Governor's revised budget blames Trump tariffs for revenue shortfalls, but his administration has a history of faulty fiscal projections. (CalMatters/Fred Greaves)

- Newsom's budget claims $12 billion hole due to 'Trump slump,' continuing pattern of unreliable fiscal projections.

- Administration's 2022 boast of $97.5 billion surplus proved illusory, creating a persistent structural deficit.

- Medi-Cal expansion costs outpaced projections by $6 billion, further worsening California's budget woes.

Share

This commentary was originally published by CalMatters. Sign up for their newsletters.

Gov. Gavin Newsom’s revised state budget assumes California will see a sharp decline in projected revenue, largely because President Donald Trump’s tariffs will slow the nation’s economy.

Newsom blames a “Trump slump,” as well as an unanticipated increase in spending on Medi-Cal, California’s medical program for the poor, for punching a $12 billion hole in the budget.

Both of those factors, however, underscore a consistent trend in budgets Newsom has proposed and signed during the last six years — projections of income and outgo that miss the mark, often by many billions of dollars, thus undermining the credibility of the governor’s financial depictions.

A History of Fiscal Miscalculations

The most obvious example happened in May 2022, as the state’s economy was recovering from the brief but severe recession caused by shutdowns during the COVID-19 pandemic.

Newsom presented a revised 2022-23 budget that was $14 billion higher than his original proposal, boasting that the state was experiencing a $97.5 billion surplus. “No other state in American history has ever experienced a surplus as large as this,” Newsom said as he unveiled the revision.

The budget he signed a month later added still another $7 billion in spending with immense new commitments, including cash payments to poor families, expanded health care for undocumented immigrants and new funds for early childhood education.

The Illusory Surplus and Its Consequences

The surplus Newsom extolled, however, was an illusion. He and his budget advisors had assumed that a one-time spike in state revenues would be permanent, setting a new base of personal and corporate income taxes and sales taxes well in excess of $200 billion a year.

But it didn’t happen.

A year ago, a brief passage in Newsom’s 2024-25 budget revision acknowledged the error.

“Due to the revenue spike from 2019-20 to 2021-22, the budget acts of 2021 and 2022 were based on forecasts that projected substantially greater revenues in the last two fiscal years than occurred,” the budget declared.

“Substantially greater” indeed.

An accompanying chart on revenues from the state’s three major tax sources revealed that “The total difference across the four fiscal years is a negative $165.1 billion,” meaning the error was $40 billion or more a year.

However, the fiscal damage was done. Newsom and the Legislature had already committed the state to tens of billions of dollars in new spending based on revenues that didn’t exist. They created what’s called a structural deficit — a chronic gap between income and outgo — that’s currently estimated at $10 billion to $30 billion a year.

One might think that, having made such an immense error of fiscal judgment, Newsom and his Department of Finance would be ultra-careful in projecting revenues and spending.

Apparently not.

Compounding Errors in Medi-Cal Projections

Last year, one of those 2022 commitments based on the erroneous surplus projection — the extension of Medi-Cal coverage to everyone in the state, including undocumented immigrants — took effect. Early this year, the administration revealed Medi-Cal costs were outpacing expectations by more than $6 billion, mostly due to the coverage expansion.

In other words it’s a double whammy. The false assumption of budget surpluses has been compounded by a false assumption about Medi-Cal costs, thereby worsening the structural deficit that, if left to fester, would compound itself even more. The Legislative Analyst’s Office says the deficit could reach $42 billion by 2028-29.

The administration’s sorry record on income and outgo projections should make the Legislature and the voting public very skeptical of Newsom’s current assumption that the “Trump slump” from tariffs will punch an even larger hole in the budget.

That certainly could happen, but with tariffs and their impact shifting day-to-day, putting any number on the revenue impacts is nothing more than guesswork. And we already know that the administration’s fiscal guesses are unreliable.

This article was originally published on CalMatters and was republished under the Creative Commons Attribution-NonCommercial-NoDerivatives license.

Make Your Voice Heard

GV Wire encourages vigorous debate from people and organizations on local, state, and national issues. Submit your op-ed to bmcewen@gvwire.com for consideration.

RELATED TOPICS:

Categories

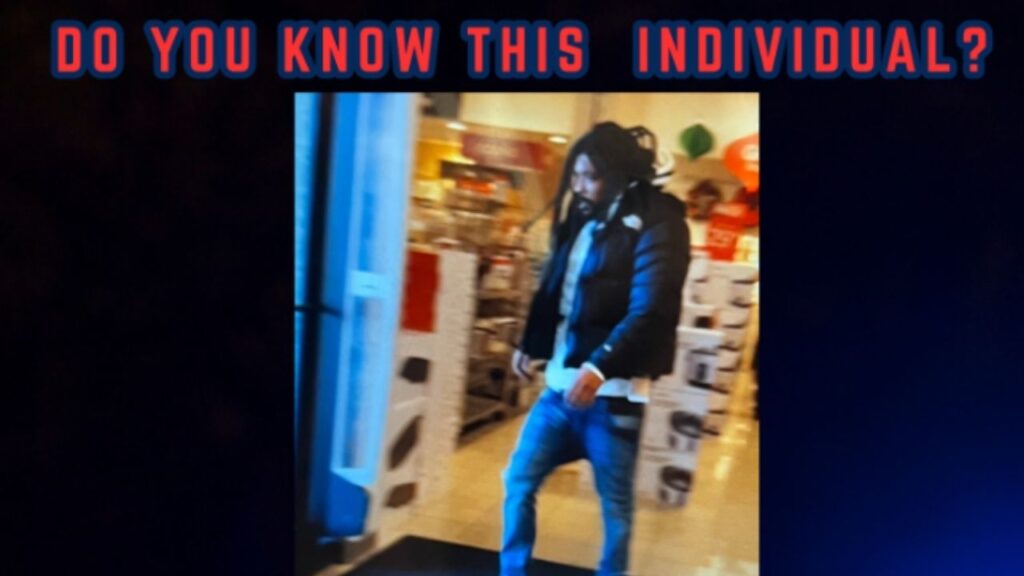

Merced Police Seek Suspect in Shoe Palace Robbery