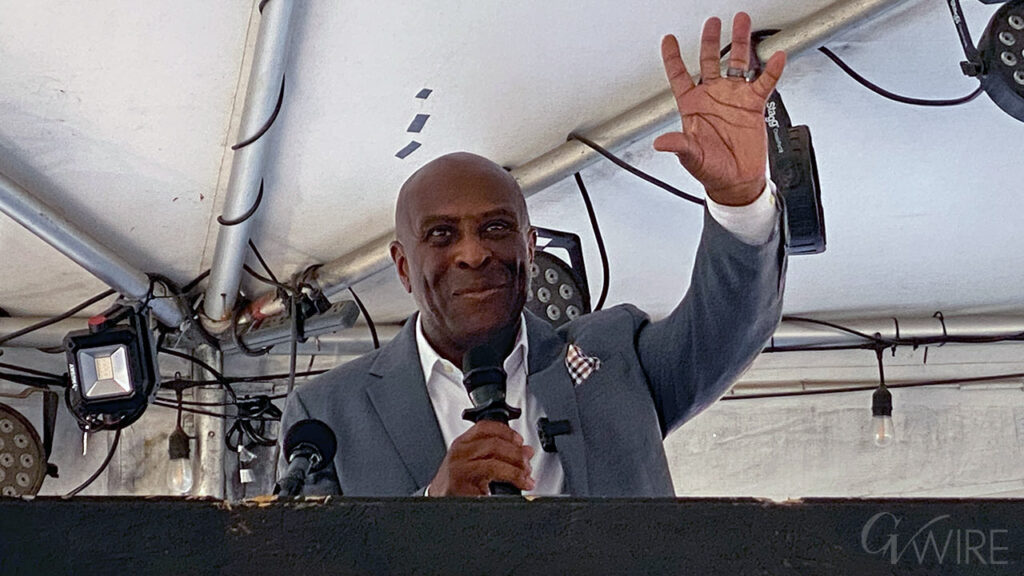

California lawmakers propose tax exemptions for veterans' retirement income, aiming to retain military retirees in the state. (AP/Rich Pedroncelli)

- New bills aim to provide tax exemptions for military retirement income, a first for California.

- The state has seen a 28% decrease in its retired military population since 2000 due to out-of-state moves.

- Analysts warn the proposed tax break may be too small to significantly impact veterans' decisions to stay in California.

Share

This story was originally published by CalMatters. Sign up for their newsletters.

California is the only state that doesn’t allow any tax exemptions on military retirement income. New bills aim to do that, but analysts say the financial incentive may be too small to get veterans to stay in California.

By Sameea Kamal

CalMatters

After at least eight tries in the Legislature, California may finally join every other state in providing at least some tax exemptions for military retirement income, which supporters argue will help veterans stay in the state and contribute to a skilled workforce.

Assemblymember James Ramos has introduced, for the third time, a bill that would allow veterans to exempt up to $20,000 of their federal pensions if they make under $125,000 a year. He narrowed his bill from last year that sought to exempt a veteran’s full retirement income. Sen. Kelly Seyarto, a Republican from Murrieta, introduced a similar bill in the Senate.

Overall, about 1.4 million veterans live in California, of whom 141,000 receive military retirement income, according to the latest data available from the U.S. Department of Defense. Another 26,000 Californians receive survivor benefits.

Ramos said the state would benefit from keeping veterans in California, where they might work in other industries after retiring from the military and further contribute to the tax base. California is home to the Navy’s Pacific Fleet and tens of thousands of Marines at Camp Pendleton.

“They bring tested job expertise to our California workforce, they live in our communities and serve as volunteers and leaders,” said Ramos, a Democrat from San Bernardino. “California can’t afford not to put out the welcome mat for our veterans.”

The goal of both bills, the legislators say, is to try to keep more military retirees in California. The state has seen its retired military population decrease due to out-of-state moves and deaths by about 28% from more than 195,000 in 2000 to just over 141,000 in 2022, according to data from the U.S. Department of Defense. California’s rate of decline during that time was second only to the District of Columbia, where it declined by 35%.

Data was not available on the employment rate among military retirees — those who served at least 20 years. But among the broader group of veterans aged 35 to 64, about 96% of those still in the labor force in California were employed, according to data from the Bureau of Labor Statistics.

Related Story: Protests Planned All Over California to Oppose Medicaid, SNAP Funding Cuts

‘The Primary Factor Is Cost of Living’

Veterans leave the state for many reasons, “but the primary factor is cost of living,” David Boone, president of the San Diego Military Advisory Council, testified at a recent state tax and revenue committee hearing on Seyarto’s bill.

“The states that are gaining veterans have developed strategies to target and attract veterans to their state,” he said.

Military retirees in California receive approximately $29,000 each annually — a total of about $4 billion a year as of 2022, according to the Department of Finance. Surviving relatives of veterans receive a combined $400 million.

If the tax break became law, California would lose an average of $600 in income tax revenue from each of the 130,000 eligible veterans, according to the Legislative Analyst’s Office. Gov. Gavin Newsom is proposing a similar idea through his budget proposal. His office estimates it would cost the state about $130 million in the next fiscal year, and $85 million each year after that.

But the financial incentive might be too small to convince retirees to stay in California, the Legislative Analyst’s Office noted, doing little to achieve the state’s goal of making the state a more competitive destination.

That’s the case for Sue Johnson, a former Californian who retired in Nevada after serving 27 years in the Air Force and the Air National Guard.

“Even if it passes, I don’t think at this point that it’s enough,” she said. “Both for my husband and I … We both had nothing and we’ve worked hard our whole lives, but then to get to the point where that is not recognized in the state policies … It’s just too much.”

Related Story: ‘They Didn’t Lift a Damn Finger’: California Crime Victim Fund Ordered to Change Practices

Teachers, Firefighters, Police Might Like a Tax Break

Staff on the Senate’s committee on revenue and taxation also raised a concern that Seyarto’s bill might set a precedent for other professions.

“If the Legislature exempts retirement income for one line of work that provides a direct benefit to the public, why should it not extend the same treatment for other commendable professions, such as teachers, firefighters, or police officers? This may lead to a slippery slope where retirement income from other professions is excluded from gross income, thereby eroding the income tax base,” the committee’s consultants wrote.

Military retirees and surviving relatives pay state and federal income taxes in California, but receive exemptions on military death benefits paid to qualified survivors, pay for time served in combat zones and partial property tax exemptions.

Of the 41 states that have a state income tax, 25 states fully exempt military retirement income, and the rest partially exempt it.

The state analyst said California could see a non-monetary value to the proposal, though: It “would no longer be the only state that fully taxes military retirement income. In this sense, although it is a small financial incentive, the proposal may well improve veterans’ perception of California.”