[location-weather id="102511"]

Trending

Fresno Spotlight: Lawsuit in Killing of Homeless Man by Deputies Will Go to Trial

Courts /

18 hours ago

Latest

Videos

Latest /

13 hours ago

Judge Blocks Pillar of Trump’s Mass Deportation Campaign

Crime /

16 hours ago

Visalia Driver Arrested for DUI After Multiple Crashes and Pedestrian Injured

U.S. /

16 hours ago

Dollar Trades Lower With Fed Cut In View, On Course For Monthly Drop

Local /

16 hours ago

Visalia Semi Crash Injures Amazon Truck Driver After Red Light Collision

World /

16 hours ago

Evacuation of Gaza City Would Be Unsafe and Unfeasible, Says Head of Red Cross

Central Valley

Featured

Local /

16 hours ago

Visalia Semi Crash Injures Amazon Truck Driver After Red Light Collision

A semi truck crash early Saturday morning left one driver seriously injured, according to the Visalia Police Department.

At approximately 1:...

Courts /

18 hours ago

Fresno Spotlight: Lawsuit in Killing of Homeless Man by Deputies Will Go to Trial

Local /

1 day ago

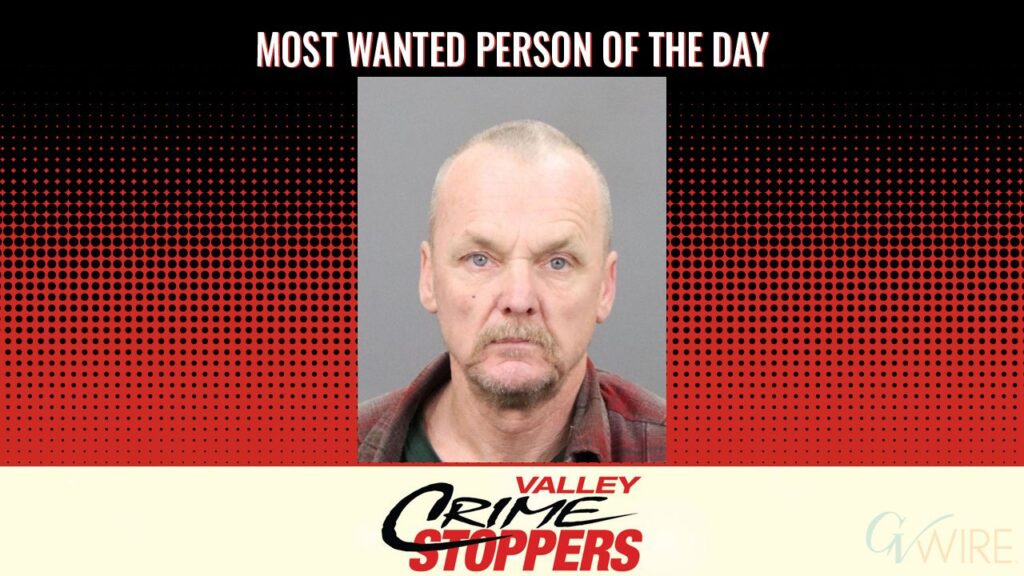

Valley Crime Stoppers’ Most Wanted Person of the Day: Curtis Wayne Recek

Video /

1 day ago

Fresno Blaze Damages Yosemite Falls Café, Restaurant to Remain Temporarily Closed

Housing /

1 day ago

Fresno Shelter Helps Homeless Recover from Hospital Stays. It’s Also a ‘Good Neighbor’

Videos

Video /

1 day ago

Fresno Blaze Damages Yosemite Falls Café, Restaurant to Remain Temporarily Closed

Video /

1 day ago

Egypt Rounds up Teenaged TikTokkers in Crackdown on Social Media

Education

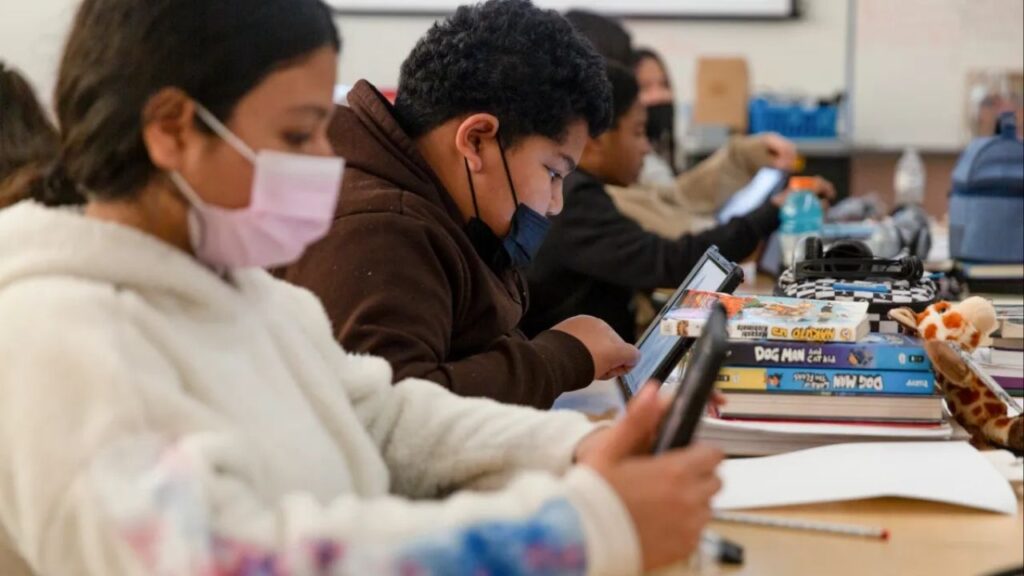

California Schools Reverse Truancy Trends. Improving Reading Scores Could Be Next

Opinion /

17 hours ago

Minneapolis Children Revealed Courage, Absorbed Fear During Church Shooting

U.S. /

3 days ago

Fresno Unified Employee With Cancer Alleges District Brass Conspired in Failed Try to Force Resignation

Courts /

3 days ago

Commentary

Commentary

Featured

Opinion /

17 hours ago

California Schools Reverse Truancy Trends. Improving Reading Scores Could Be Next

This commentary was originally published by CalMatters. Sign up for their newsletters.

Dan Walters

CalMatters

Good news is a rarity in Cali...

Sports

SF 49ers /

3 days ago

49ers Sign Former Clovis West Star as Their Third QB

Around the state

Opinion /

17 hours ago

California Schools Reverse Truancy Trends. Improving Reading Scores Could Be Next

Economy /

4 days ago

Second-Highest Unemployment Rate Still In California

Travel /

4 days ago

Commercial Vehicle Fire Closes Southbound I-5 Near Grapevine

Animals /

4 days ago

Tensions Between Some Tahoe Residents and Wildlife Workers Become Unbearable

Global View

Evacuation of Gaza City Would Be Unsafe and Unfeasible, Says Head of Red Cross

World /

16 hours ago

Prime Minister of Yemen’s Houthi Government Killed in Israeli Strike

World /

17 hours ago

Israeli Military Says Local Tactical Pause Will Not Apply to Gaza City

World /

2 days ago

US Denies Visas to Palestinian Officials Ahead of UN General Assembly

World /

2 days ago

White House Says Trump Not Happy With Russia Strike on Ukraine, to Make Statement Later

World /

3 days ago

Israel Steps up Bombardment of Gaza City, Kills 16 People Around Enclave, Medics Say

World /

3 days ago

MORE NEWS

Entertainment

Events /

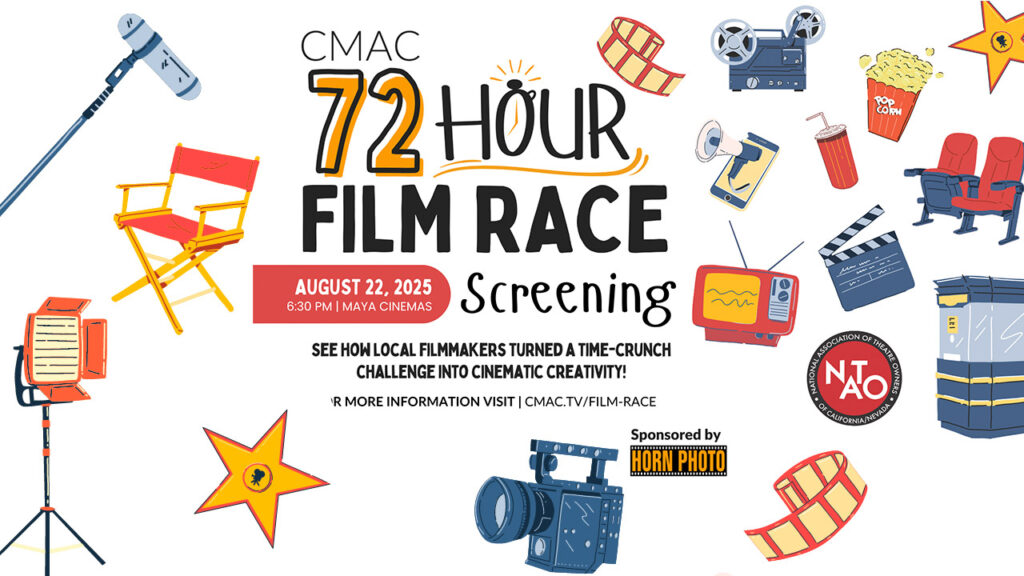

1 week ago

Find Out How You Can Watch Sold Out 72-Hour Film Race

Local /

1 week ago