Share

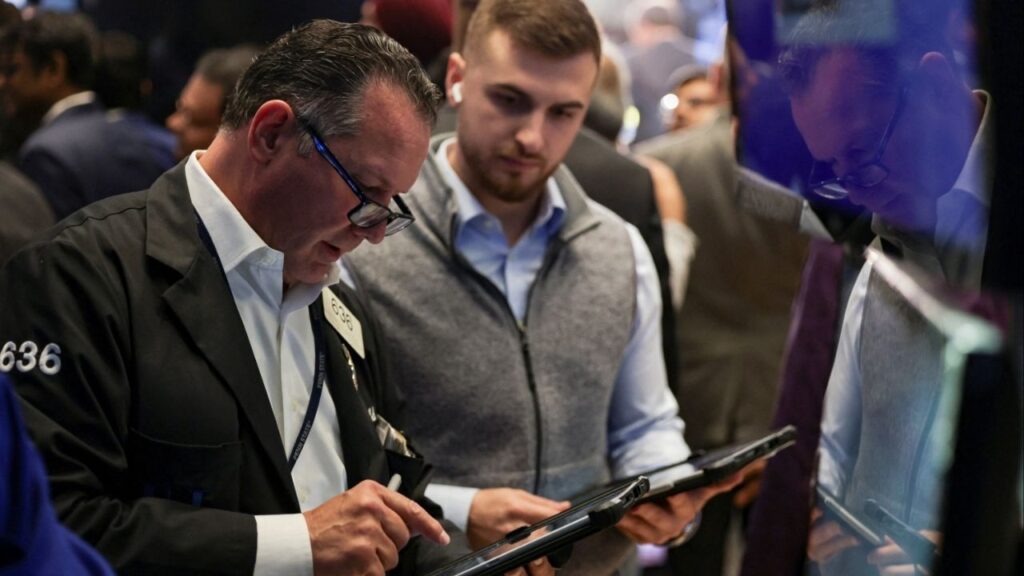

NEW YORK — Stocks fell sharply Wednesday after the bond market threw up another warning flag on the economy.

The yield on the 10-year Treasury briefly dropped below the two-year Treasury’s yield Wednesday morning for the first time since 2007. The so-called inversion has correctly predicted many past recessions and is the loudest warning bell yet about a possible recession ahead.

Investors responded by dumping stocks, more than erasing gains from a rally the day before. The Dow Jones Industrial Average dropped more than 700 points in afternoon trading. Banks and tech stocks fell sharply, and retailers came under especially heavy selling pressure after Macy’s issued a dismal earnings report and cut its full-year forecast.

Volatility has returned to the markets in August amid rising tensions in the trade dispute between the U.S. and China. The S&P 500 is down more than 4% as investors fear a prolonged trade dispute could further weaken the global economy.

Traders tend to plow money into ultra-safe U.S. government bonds when they’re fearful of an economic slowdown, and that sends yields lower. When long-term yields fall enough, market watchers see it as a prediction that a recession could be on the way in a year or two. The yield on the 10-year Treasury has dropped from 2.02% on July 31 to below 1.60%. The 30-year Treasury yield also hit a record low Wednesday.

Losses Come a Day After Stocks Rallied

Economic data from two of the world’s biggest economies added to investors’ fears. European markets fell after Germany’s economy contracted 0.1% in the spring due to the global trade war and troubles in the auto industry. In China, the world’s second-largest economy, growth in factory output, retail spending and investment weakened in July.

The S&P 500 fell 2.8%, as of 1:11 p.m. Eastern time, giving back all of the prior day’s jump, which came after the U.S. delayed some of the tariffs threatened on Chinese imports.

The Dow sank 719 points, or 2.7%, to 25,556, and the Nasdaq composite lost 3%.

The losses come a day after stocks rallied when the Trump administration delayed some tariffs on Chinese goods it had planned for Sept. 1. Fiona Cincotta, senior market analyst at City Index, said that Tuesday’s rally brought on by the delay “was short lived – blink and you missed it.”

Despite the pullback on tariffs, investors are still worried that the trade war between the world’s two largest economies may drag on through the 2020 U.S. election and cause more economic damage. Yet, for all its whipsawing up and down, the S&P 500 remains within 5.6% of its record, which was set in late July.

Other Parts of Yield Curve Have Already Inverted

Banks took heavy losses Wednesday. Lower bond yields are bad for banks because they force interest rates on loans such as mortgages lower, which means lower profits for banks. Citigroup sank 4.9% and Bank of America gave up 4.2%.

Much of the market’s focus was on the U.S. yield curve, which has historically been one of the more reliable recession indicators. After briefly trading below the yield on the two-year Treasury earlier Wednesday, the yield on the 10-year Treasury was 1.59% at midday, a touch above the 1.58% yield on the two-year.

Other parts of the yield curve have already inverted, beginning late last year. But each time, some market watchers cautioned not to make too much of it. Academics tend to pay the most attention to the spread between the three-month Treasury and the 10-year Treasury, which inverted in the spring. Traders often pay more attention to the two-year and 10-year spread.

Each of the last five times the two-year and 10-year Treasury yields have inverted, a recession has followed. The average amount of time is around 22 months, according to Raymond James’ Giddis. The last inversion of this part of the yield curve began in December 2005, two years before the Great Recession tore through the global economy.

Energy Stocks Also Sank Sharply

The indicator isn’t perfect, though, and it’s given false signals in the past. Some market watchers also say the yield curve may be a less reliable indicator this time because technical factors may be distorting longer-term yields, such as negative bond yields abroad and the Federal Reserve’s holdings of $3.8 trillion in Treasurys and other investments on its balance sheet.

Macy’s plunged 15.4%, the sharpest loss in the S&P 500, after it slashed its profit forecast for the year. The retailer’s profit for the latest quarter fell far short of analysts’ forecasts as it was forced to slash prices on unsold merchandise. The grim results from Macy’s sent other retailers sharply lower, too. Nordstrom sank 11% and Kohl’s dropped 10.8%.

Energy stocks also sank sharply, hurt by another drop in the price of crude oil on worries that a weakening global economy will drag down demand. National Oilwell Varco lost 6.5%, and Schlumberger fell 5.9%. The price of benchmark U.S. crude slid 4.6% to $54.48 per barrel. Brent crude, the international standard, lost 4.2% to $58.73.

Overseas, Germany’s DAX dropped 2.3% following the weak German economic data. France’s CAC 40 fell 2.2%, and the FTSE 100 in London lost 1.7%.

In Asia, Japan’s Nikkei 225 rose 1%, the Kospi in South Korea gained 0.7% and the Hang Seng in Hong Kong added 0.1%.