Patients forced to wait for critical care after insurers misrepresent provider networks. CalMatters exposes the “ghost network” problem. (Jungho Kim/CalMatters)

- Patients nationwide struggle when insurers list doctors who no longer accept their plan - a problem known as “ghost networks.”

- In California, more than a third of providers in directories may be inaccurate or outdated, leaving patients stranded without access to care.

- Mary Kuhn needed urgent surgery but was repeatedly denied coverage because her insurer’s directory falsely listed her surgeon as in-network.

Share

|

Getting your Trinity Audio player ready...

|

This story was originally published by CalMatters. Sign up for their newsletters.

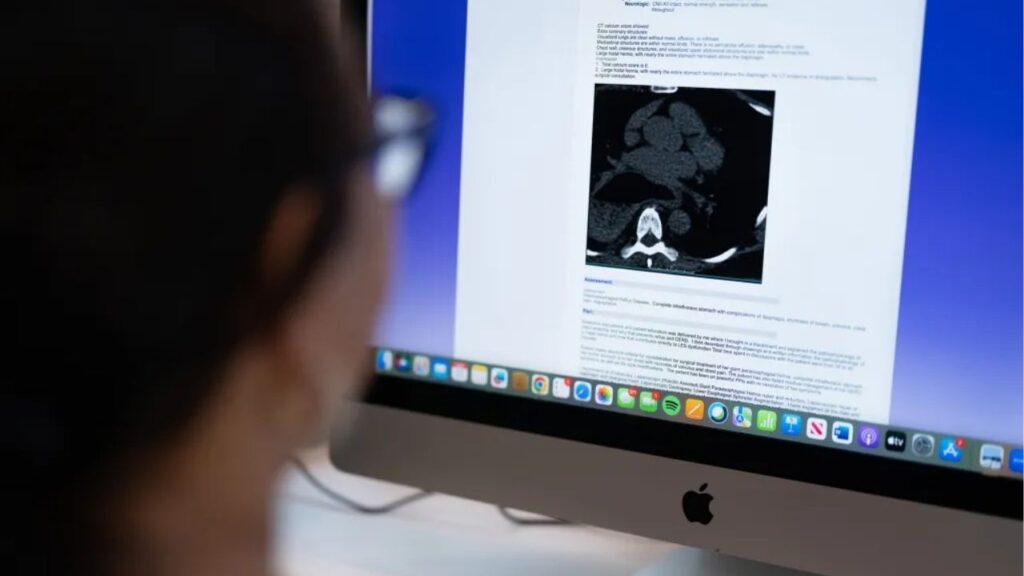

Mary Kuhn went to the emergency room at John Muir Medical Center because it felt like she was having a heart attack. Her chest and jaw hurt. Her tongue was numb. Instead of confirming a heart attack, testing later ordered by a cardiologist revealed a shocking diagnosis.

Kuhn had a massive hiatal hernia that required surgery. Her entire stomach had pushed into her chest cavity through an opening in the diaphragm, a muscle that divides the torso, and was wrapped around itself. In the crowded space, her esophagus was bent and twisted. If the entwined organs kept rotating further, they could cut off their own blood supply.

That could be fatal.

On the hunt for a specialist, Kuhn ran into a problem that plagues many California patients: Doctors listed in her health insurer’s directory didn’t actually accept her insurance. She had encountered a “ghost network.”

Ghost networks are a longstanding problem in California that advocates and lawmakers have tried to fix for more than a decade. Patients searching for primary care, physical or mental health therapy or specialty care discover that the lists of in-network providers published by insurance companies are frequently inaccurate or outdated — by some estimates a third or more of these listings may be inaccurate. Phone numbers and addresses may be wrong. Most frustrating is when listed providers no longer contract with a patient’s insurance company.

“We’ve been hearing for years from consumers, stories about how hard it is to find a provider,” said Katie Van Deynze, a lobbyist with Health Access California, a consumer advocacy group that has worked to improve provider directories.

Kristen Hwang

CalMatters

But insurers and providers oppose efforts to further regulate directories and blame each other for inaccuracies.

Kuhn’s primary care physician referred her to a cardiothoracic surgeon in Walnut Creek. That surgeon appeared in Blue Shield of California’s online directory of providers. Kuhn met with him in November and scheduled the surgery for January, she said.

Before that could happen, in December 2024, Blue Shield sent Kuhn a denial letter refusing to pay for the surgeon’s services, stating the doctor was “not in your health plan,” according to correspondence shared with CalMatters.

“I thought that’s a mistake. Of course he’s in-network, I see him there,” Kuhn said.

In a statement, Blue Shield spokesperson Mark Seelig said the company could not comment on an individual patient’s case, but defended its provider directory.

“Blue Shield rigorously validates its provider directory according to state and federal regulations. Providers must update and attest to their information every 90 days, and Blue Shield publishes changes within 48 hours and conducts regular audits,” Seelig said.

Patients need to select online the correct plan, provider group and location for the most accurate directory results, Seelig said.

This Oct. 10, nearly a year after Kuhn first encountered this issue, the physician was still listed as an in-network provider. A representative from the physician’s office confirmed to CalMatters that he is not part of the Blue Shield network.

Lawmakers Struggle to Fix Errors

Lawmakers took steps 10 years ago to help patients more easily find in-network medical care, but the resulting rules are incomplete and underenforced. Bureaucracy and fierce industry opposition have blocked significant reform.

Anecdotally, patients struggle with inaccurate directory results every day, even when trying to find a primary care doctor, Health Access lobbyist Van Deynze said. As a result people delay care; conditions get worse; some even give up.

“This is a really big barrier,” Van Deynze said.

During a legislative hearing earlier this year, Assembly Majority Leader Cecilia Aguiar-Curry told fellow lawmakers that health insurer directories have “significant error rates” despite existing law that requires them to publish accurate information.

The state has failed to enforce that 2015 law, she said, issuing “small penalties” to profitable insurers.

“There’s virtually no incentive for health plans to fix this problem,” Aguiar-Curry said.

The Department of Managed Health Care, which regulates most California health insurers, has issued eight penalties totaling $152,500 under the 2015 law. The largest penalty was $75,000, and the smallest was $5,000, according to data from the department.

In a statement, spokesperson Rachel Arrezola defended the regulatory agency’s oversight of plan directories.

“The Department uses its full authority to actively monitor health plan compliance with the provider directory standards in the law, and takes enforcement action, including administrative penalties, when plans violate the law,” Arrezola said.

Attempts to add more stringent enforcement requirements, however, keep stalling in the Legislature.

Three days before the end of the legislative session this year, Aguiar-Curry withdrew a bill that would have required directories to be 95% accurate by July 2029. That bill also would have authorized state insurance regulators to levy heftier fines on insurers that did not meet the accuracy benchmark.

Gibson Martucci, a spokesperson for Aguiar-Curry, said the Department of Managed Health Care gave the lawmaker “late feedback” on the legislation that required Aguiar-Curry to convert it into a two-year bill. Part of the reason, Martucci said in a statement, was that the department is creating regulations authorized by the 2015 law that will be finalized soon.

Aguiar-Curry intends to revive the legislation in January once the department’ s regulations are finished, Martucci said.

“After more than a decade of consumer frustration, only binding timelines, real enforcement, and structural changes will deliver the improvements consumers need to access care,” Martucci said.

Arrezola said the regulatory agency did not ask Aguiar-Curry to pull the bill. The department refused an interview request, pointing to the pending regulations. Those regulations aim to standardize the information that insurers need to publish in directories, including types of contact information, whether a provider is accepting new patients, and the date in which the directory was last updated.

“Adding a new, and duplicative auditing and verification process, to the provider directory, while pending rulemaking is occurring would conflict with work underway,” Arrezola said in a statement.

Zoe Bulls, a former intern with the Consumer Protection Policy Center at the University of San Diego who has closely watched the rulemaking process, said Aguiar-Curry’s bill went further than the department’s proposed regulations.

“There’s obviously gaps in the efficacy of those standards, because we still don’t have highly accurate provider directories,” Bulls said.

Kuhn also said the pending regulations seemed weak.

Delays and Denials Lead to Worse Outcomes

The first time Kuhn met with the cardiothoracic surgeon, her condition was already perilous.

He told her if she ever felt the need to vomit but was physically unable to do so, she needed to go to the emergency room right away. That would be a sign that her stomach was so twisted it required emergency surgery.

Kuhn told him she had already experienced that symptom twice.

He looked at Kuhn and said “You’re very lucky,” she recounted.

Still, it would be six months before Kuhn was able to get the operation following Blue Shield’s denial.

State law requires health insurers to cover out-of-network providers as if they were in-network if there are no other available providers. It also requires insurers to honor their directory that lists in-network providers. State and federal law also allow patients to appeal decisions made by insurers.

In the denial letter reviewed by CalMatters, Blue Shield stated that two in-network providers were qualified to perform the operation.

Neither could do what the specialist said was necessary, according to Kuhn and medical records reviewed by CalMatters. A thoracic surgeon who told Kuhn his expertise was in lung surgery said he couldn’t perform the operation. The other provider, a general surgeon, explained he could only perform part of the operation. He told Kuhn he would enter her abdomen and pull the stomach down, but wouldn’t address her twisted esophagus or fully fix the herniated diaphragm. So Kuhn appealed Blue Shield’s decision.

An appeal letter sent from the cardiothoracic surgeon’s office supporting Kuhn stated that “surgery was urgently needed due to her hernia being so large.”

For months, as the appeals process played out, Kuhn’s health deteriorated. She experienced headaches, nausea and fatigue. Her heart raced at random times. She could hardly eat any food. Breathing and swallowing were difficult. Blue Shield said in a letter to Kuhn that her condition did not qualify for an expedited grievance review.

Blue Shield would deny her appeal twice.

Before all of this, Kuhn loved to walk and swim. She spent hours in the garden, carrying bags of mulch and working with her hands. As her health declined, her active life vanished. A group at Kuhn’s church in Lafayette prayed weekly that she would be able to get her operation.

By the time Kuhn went into surgery in June, her left lung had partially collapsed and a portion of the hernia had attached to her aorta.

“Think of what that general surgeon would have done to reach up and pull the stomach down. If he had, he would have ruptured my aorta,” Kuhn said.

Patients Struggle Nationwide With Directory Errors

It’s hard to know how many patients run into issues with ghost networks, but Google searches are often more accurate than provider directories, according to a nationwide assessment from the U.S. Department of Health and Human Services, which looked at states’ efforts to improve directories.

The most recent study on provider directories in California looked at data for all managed care plans over two years, 2018 and 2019. That study found that accuracy generally improved year over year, but many errors still persisted.

For the state’s primary care providers in 2019, commercial plans had inaccurate information 24% of the time. Inaccuracies were generally worse among specialties, with 32% of endocrinology listings having wrong information.

On average about 50 people submit complaints about provider directories to the Department of Managed Health Care each year, according to data from the department. Patient advocates, however, say that’s an undercount because most people don’t know they can file complaints with the state or give up altogether.

Industry groups say they support the goal of having accurate directories. In a letter to lawmakers from the California Association of Health Plans and the Association of California Life and Health Insurance Companies, the groups wrote that they want providers to share in the responsibility for maintaining accurate records.

Plans spend more than $2 billion annually to maintain directories, they argue, and insurers can’t reliably update information if doctors and other providers don’t tell them when they’ve moved practices or dropped insurance. They also want state regulators to share in the role of ensuring directories are accurate. They oppose Aguiar-Curry’s legislation.

“It’s a matter of ensuring that providers and health plans are held to the same standards,” said Mary Ellen Grant, a spokesperson for the California Association of Health Plans.

Kuhn’s insurer, Blue Shield, did not take a position on the bill but said the company was “committed to a comprehensive solution that increases accountability and ensures members can easily find in-network care.”

For their part, groups representing doctors, dentists and other providers also oppose the legislation, arguing that insurers are the ones responsible for maintaining the directories.

Major opponents have given more than $5.2 million to California legislators since 2015, according to the CalMatters Digital Democracy database.

The disagreement leaves patients like Kuhn in the lurch.

“From the patient’s perspective everything is so darn confusing,” Kuhn said. “The provider directory is a critical tool but if it is not maintained it is useless and increases the stress and difficulty of getting health care.”

Reviewers Frequently Overturn Insurance Decisions

Kuhn sought an independent medical review at the advice of the U.S. Department of Labor, which regulates her plan. The reviewers agreed with her and overturned Blue Shield’s denials.

The reviewers wrote that Blue Shield should approve the cardiothoracic surgeon Kuhn wanted to perform the surgery because there were no other in-network providers who could do the operation.

The decision letter, reviewed by CalMatters, states that Kuhn had a “very complex” and “severe” condition that required a highly trained thoracic surgeon to correct. “This procedure should not be performed by a general surgeon” as Blue Shield suggested, reviewers wrote.

Kuhn should also only be responsible for regular in-network cost sharing, the decision states.

That letter allowed Kuhn to schedule her surgery, a relief after so many months. She had grown so weak that she couldn’t change the sheets on the bed without feeling faint. One time she even passed out.

A week before the surgery, Kuhn received a letter saying again that the cardiothoracic surgeon was not part of the Blue Shield of California network and that she could be responsible for paying his whole fee out-of-pocket. It was $258,000.

In a panic, she called the surgeon’s office and spoke to a patient advocate who assured her that she wouldn’t have to pay that amount. She was protected from “balance billing” by the No Surprises Act, which prohibits providers from charging patients for out-of-network services in certain situations.

Kuhn said she believes the warning letter was a scare tactic to get her to cancel the surgery.

“They delayed, they denied and then they tried to scare me,” she said.

By that time she felt like her body was giving out, and she went through with the surgery.

Today, Kuhn feels better than she has in years. Her asthma has improved. She can eat a full meal. She can go on a walk without becoming short of breath. Her heart no longer races. There’s no pain. Her church prayer group was elated.

“I knew my life depended on not giving up,” Kuhn said. “If I had listened to their threats, I would have died.”

Supported by the California Health Care Foundation (CHCF), which works to ensure that people have access to the care they need, when they need it, at a price they can afford. Visit www.chcf.org to learn more.

This article was originally published on CalMatters and was republished under the Creative Commons Attribution-NonCommercial-NoDerivatives license.

RELATED TOPICS:

Categories