to help mitigate some of those costs. The sheriff also expects to need 40 new patrol vehicles, a new search-and-rescue truck, new K9 units, drones, and other critical technology upgrades.

$1.6 Billion in Deferred Maintenance on County Roads

Supervisor Buddy Mendes said 10% of Fresno County roads are in such poor condition that fixing them will cost at least $1 million a mile, many of them in western Fresno County.

In total, deferred maintenance on county roads is $1.6 billion, said Steven White, director of the department of public works and planning.

The county repaired 120 miles of roads last year, White said.

Fresno County Supervisor Nathan Magsig wanted the county to prioritize repairing Alder Springs Road, which was destroyed after the 2020 Creek Fire. Homeowners there have been unable to rebuild because the road was totally destroyed, he said. That means paying taxes on insurance money as the three-year window to rebuild expired.

White said because of the age of the road previously, it required extra environmental review.

Prop. 1 Will Bring ‘Monumental’ Change to Behavioral Health

Fresno County Behavioral Health did not anticipate any significant changes to their budget — yet, said director Susan Holt. The department helped 35,000 people this past year — 8,000 of whom had substance abuse disorders.

The department anticipates major changes as Prop. 1 — driven by Gov. Gavin Newsom — changes the 1% statewide tax on California’s top earners that supports behavioral health. Holt called the changes that will have to be implemented next year “monumental.”

Holt’s preliminary estimates expects a $2 million decline.

She said that was why they didn’t ask for any department increases as they will have to figure out what funding changes will mean.

“There may be some things we have to recommend to sunset that our department does that we will no longer have revenue in 2026/27 fiscal to pursue,” Holt said.

Implementation of Prop. 36’s mandated drug treatment also largely fell on behavioral health, Holt said.

Holt said Prop. 1’s $50 million statewide fund for behavioral health expansion is not sustainable, “but we will be strategic.”