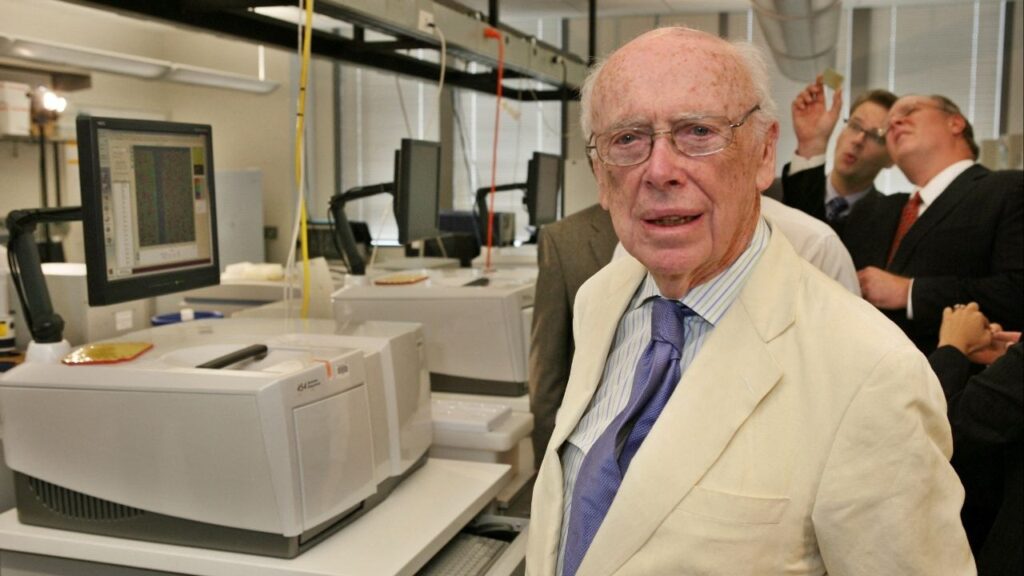

A man walks past a Wall Street marking outside the New York Stock Exchange (NYSE) building in New York City, U.S., March 11, 2025. (Reuters File)

- Wall Street rebounded as oil prices fell, calming inflation fears after Israel-Iran strikes left crude production and exports untouched.

- Markets eye Federal Reserve’s Wednesday decision, with investors watching for rate cut clues amid stable economic data and retreating oil prices.

- Dow, S&P, Nasdaq surged over 1%, boosted by easing geopolitical fears and corporate movers like U.S. Steel and Cisco.

Share

|

Getting your Trinity Audio player ready...

|

U.S. stock indexes rose on Monday as oil prices retreated after the Israel-Iran attacks left crude production and exports unaffected, allaying investor concerns ahead of a Federal Reserve policy meeting.

Wall Street indexes shed more than 1% on Friday as oil prices surged 7% after Israel and Iran traded air strikes, feeding investor worries that the combat could widely disrupt oil exports from the Middle East.

Crude prices fell more than 3% after touching their highest levels since January last week as the renewed military strikes over the weekend left oil production and export facilities unaffected, offering some respite to investors worried about a resurgence in inflation. [O/R]

U.S. stocks extended gains and crude prices fell further after the Wall Street Journal reported that Iran had been urgently signaling that it seeks to end to hostilities and resume talks over its nuclear programs, sending messages to Israel and the United States via Arab intermediaries.

“The strikes have continued, but it doesn’t seem like the oil markets and shipping lanes have been disrupted. Markets are just calming down a little bit from that big surprise on Friday,” said David Miller, chief investment officer at Catalyst Funds.

Focus will shift to the U.S. Federal Reserve’s monetary policy decision on Wednesday, when policymakers are widely expected to keep interest rates unchanged.

Fed Chair Jerome Powell’s comments as well as the central bank’s updated projections for monetary policy and the economy will come under scrutiny as investors seek clues on the possibility of rate cuts later this year.

Money markets show traders pricing in about 46 basis points of cuts by the end of 2025, with a 56% chance of a 25-bps reduction in September, according to CME Group’s Fedwatch tool.

Key data expected this week includes monthly retail sales, import prices and weekly jobless claims.

Major Markets Rise

At 10:04 a.m. the Dow Jones Industrial Average rose 439.65 points, or 1.04%, to 42,636.31, the S&P 500 gained 63.22 points, or 1.06%, to 6,040.19, and the Nasdaq Composite gained 261.80 points, or 1.35%, to 19,668.63.

Shares of telecom companies T-Mobile US, AT&T and Verizon were mixed after dipping earlier as Trump Organization launched a self-branded mobile network, dubbed Trump Mobile.

Meanwhile, UPS and FedEx edged up about 1% after Trump Mobile named the companies as shipping partners.

Shares of Sarepta Therapeutics plunged 46% after the company disclosed a second case of a patient dying due to acute liver failure after receiving its gene therapy for a rare form of muscular dystrophy.

U.S. Steel rose 5% after Trump approved Nippon Steel’s $14.9 billion bid for the company.

Cisco gained 1.8% after Deutsche Bank upgraded the communications equipment maker to “buy” from “hold”.

Advancing issues outnumbered decliners by a 4.36-to-1 ratio on the NYSE and 2.7-to-1 ratio on the Nasdaq.

The S&P 500 posted 11 new 52-week highs and three new lows, while the Nasdaq Composite recorded 43 new highs and 67 new lows.

—

(Reporting by Sruthi Shankar in Bengaluru; Editing by Pooja Desai)

RELATED TOPICS:

Categories