Mortgage rates climb to their highest point since February, adding financial pressure to homebuyers already facing a challenging spring market. (AP File)

- The elevated mortgage rates add hundreds of dollars monthly to borrower costs, discouraging potential homebuyers this spring.

- Recent surge in mortgage rates reflects moves in the 10-year Treasury yield, which jumped after U.S.-China trade truce announcement.

- Economists expect mortgage rates to remain volatile but forecast the average 30-year mortgage rate to stay between 6% and 7% this year.

Share

The average rate on a 30-year mortgage in the U.S. climbed this week to its highest level since mid-February, a setback for home shoppers that threatens to slow sales further this spring homebuying season.

The rate increased to 6.86% from 6.81% last week, mortgage buyer Freddie Mac said Thursday. A year ago, the rate averaged 6.94%.

Borrowing costs on 15-year fixed-rate mortgages, popular with homeowners refinancing their home loans, also rose. The average rate ticked up to 6.01% from 5.92% last week. It’s down from 6.24% a year ago, Freddie Mac said.

Factors Driving Rate Increases

Mortgage rates are influenced by several factors, including global demand for U.S. Treasurys, the Federal Reserve’s interest rate policy decisions and bond market investors’ expectations about the economy and inflation.

The average rate on a 30-year mortgage has remained relatively close to its high so far this year of just above 7%, which it set in mid-January. The average rate’s low point so far was five weeks ago, when it briefly dropped to 6.62%. It’s now at its highest level since Feb. 13, when it averaged 6.87%.

The elevated mortgage rates, which can add hundreds of dollars a month in costs for borrowers, have discouraged home shoppers, leading to a lackluster start to the spring homebuying season, even as the inventory of homes on the market is up sharply from last year. Sales of previously occupied U.S. homes fell last month to the slowest pace for the month of April going back to 2009.

Bond Yields and Market Pressures

The recent rise in mortgage rates reflects moves in the 10-year Treasury yield, which lenders use as a guide to pricing home loans.

The yield, which had mostly fallen after climbing to around 4.8% in mid-January, began rising March amid investor anxiety over the Trump administration’s trade war. It rose again last week after the U.S. and China agreed to a 90-day truce in their trade dispute, raising expectations that the Federal Reserve won’t have to cut interest rates as deeply as expected this year in order to shield the economy from the damage of tariffs.

This week, long-term bond yields surged again after Moody’s lowered its credit rating for the U.S. over concerns about swelling federal government debt.

The 10-year Treasury yield was at 4.56% in midday trading Thursday after the House of Representatives approved a bill that would cut taxes and could add trillions of dollars to the U.S. debt.

“Since mortgage rates closely track the 10-year yield, this upward pressure has translated into increased borrowing costs for homebuyers, which means higher mortgage rates,” said Jiayi Xu, an economist at Realtor.com.

Impact on Homebuyer Demand

The increase in mortgage rates is discouraging some would-be homebuyers during what’s traditionally the busiest period of the year for home sales. Last week, mortgage applications fell 5.1% from a week earlier as home loan borrowing costs increased, according to the Mortgage Bankers Association.

Applications for a loan to buy a home were still up 13% from a year earlier.

Economists expect mortgage rates to remain volatile in coming months, with forecasts calling for the average rate on a 30-year mortgage to remain between 6% and 7% this year.

RELATED TOPICS:

Categories

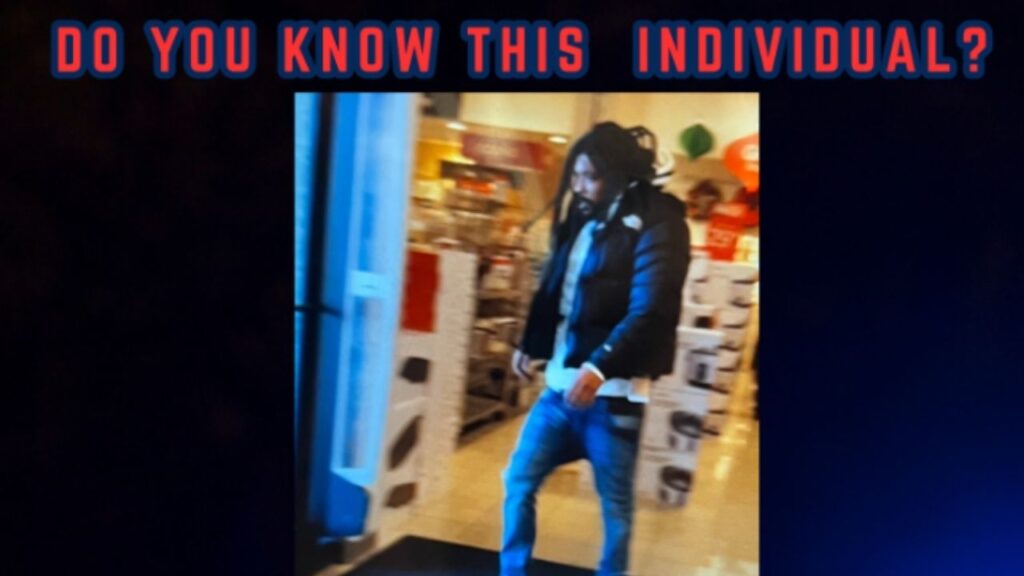

Merced Police Seek Suspect in Shoe Palace Robbery