The Fresno City Council will weigh a plan to address a state law controlling outward growth in cities on Thursday, Oct. 16, 2025. (GV Wire Composite)

- The Fresno City Council will vote on a plan to tax new homes, commercial developments, and apartments on Thursday

- The state-required tax on buildings away from the city core is part of an effort to reduce travel miles and curb emissions.

- Critics say the plan affects low-income families most as it makes market-rate housing less affordable without any guaranteed benefits.

Share

|

Getting your Trinity Audio player ready...

|

On Thursday, Fresno City Councilmembers will weigh the administration’s plan to address California’s law controlling outward growth and curbing emissions.

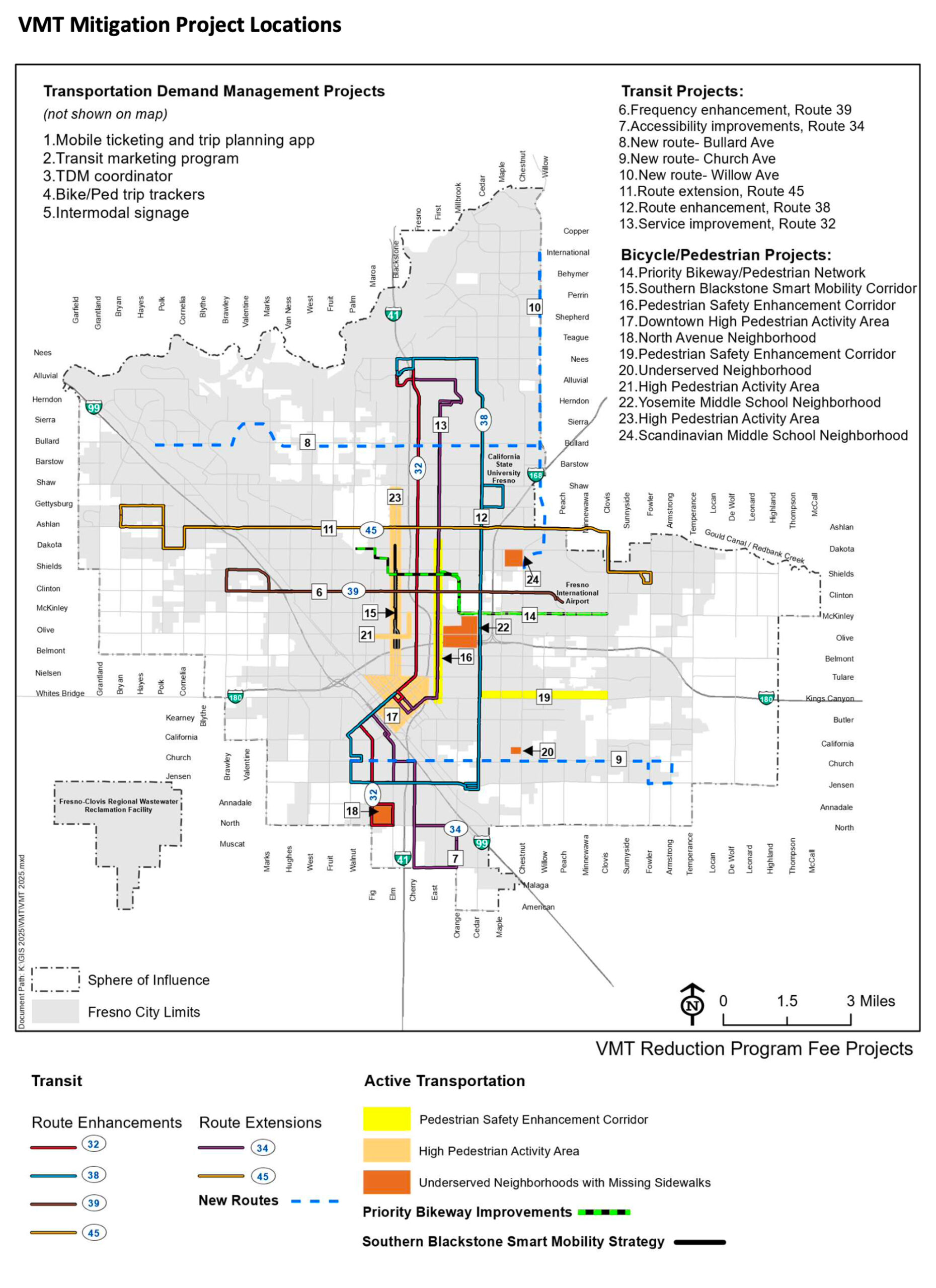

Fresno’s Planning and Development Department proposes 24 walkability and transit projects to meet the demands of California’s Senate Bill 743, written in 2013.

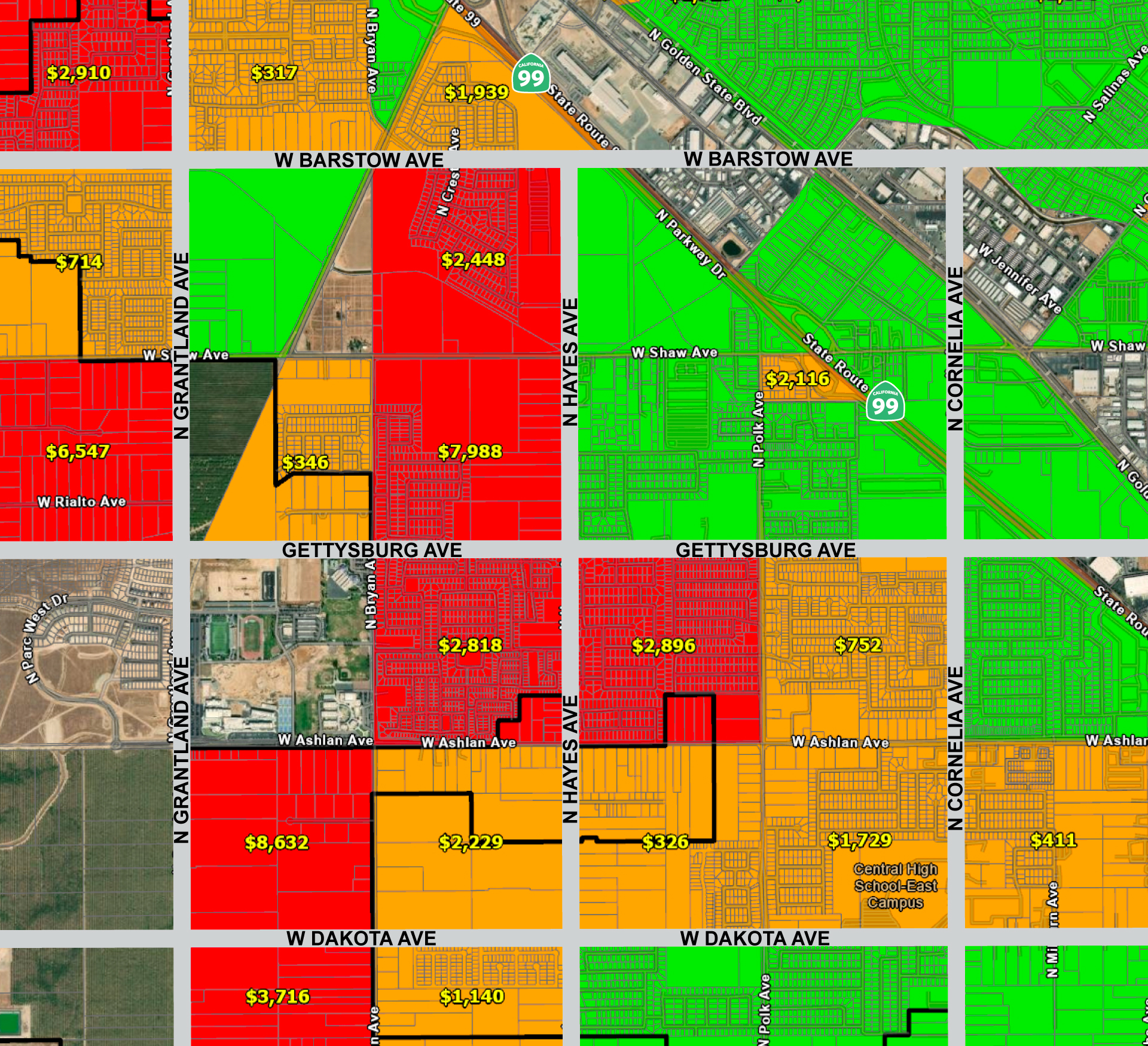

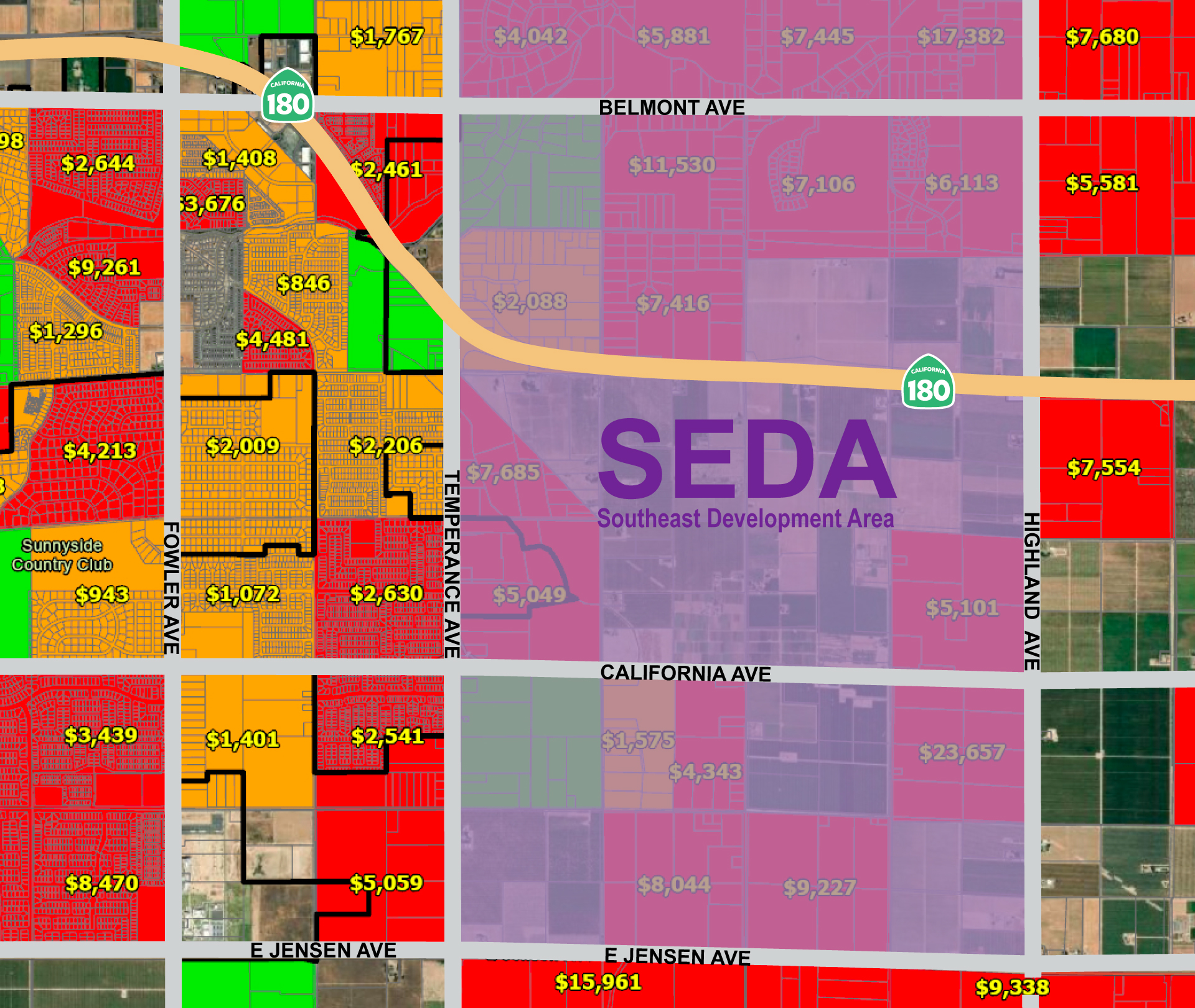

Paying for those projects will come from taxes placed on homes built in Fresno’s exterior, determined by a map created by the Fresno Council of Governments.

Fresno’s tax on vehicle miles traveled — VMT — is among the lower assessment levels in the state, but it still could mean thousands to tens of thousands of dollars more on a new home. The city also assesses apartments and commercial buildings, possibly making it even harder to get grocery stores in the city’s periphery.

Another tax assessed through Assembly Bill 130 would add still more costs to many new market-rate homes and apartments, as well as commercial buildings. These new AB 130 fees would go into a state pot to fund affordable housing or related infrastructure projects.

Related Story: Fresno Housing Killer Buried in Newsom’s Latest Budget. What Can City ...

VMT Rules Could Affect Affordability: Arias

To reduce VMT scores, builders can widen sidewalks, add bike lanes, improve access to buses, and limit parking in new developments. Apartments with less parking get lower VMT.

“The additional cost might make apartments and single-family units in SW Fresno unaffordable to working families leading to further gentrification of existing residents who want to upgrade or own a home.” — Fresno City Councilmember Miguel Arias

Builders can also reduce the tax by adding in commercial buildings, but it should be noted that commercial buildings get taxed as well. Retail projects such as grocery stores can be assessed hundreds of thousands of dollars.

One example in the city’s study shows a theoretical commercial project with a medium impact at Nees and Fresno avenues requiring a $950,000 fee. Adding a grocery store in southeast Fresno’s food desert areas could become even more expensive to build.

Fresno Mayor Jerry Dyer declined an interview, and the city did not make anyone available to talk about the plan after multiple requests.

Darren Rose, president and CEO of the Building Industry Association of Fresno Madera Counties, said the plan means certainty for builders who have long awaited VMT rules. That certainty, however, comes at the cost of affordability.

“It further complicates the affordability issue. We’re rapidly nearing a point where I think it’s about 20% of Fresno or Fresno County folks can actually afford a median-priced home,” Rose said. “It’s just becoming very cost prohibitive.”

Fresno City Councilmember Miguel Arias, who represents southwest Fresno — which would have high taxes rates in some areas — said the city’s plan could unevenly impact housing in his district.

“The additional cost might make apartments and single-family units in SW Fresno unaffordable to working families leading to further gentrification of existing residents who want to upgrade or own a home,” said Arias.

Council president Mike Karbassi declined to comment. Other councilmembers did not respond.

(Disclaimer: GV Wire Publisher Darius Assemi is CEO and president of Fresno builder Granville Homes.)

City Project List Expands Transit, Walkability. Some Projects Already Paid For

The city’s project list includes new or expanded bus routes, bike lanes, and a new app.

The plan improves bus routes on Cedar Avenue and First Street.

New bus routes along Bullard and Willow avenues would increase transit access in north Fresno.

The city rolled out a new bus route in August along Church Avenue, connecting Sanger West High School and future housing developments there to the Fresno City College West Fresno Campus. New home fees would reimburse the city for $1.6 million of that project.

One project includes expanding the 45 Bus Route that travels along Ashlan Avenue. The east-west bus route shown on the city’s study already travels from Blythe Avenue to Fowler Avenue.

Marketing projects would promote public transit, better signage would be added, and trip trackers for bikes and pedestrians would calculate usage. A $2.5 million app and a $500,000 marketing program will help push mass transit.

Other projects increase walkability in neighborhoods.

At least two projects cited by the city have either been completed or have had funds already allocated.

The city cites its existing plan to add bike lanes and widen sidewalks on South Blackstone Avenue. In a previous interview with GV Wire, Public and Planning Director Scott Mozier said the project was fully funded with 90% of the $15 million coming from state grants.

One Street Corner Might Get Taxed Thousands. The Other Side? Nothing.

The council of governments calculated VMT by gauging how close neighborhoods are to schools, job centers, or shopping centers.

The map used by Fresno and created by the Fresno Council of Governments shows a patchwork of estimated travel miles, where one corner might incur a hefty fee and across the street no fee at all.

For instance, at the northwest corner of Gettysburg and Hayes avenues, the city could add a $7,917 tax while the northeast corner wouldn’t get any tax, according to GV Wire analysis using travel mile data and the formula outlined by the city.

Apartments — the kind of housing the state and city have pushed for — get assessed higher than homes. The city in its study uses a 3.05-person average for single-family homes while they assume 3.45 people per apartment unit, according to GV Wire analysis.

A 200-unit apartment complex with a VMT score of 18 would be taxed an additional $600,000 — or about $3,000 a unit.

Most of the land that Fresno Mayor Jerry Dyer wants to develop as part of the Southeast Development Area has not been assessed. However, one analyzed parcel at Jensen and Fowler avenues earned a score below the threshold while caddy corner, outside SEDA, homes would be assessed a $8,457 tax.

When asked about how VMT was calculated, Kai Han, senior regional planner with Fresno COG’s modeling team said in an email to GV Wire they used a 2022 travel study. The two-part study consisted of a survey and a one-day travel diary from about 7,400 households across the San Joaquin Valley.

Han said the process divided certain areas into parcels they analyzed individually.

RELATED TOPICS:

Categories

OpenAI’s ChatGPT Down for Thousands Again, Downdetector Reports

US Flu Cases Are Rising Again