Share

|

Getting your Trinity Audio player ready...

|

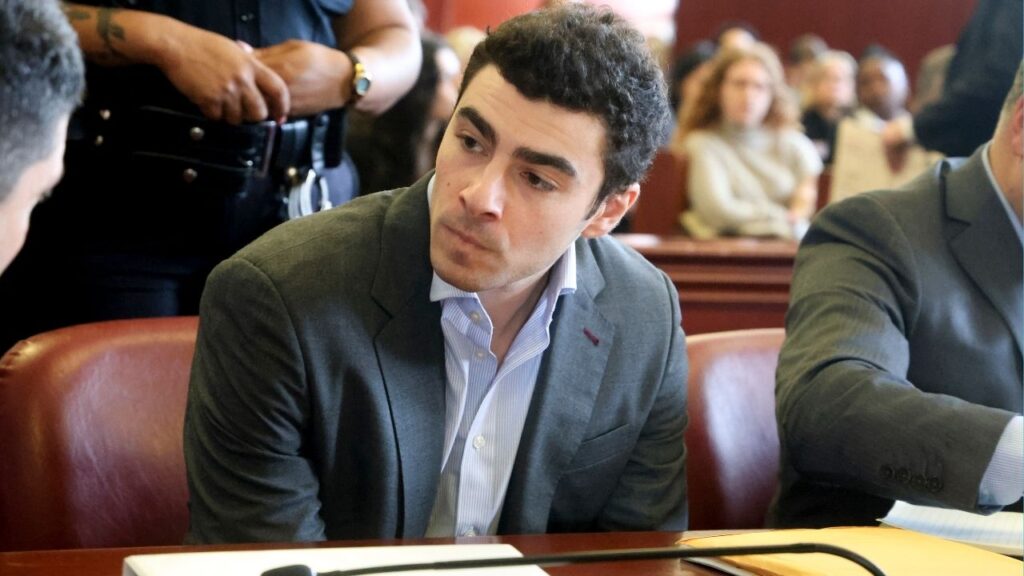

Assemblymember Joaquin Arambula wants to do the same for a state home-lending program as for state health care — expand the program to undocumented people.

Arambula, D-Fresno, introduced AB 1840, which would allow “undocumented persons” eligibility for the California Dream for All Program — administered by the California Home Financing Agency — which provides first-time homebuyers help with a down payment.

“AB 1840 simply clarifies who is eligible for the California Dream for All program, which doesn’t have a citizenship requirement. But, I wanted to ensure that qualified first-time homebuyers include undocumented applicants. This won’t affect the State budget. The program was allocated $500 million in the 2022-23 budget and is a revolving shared appreciation loan program. So, it recovers its investment and can then extend loans to other qualified applicants,” Arambula told GV Wire.

“More importantly, the program is crucial in making homeownership more attainable and strengthening the economic development and quality of life for all our communities,” he said.

According to the Dream for All handbook, borrowers must “be either a citizen or other National of the United States, or a ‘Qualified Alien’ as defined at 8 U.S.C § 1641.”

Arambula’s office said the intent of the bill is to include the undocumented, although the term is not specifically defined.

A new state law that took effect on Jan. 1 expanded the state low-income health insurance program, Medi-Cal, to all those who qualify, including undocumented residents. Now, an estimated 700,000 Californians between the ages of 26-49 are also eligible; prior law set age restrictions for the undocumented. The state has committed $4 billion for the expansion.

Dream for All Program

“I wanted to ensure that qualified first-time homebuyers include undocumented applicants. This won’t affect the State budget.” — Assemblymember Joaquin Arambula

Implemented for the first time last year, the Dream for All Shared Appreciation Loan helps first-time homebuyers with a down payment, which can also be used for closing costs. The program requires a CalHFA-approved loan.

CalMatters reported that last year, $300 million in loans were claimed in just 11 days. The program helped approximately 2,500 homebuyers, including 75 from Fresno County. The program is changing this year from a first-come, first-served model to a lottery. Up to 2,000 borrowers are expected to share $250 million in state funds.

The program provides a loan for 20% of the purchase price, up to $150,000. The homeowner would pay back the loan when the home is eventually sold, plus 20% of any appreciation of the home’s value. CalHFA’s share would be 15% for lower-income buyers (considered 80% or less of the area median income).

For example, if a borrower purchases a home for $500,000, the Dream for All loan would be $100,000 (20%). When the home is sold for $700,000, the borrower would owe $140,000 ($100,000 principal, plus 20% of the $200,000 appreciation, or $40,000). If the home does not gain value at the time of a future sale, only the principal loan is due.

There are additional requirements, mainly income-based. The most recent income limit for Fresno County is $132,000. Only one borrower has to be a California resident, and one borrower has to be first-generation homebuyer — generally defined as their parents not currently owning a home.

Introduced Jan. 16, the bill could heard in committee no sooner than Feb. 16. Nothing has been scheduled.

RELATED TOPICS:

Categories