Global shares rallied on Tuesday (June 24) after U.S. President Donald Trump said Iran and Israel had agreed to a ceasefire, sending oil prices into a deep dive as concerns over supply disruptions ebbed. Julian Satterthwaite reports. (Reuters)

- U.S. stocks rose after Trump announced a ceasefire between Israel and Iran, easing fears of broader Middle East conflict.

- Energy stocks fell as oil prices dropped nearly 5%, while financial and tech sectors led gains across major indexes.

- Fed Chair Powell reiterated a cautious stance on rate cuts; markets now expect at least two reductions by year-end.

Share

|

Getting your Trinity Audio player ready...

|

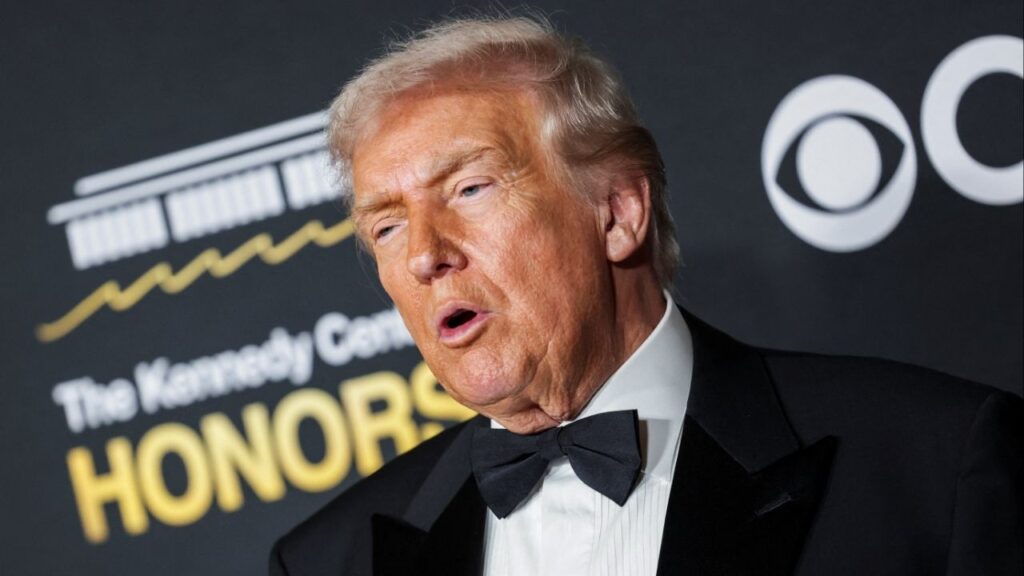

U.S. stock indexes rose on Tuesday as President Donald Trump’s announcement of a ceasefire between Israel and Iran helped calm investor fears of a broader conflict in the oil-rich Middle East.

Financial and technology stocks led the rally among S&P 500 sub-sectors, while energy stocks declined the most, tracking a nearly 5% drop in crude prices after the ceasefire announcement eased the threat of Gulf oil supply disruptions.

Defense stocks Lockheed Martin and RTX Corp fell 1.7% and 2.5%.

Investors also assessed Federal Reserve Chair Jerome Powell’s comments on monetary policy, where he reiterated the central bank’s wait-and-watch approach to interest rates as tariff-driven price pressures become evident.

Trump’s Call for Truce Marks Sharp Turnaround

Trump’s call for a truce marked a sharp turnaround after the U.S. bombed Iranian nuclear sites over the weekend and Iran retaliated by firing missiles at a U.S. base in Qatar.

Despite reports of both Israel and Iran violating the ceasefire through the day, investors have taken heart from the de-escalation in hostilities.

At 10:20 a.m. ET, the Dow Jones Industrial Average rose 288.65 points, or 0.68%, to 42,870.43, the S&P 500 gained 45.35 points, or 0.75%, to 6,070.52 and the Nasdaq Composite gained 206.04 points, or 1.05%, to 19,837.01.

The benchmark S&P 500 index remains about 1.3% below its all-time highs.

Powell has been on the receiving end of Trump’s criticisms for not cutting interest rates, with the President hinting at firing the top Fed policymaker or naming a successor soon.

“There’s no question that Trump has put pressure to cut interest rates. But I don’t think Powell is going to budge,” said Peter Cardillo, chief market economist at Spartan Capital Securities.

Atlanta Fed President Raphael Bostic told Reuters the central bank doesn’t need to cut interest rates soon, as companies plan to raise prices due to higher import taxes and the job market is still strong.

In contrast, Fed Vice Chair Michelle Bowman on Monday backed the resumption of the policy easing cycle in July.

Market participants are pricing in at least two 25-basis point rate reductions before year-end, with the first cut seen in September.

Fed Officials Expected to Speak

Several central bank officials, including Fed Board Governor Michael Barr and Fed Minneapolis President Neel Kashkari, are also scheduled to speak later in the day.

An index tracking consumer confidence fell to 93 in June, a Conference Board report showed. Economists polled by Reuters had expected the index to stand at 100.

Focus later this week will be on the Commerce Department’s final take on first-quarter GDP and its Personal Consumption Expenditures (PCE) data.

Among megacap stocks, Tesla shares lost 1.4%.

Shares of crypto companies rose after bitcoin hit a one-week high. Coinbase Global was up 7% and Strategy advanced 2.6%.

Package delivery firm FedEx edged up 0.6% ahead of its quarterly results due after the closing bell.

Advancing issues outnumbered decliners by a 2.86-to-1 ratio on the NYSE and by a 2.9-to-1 ratio on the Nasdaq.

The S&P 500 posted 18 new 52-week highs and no new lows while the Nasdaq Composite recorded 83 new highs and 35 new lows.

—

(Reporting by Kanchana Chakravarty in Bengaluru; Editing by Devika Syamnath)

RELATED TOPICS:

Categories