Combination picture of Joe Biden and U.S. President Donald Trump, November 4, 2020. (Reuters/Kevin Lamarque/Carlos Barria)

Share

|

Getting your Trinity Audio player ready...

|

WASHINGTON — President Donald Trump campaigned on a pledge to lower consumer prices that skyrocketed during Joe Biden’s term, but he is now facing the same hard reality that dogged his predecessor: Once prices rise, they seldom fall, and Americans hate higher prices.

Trump may now be making some of the same mistakes as Biden, including downplaying the impact of higher prices on households and looking to corporate investments to boost jobs and wages, a strategy that takes years to pan out.

Repeatedly in recent days, including at the start of a state visit by Saudi Arabian Crown Prince Mohammed bin Salman, Trump has touted what he says are trillions of dollars in new investments that will create jobs, while saying inflation is under control, leaning on relatively low gasoline prices as his primary evidence.

“It’s eerily similar,” said Michael Strain, head of economic policy studies at the conservative American Enterprise Institute. “The mistake that they’re both making is not accepting the fact of life, the fact of politics – that the American people really care about prices going up rapidly.”

Inflation is down, running around 3% annually versus more than 9% at its peak under Biden. But goods – those subject to Trump’s tariffs in particular – cost more than before, and wage gains for many have been largely offset by higher prices. Food prices are creeping higher, led by items Americans love to consume, such as nearly 15% increases for beef, 7% for bananas and more than 20% for coffee, according to the latest Consumer Price Index data. Prices for tools and hardware – largely imported – are 6.2% higher than a year ago, up the most in more than two years, while cleaning supplies like paper towels are 5.5% pricier, up the most since December 2023.

Mounting frustration over Trump’s handling of the economy is driving down his approval rating, a fact Trump acknowledged this week. At just 38%, they’re the lowest since his return to power, a Reuters/Ipsos poll found.

Other measures of consumer satisfaction are also low, largely because of prices. The University of Michigan’s Consumer Sentiment Index sank to its second-lowest ever in November, with drops measured across party lines. For independents – a constituency critical to either party’s hopes for national election wins – November marked a record low. Even Republicans were unhappy, registering the biggest drop in sentiment in a year and a half.

Thanksgiving dinner illustrates the problem. The American Farm Bureau Federation estimates it will cost 5% less this year than 2024, thanks to steep discounts for turkeys, but that tally is still 13% more than in 2019 before the COVID-19 pandemic. Half the meal’s other foods, including sweet potatoes, frozen peas and a fresh vegetable tray appetizer, cost more than in 2024.

Disaffection about the economy powered Trump’s victory last year, but that support isn’t guaranteed, as seen in Republican losses in state and local elections this month.

Keen to avert further losses in 2026’s midterm congressional elections, Trump plans more visits to battleground states in coming months, with a focus on tax cuts on overtime, tips and Social Security, deregulation and lower drug prices his administration says could boost Americans’ buying power. One stop could be Las Vegas, where Trump unveiled plans to cut taxes on tips, administration officials said.

“The president knows he has a proven economic formula that works. It did in his first term,” a senior White House official said this week. “It’s just going to take more time.”

Tariffs on Certain Foods Being Rolled Back

Trump last week rolled back tariffs on hundreds of food items including coffee and bananas, and also talks of sending $2,000 tariff-funded checks to lower- and middle-income households. He also suggested 50-year mortgages could make home ownership more affordable, an idea panned by experts as more expensive in the long run.

Trump, a billionaire, had been dismissive of Americans’ concerns until recently, Strain said, recalling his April comments when he conceded his tariffs might mean American parents could only afford a few dolls for their girls instead of 30.

Now, he is grasping for new policies to address high costs more quickly, while pressuring the Federal Reserve to cut interest rates, but few details have emerged.

Both Trump and Biden put the power of the government’s purse behind expanding manufacturing, but such investments take time to generate jobs and sometimes commitments fizzle out. Biden in 2024 touted a new $3.3 billion Microsoft data center in Wisconsin where Trump had hailed a $10 billion investment by Taiwan’s Foxconn years earlier that never lived up to a promise for 13,000 new jobs.

Trump is also pushing massive corporate investments in artificial intelligence, which could boost growth but may also reduce human labor. Investors also fret an AI bubble may be forming, another risk.

Trump and Biden each blamed meatpackers for high meat prices, and each sought ways to lower healthcare costs, another sore point, with more Trump announcements expected on that front.

Eyes on the Midterms

Tiesha Blackwell, 25, lives near Detroit and has seen the prices of some foods and gasoline go down since Trump’s return. Things are still more expensive than before COVID, she said, and she now worries about health care costs soaring next year, when she ages out of her mother’s insurance plan.

“I’m scared to see what health care rates are going to be next year,” she said.

Scott Lincicome at the Cato Institute said prices generally didn’t fall once they’d gone up. “The best you can hope for is them kind of plateauing and wages catching up, and then you feel rich again,” he said.

“Politicians want easy solutions. They want photo ops. They want ribbon cutting ceremonies,” he said, noting that most Americans want drama-free, steady growth.

Many Americans also soured on tariffs, Lincicome said, but Trump shows no sign of removing them beyond select exemptions.

Trump’s also touting unrealistic estimates for economic growth of 6% next year, Lincicome said, including at a recent dinner with Wall Street CEOs. Even getting to the 4% growth forecast by Trump’s top economic adviser Kevin Hassett would be a big reach, he said.

The International Monetary Fund, meanwhile, projects U.S. growth of 2.0% in 2025 and 2.1% in 2026.

Ben Harris, a former Biden Treasury official who is now at the Brookings Institution, acknowledged that Biden’s team calling inflation “transitory” was unfortunate. But he said it’s not credible for Trump to blame price pressures on Biden nearly a year into office, especially as his tariffs, immigration crackdown and pressure on the Fed may be a recipe for boosting inflation.

“They should have expected this,” he said. “If your goal is to reshore manufacturing, of course that’s going to be more expensive because the reason it was offshored in the first place was because corporations wanted to lower prices.”

Unlike 2019, during Trump’s first term, when tariffs on refrigerators and other items were quickly passed through to consumers, prices stayed steady longer this time, but Goldman Sachs and other banks expect a full pass-through next year, which could fuel consumer angst ahead of 2026 midterm elections.

The bigger damage, Harris said, could be longer-term, with many international investors increasingly looking to hedge their bets. “The notion that you can be tariffed on a whim, as virtually everyone was on ‘Liberation Day’, that makes business leaders and investors say, ‘It would be irresponsible of me if I did not try to diversify away from the United States.'”

Still, Trump continues to tout the upside from his tariffs, including roughly $150 billion of new federal revenue from the levies taken in since his return in January and pledges by a number of countries and corporations to invest in new U.S. manufacturing as a result.

“Our country has never been in a position like this,” Trump said at the White House event with the Saudi crown prince. “And it is really because of the fact that we use tariffs to bring all this money in, and you’re going to see the results in a year when these plants start to open up.”

—

(Reporting by Howard Schneider and Andrea Shalal; Editing by Dan Burns and Anna Driver)

RELATED TOPICS:

Trump Faces Same Reality as Biden: Americans Despise Higher Prices

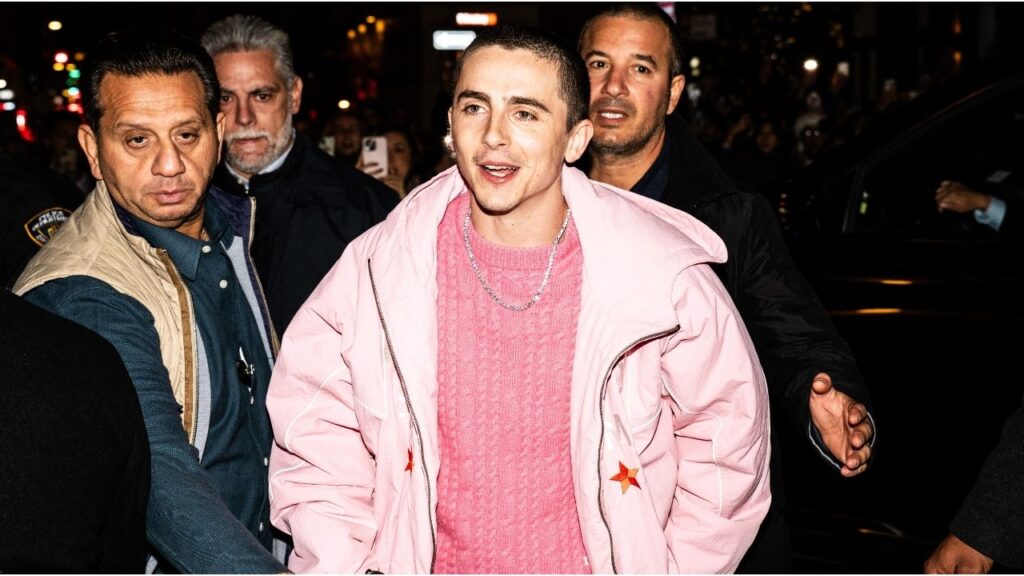

They Came for Timothée. They Left With $250 Windbreakers.

Visalia Police Arrest DUI Driver After Failing to Yield, Crash

Hoover High School Hosts Thanksgiving Dinner Box Giveaway Sunday