Gov. Gavin Newsome and legislative leaders agreed to more than double the state’s subsidy to Southern California’s film and video industry, setting aside $750 million for tax credits to induce producers to shoot in California rather than in some other state or country.(CalMatters/Fred Greaves/File)

- Despite California's huge budget deficit, Gov. Newsom doubled Hollywood film tax credits to $750 million.

- Public employee unions and their allies want the state to close some corporate tax breaks to reduce its chronic deficit.

- So are tax rebates just mutually beneficial business deals, unsavory kickbacks, or legal extortion? It’s a fine line.

Share

|

Getting your Trinity Audio player ready...

|

This commentary was originally published by CalMatters. Sign up for their newsletters.

When Gov. Gavin Newsom and legislative leaders were negotiating a final state budget last June, they reduced some health and welfare programs to help close a multi-billion-dollar gap between income and outgo.

Nevertheless, they agreed to more than double the state’s subsidy to Southern California’s film and video industry, which enjoys strong political clout, by setting aside $750 million for tax credits, to induce producers to shoot in California rather than in some other state or country.

“You’ve got to be competitive, and now we’re competitive,” Newsom said as he signed Assembly Bill 1138 at a Burbank studio. “Not to be the cheapest place to do business — that’s never been California’s brand or motto going back a century. We want to be the best place.”

The film and video subsidy is only one way that California’s state and local governments steer money into favored economic sectors or even specific corporations. There are dozens of “tax expenditures” in the state’s tax systems — so many that the state Department of Finance annually publishes a report on who gets them and how much they cost.

While the budget expands Hollywood’s new tax subsidy, it also tightens up the calculation of corporate income taxes paid by the banking industry. In effect it’s raising taxes on one sector to indirectly pay for lowering them on another.

Unions Want State to Cut Corporate Tax Breaks

Overall, California’s tax expenditures reduce revenues by more than $100 billion a year, roughly equivalent to 50% of the state’s general fund budget. Public employee unions and their allies are proposing the state close some corporate tax breaks to reduce its chronic deficit.

At the local level, cities and some counties for decades used redevelopment to encourage investment in neighborhoods deemed to be blighted, redirecting some taxes in the so-called redevelopment zones back into the pockets of developers.

When Jerry Brown returned to the governorship in 2011, he persuaded the Legislature to end redevelopment, thereby shifting more property taxes to school districts, which reduced the state’s financial obligation to schools and helped Brown balance the state budget.

Redevelopment, however, is not the only way local governments, particularly cities, use subsidies to encourage investment on the theory that public coffers will see net revenue benefits. Another way is to entice businesses that sell taxable goods and services by rebating a share of sales taxes back to sellers.

Fine Line Between Deals, Kickbacks, and Legal Extortion

A new report from the Legislature’s budget analyst details two ways for rebate subsidies to be structured. One involves persuading the owner of a physical store of some kind to relocate from another community. The other is “encouraging retailers to shift the legally-defined place of sale without changing the location of any real economic activity.”

Generally one percentage point of the overall sales tax — which can range from 7.25% to 11.25% of the sale price — returns to the community in which the sale takes place. However, the designated sales point can be manipulated to favor a city that agrees to rebate a share of that tax back to the seller. In an age of decreasing sales in physical stores and increasing Internet sales, designating a point of sale can have major financial consequences.

The report by Seth Kerstein of the Legislative Analyst’s Office calculates that $140 million in rebates flowed from local governments to sellers in the 2023-24 fiscal year, with the largest shares going to Internet sellers and companies that provide fuel to airlines and other transportation entities.

Kerstein could calculate the total because a 2024 law Newsom signed requires disclosure of local rebate agreements. Newsom in 2019 vetoed a bill that would have imposed more restrictions on those agreements.

So are tax rebates just mutually beneficial business deals, unsavory kickbacks or legal extortion? It’s a fine line.

This article was originally published on CalMatters and was republished under the Creative Commons Attribution-NonCommercial-NoDerivatives license.

RELATED TOPICS:

Categories

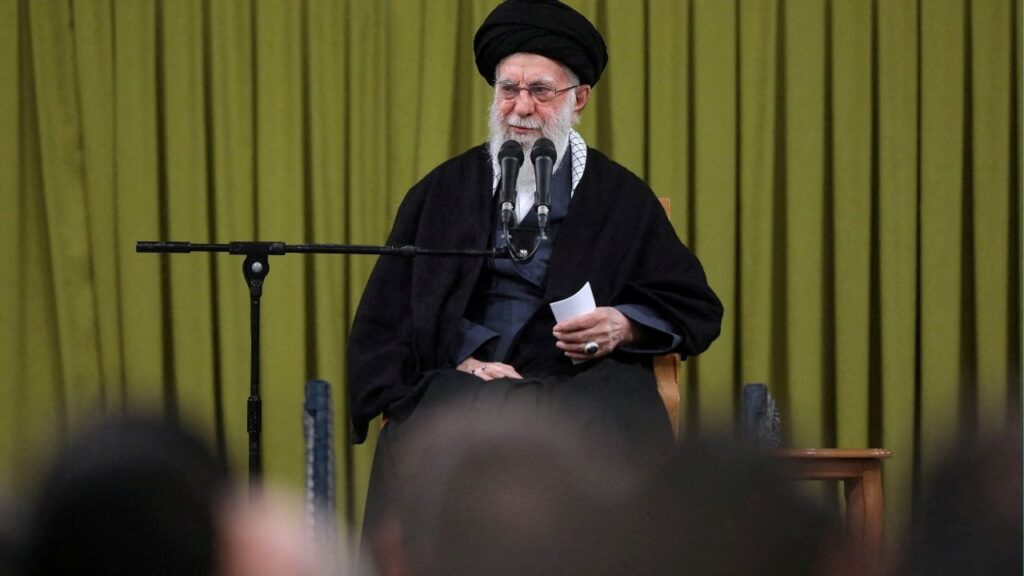

Who Could Take Over for Ayatollah Ali Khamenei?

Why Have You Started This War, Mr. President?