The final pages of the 2020-21 budget that Gov. Gavin Newsom proposed this month contain arguably its most important factor — an utter dependence on taxing a relative handful of high-income Californians. Personal income taxes, the budget projects, will generate $102.8 billion during the fiscal year that will begin on July 1,...

Walters: Are the Wealthy Fleeing California Taxes?

Here is an indisputable fact about California taxation: More than two-thirds of state general fund revenues come from personal income taxes and about half of those taxes are paid by the 1% of taxpayers atop the income scale. In other words, K-12 schools, state colleges and universities, health and welfare...

Walters: California Gets a Hollow Victory in Tax Battle

California officials have pursued Gilbert Hyatt for nearly three decades, trying to force him to pay state income taxes on royalties he began receiving in the early 1990s from his groundbreaking technology inventions. Hyatt moved from Southern California to Las Vegas just before the royalty payments began rolling in, clearly...

Walters: Slowing Economy Could Hit State Budget

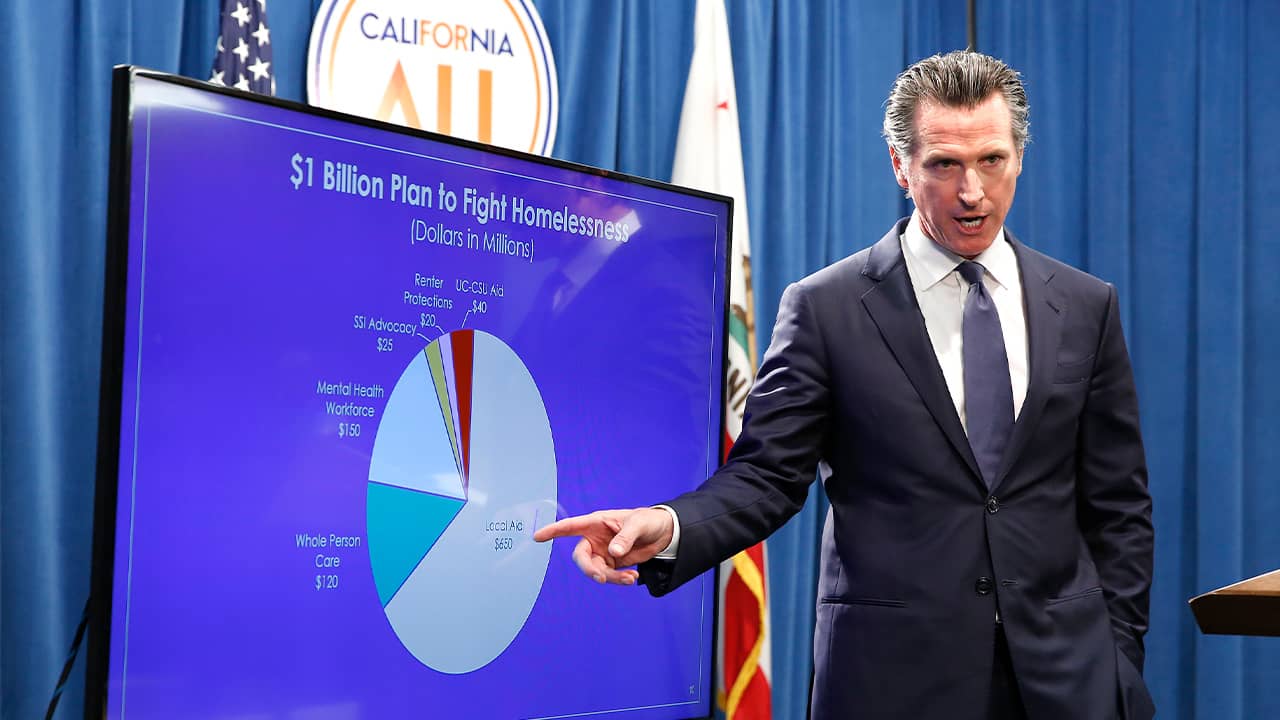

Gov. Gavin Newsom’s first budget proposal, unveiled two months ago, took a surprisingly conservative approach, given his promises of high-dollar spending during his campaign for the governorship. While he proposed token appropriations to expand health insurance for the poor and pre-kindergarten care and education, his 2019-20 budget would devote most...

You Have Two Extra Days to Pay Your Taxes. And Take This Quiz.

“Tax Day,” the day when U.S. individual tax returns are due, is usually April 15. This year Americans get until April 17 to file their returns because April 15 falls on a Sunday and April 16 is Emancipation Day in Washington, marking President Abraham Lincoln’s signing of the Compensated Emancipation...