Representations of cryptocurrency Bitcoin are seen in this illustration taken November 25, 2024. (Reuters File)

- Anthony Pompliano launches ProCap Financial, a bitcoin treasury firm aiming to hold up to $1 billion in cryptocurrency assets.

- ProCap merges with a SPAC, raising $750 million in the largest-ever bitcoin treasury fundraising, backed by major institutional investors.

- Unlike traditional models, ProCap will use its bitcoin holdings to generate revenue through lending, derivatives, and financial services.

Share

|

Getting your Trinity Audio player ready...

|

BOSTON – U.S. investor and entrepreneur Anthony Pompliano announced on Monday the creation of a new bitcoin treasury company that would hold up to $1 billion of the world’s largest cryptocurrency on its balance sheet.

Pompliano said in a statement that his financial services firm ProCap BTC would merge with Columbus Circle Capital I, a special purpose acquisition company, to create ProCap Financial, a bitcoin treasury firm.

Several public companies have employed bitcoin treasury strategies, which involve allocating a portion of their cash and reserves toward bitcoin, to replicate the success of software company MicroStrategy, which began accumulating bitcoin in 2020 and now holds more than $63 billion worth of the digital token.

The trend comes as U.S. President Donald Trump has sought to overhaul cryptocurrency policy, including calls to establish a strategic bitcoin reserve, after courting cash from the industry on the campaign trail.

ProCap BTC Raised $500 Million in Equity

Pompliano, one of the biggest investors in the crypto space over the last several years, said ProCap BTC has raised $500 million in equity and $250 million in a convertible note, in what he termed the largest initial fundraising in history for a bitcoin treasury company.

Unlike traditional bitcoin treasury companies, Pompliano said ProCap Financial would use its bitcoin balance sheet to generate revenue and profit through a variety of strategies, including lending, derivatives, and other products and services.

He also said leading institutional investors Susquehanna, Jane Street, and Magnetar have committed capital, as have crypto firms Off the Chain Capital, Pantera, Coinfund, Parafi, Blockchain.com, and FalconX.

Reuters was unable to verify whether these companies were investing in ProCap Financial.

“The legacy financial system is being disrupted by bitcoin right before our eyes,” Pompliano said.

“Our objective is to develop a platform that will not only acquire bitcoin for our balance sheet, but will also implement risk-mitigated solutions to generate sustainable revenue and profits from our bitcoin holdings.”

—

(Reporting by Gertrude Chavez-Dreyfuss; Editing by Saad Sayeed)

RELATED TOPICS:

Categories

Kazakhstan to Join Abraham Accords, Trump Says

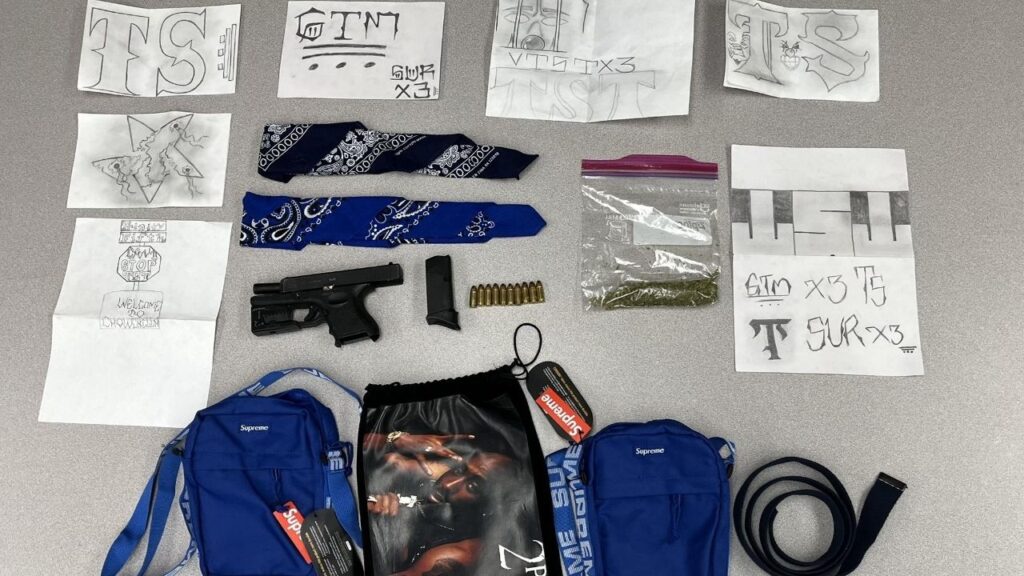

Chowchilla Police Arrest Two in Connection With Shooting

Who Will Replace Pelosi in Congress?