Wall Street tumbles as vaccine makers plunge following Trump's HHS pick, signaling potential policy shifts. (AP/Richard Drew)

- Moderna and Pfizer stocks sink on concerns about profits after Trump's anti-vaccine HHS nominee announcement.

- Applied Materials drops 7.9% despite strong quarterly profits, dragging down the S&P 500 index.

- Traders recalibrate Fed rate cut expectations as Treasury yields climb on economic resilience and inflation worries.

Share

|

Getting your Trinity Audio player ready...

|

NEW YORK — U.S. stocks are falling toward their worst loss since Election Day on Friday as the big bump Wall Street got from last week’s election of Donald Trump and cut to interest rates by the Federal Reserve keeps fading.

The S&P 500 sank 1.1% in morning trading and was heading for a losing week and its worst day since October. The Dow Jones Industrial Average was down 283 points, or 0.6%, as of 10:30 a.m. Eastern time, and the Nasdaq composite was 1.8% lower.

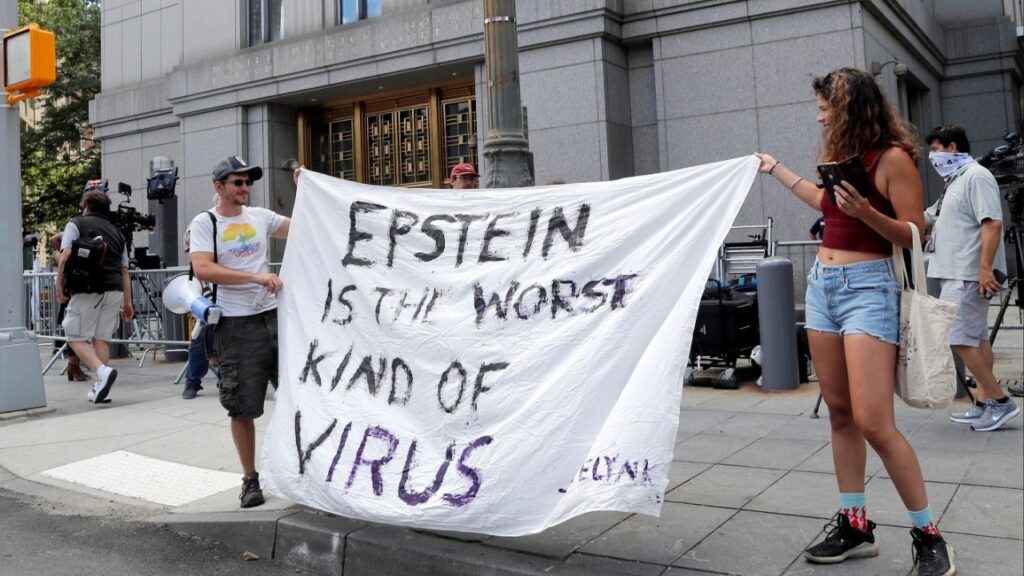

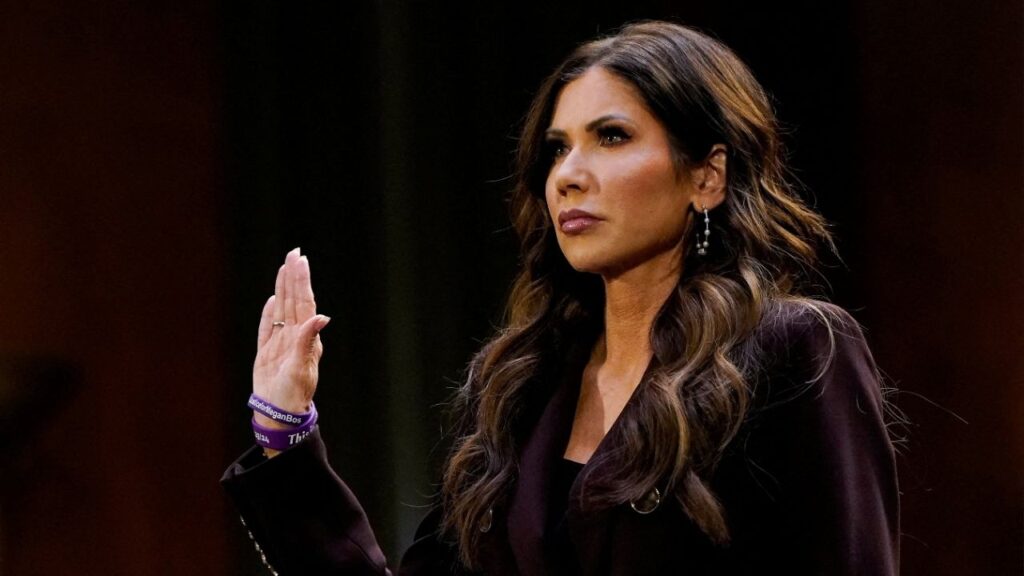

Makers of vaccines helped drag the market down after President-elect Donald Trump said he wants Robert F. Kennedy Jr., a prominent anti-vaccine activist, to be his Secretary of Health and Human Services. Moderna sank 7.1%, and Pfizer fell 3.4% amid concerns about a possible hit to profits.

The only stock to fall more in the S&P 500 was Applied Materials, which dropped 7.9% even though it reported a stronger profit for the latest quarter than analysts expected. The provider of manufacturing equipment and services to the semiconductor industry gave a forecasted range for upcoming revenue whose midpoint was short of analysts’ expectations.

Related Story: Stock Market Today: Wall Street Rallies on Election Day as Economy Remains

Pressure on Companies to Deliver Growth

The pressure is on companies to deliver big growth, in part because their stock prices have been rising so much faster than their earnings. That’s made the broad stock market look more expensive by a range of measures, which has critics calling for at least a fade. The S&P 500 is still up more than 23% for the year and near its all-time high set a few days ago, despite this week’s weakness.

Stocks had been broadly roaring since Election Day, when Trump’s victory sent a jolt through financial markets worldwide. Investors immediately began sending up stocks of banks, smaller U.S. companies and cryptocurrencies as they laid bets on the winners coming out of Trump’s preference for higher tariffs, lower tax rates and lighter regulation.

But investors are also taking into account some of the potential downsides from Trump’s return to the White House.

Related Story: America’s Economy Is Bigger and Better Than Ever

Impact on Interest Rates and Federal Reserve Policy

Besides Friday’s hit to vaccine makers, Treasury yields have also been climbing in the bond market on both the economy’s surprising resilience and worries that Trump’s policies could spur bigger U.S. government deficits and faster inflation.

That’s forced traders to recalibrate how much relief the Federal Reserve could provide for the economy next year through cuts to interest rates. The Fed earlier this month lowered its main interest rate for the second time this year, and past forecasts published by Fed officials had indicated more cuts were likely to come through 2025.

Lower interest rates can act as fuel for the stock market and economy, particularly after the Fed had kept rates at a two-decade high, but they can also put upward pressure on inflation.

On Thursday, Fed Chair Jerome Powell suggested the U.S. central bank needs to be cautious about future decisions on interest rates. “The economy is not sending any signals that we need to be in a hurry to lower rates,” he said, though he declined to discuss how Trump’s policies could alter things.

Traders have since ratcheted back expectations for the Fed to cut rates again at its meeting next month, though they still see better than a coin flip’s chance of it, according to data from CME Group.

On Friday, Treasury yields were mixed in the bond market following several reports on the economy.

One showed shoppers spent more at U.S. retailers last month than expected, another signal that the most influential force on the economy remains solid.

“Many consumers were reporting that they were putting off trips and big ticket item purchases until after the election,” according to Brian Jacobsen, chief economist at Annex Wealth Management. “Many businesses reported they were putting off capital investment due to the election. Now that the uncertainty of the outcome is behind us, we could see some decent ‘relief spending.'”

Friday’s data on retail sales, though, may not be quite as strong as it appeared. After taking away purchases of automobiles, sales at retailers were weaker last month than economists expected.

A separate report, meanwhile, showed manufacturing activity in New York state is growing strongly. That soundly beat expectations for zero growth, and it comes off October’s contraction. Some of the survey’s responses were collected after Election Day.

Related Story: Economists Warn of Inflation and Debt Risks in Trump’s Second Term Plans

In the bond market, the 10-year Treasury yield rose to 4.47% from 4.44% late Thursday. The two-year yield, which more closely tracks expectations for Fed action, slipped to 4.32% from 4.36% late Thursday.

In stock markets abroad, London’s FTSE 100 rose 0.1% after data from the Office for National Statistics showed economic growth slowed to 0.1% in the July-September quarter from the 0.5% in the previous quarter. It was weaker than expected.

Tokyo’s Nikkei 225 gained 0.3% after data showed growth for Japan’s economy accelerated in the latest quarter, even as the Bank of Japan raised interest rates in July.

RELATED TOPICS:

Categories

Minnesota Sues Federal Government Over Withheld Medicaid Funds

Fresno Police Arrest 19 in DUI Enforcement Operation