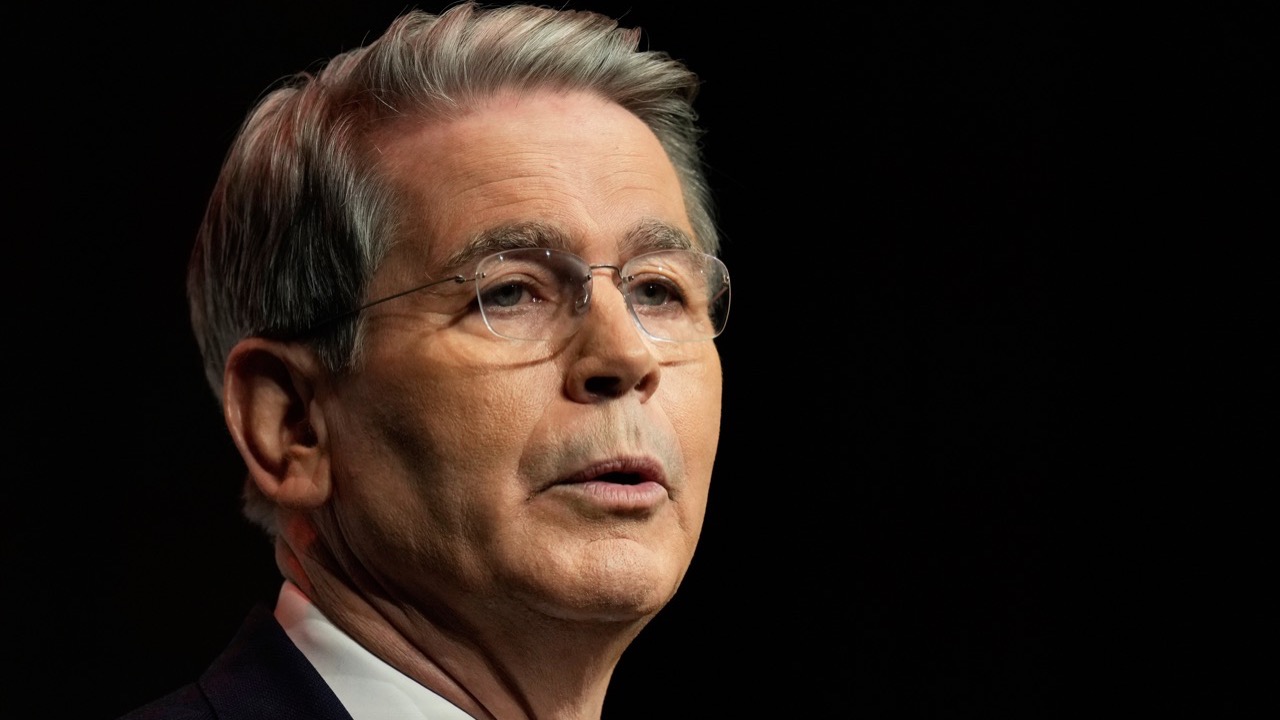

Congressional Budget Office report indicates the U.S. could face a debt crisis as early as August without legislative action. (AP/Seth Wenig)

- CBO warns of potential U.S. debt default by August without a deal to raise the debt ceiling.

- Treasury's 'extraordinary measures' may be exhausted, leaving the government unable to pay all its bills.

- Bipartisan Policy Center suggests an even earlier mid-July deadline for potential cash shortfall.

Share

WASHINGTON — The United States is on track to hit its statutory debt ceiling — the so-called X-date when the country runs short of money to pay its bills— as early as August without a deal between lawmakers and the White House, according to a Congressional Budget Office report Wednesday.

By that time, the government would no longer have enough of a financial cushion to pay all its bills after exhausting its “extraordinary measures” the accounting maneuvers used to stretch existing funds.

Risk of Default Looms Without Agreement

Washington would risk defaulting on its debt unless Congress and Republican President Donald Trump agree to lift the borrowing limit or abolish the debt ceiling concept altogether.

The debt limit was reinstated Jan. 2, following its suspension by Congress in the Fiscal Responsibility Act of 2023.

“The Treasury has already reached the current debt limit of $36.1 trillion, so it has no room to borrow under its standard operating procedures,” according to the CBO report.

Bipartisan Policy Center Estimates Earlier Deadline

An analysis released on Monday by the Bipartisan Policy Center estimates that the U.S. could run out of cash by mid-July if Congress did not raise or suspend the nation’s debt limit.

Trump had previously demanded that a provision raising or suspending the debt limit — something that his own party routinely resists — be included in legislation to avert the last potential government shutdown. “Anything else is a betrayal of our country,” Trump said in a statement in December. That deal did not address the debt limit.

Related Story: The Fed Expects to Cut Rates More Slowly in 2025. What That Could Mean for Mortgages, Debt and More

Treasury’s Extraordinary Measures in Place

After the debt limit was reinstated, in one of her last acts as Treasury Secretary, Janet Yellen said Treasury would institute “extraordinary measures” intended to prevent the U.S. from reaching the debt ceiling.

Since then, the Treasury Department has stopped paying into certain accounts, including a slew of federal worker pension and disability funds, to make up for the shortfall in money. Treasury Secretary Scott Bessent has continued to notify Congress about the use of extraordinary measures in an effort to prevent a breach of the debt ceiling.

The CBO estimates that if the debt limit remains unchanged, then “the government’s ability to borrow using extraordinary measures will probably be exhausted in August or September 2025. The projected exhaustion date is uncertain because the timing and amount of revenue collections and outlays over the intervening months could differ from CBO’s projections.”