Former President Donald Trump at a rally in Greenville, N.C., on Oct. 21, 2024. Trump has floated the idea of replacing federal revenue from income taxes with money received from tariffs, but he has not provided specific details of how that would work. (Doug Mills/The New York Times)

- Trump suggests replacing income taxes with tariffs, drawing criticism from experts across the political spectrum.

- The proposal would shift the tax burden from progressive income taxes to regressive tariffs, potentially impacting lower-income Americans.

- Income taxes were introduced to address wealth inequality and fund government programs, a stark contrast to Trump's vision.

Share

|

Getting your Trinity Audio player ready...

|

WASHINGTON — Former President Donald Trump has spent much of the presidential campaign brainstorming new, and sometimes untested, ways to cut taxes. In the election’s final stretch, he raised the possibility of going even further: eliminating income taxes entirely.

During a Fox News segment Monday, Trump took questions at a barbershop in New York City. When asked if the United States could potentially end all federal taxation, Trump said the country could return to the economic policies in the late 19th century, when there was no federal income tax.

“It had all tariffs; it didn’t have an income tax,” Trump said. “Now we have income taxes, and we have people that are dying. They’re paying tax, and they don’t have the money to pay the tax.”

In June, Trump floated the idea of replacing federal revenue from income taxes with money received from tariffs. Trump has not provided specific details of how that would work, and it is unclear if he wants to eliminate all federal taxes, including corporate income taxes and payroll taxes, or only end the individual income tax.

Either way, liberal and conservative experts have dismissed his idea as mathematically impossible and economically destructive. Even if Republicans control Congress, lawmakers are unlikely to dismantle the income tax system. Yet Trump’s combination of tax cuts and tariff increases has been central to his political pitch.

Related Story: Trump Accused of Groping a Woman in 1993 While Jeffrey Epstein Watched

“There is a way, if what I’m planning comes out,” Trump said of ending income taxes.

Replacing income taxes with tariffs would reverse the progressivity of the tax system in the United States. In general, income taxes are progressive, meaning that Americans with more income pay a higher tax rate. Tariffs, which impose a tax on products imported into the United States, are regressive. They raise the prices on imported items like clothing and groceries, placing a larger burden on lower-income Americans who spend a bigger percentage of their income on those goods.

Trump has denied that Americans pay the cost of tariffs. He argues that companies overseas bear the cost of tariffs on the products they ship to the United States. Economists largely debunk that argument — companies generally pass along those higher costs to consumers by raising prices.

Related Story: Harris and Trump Deadlocked to the End, Final Times/Siena National Poll Finds

Why Does the United States Have Income Taxes?

The United States put income taxes in place to achieve two main goals: raising taxes on the rich and paying for a larger federal government.

The country briefly had an income tax during the Civil War, but it was not until Trump’s favorite historical period — the late 19th century — that the idea gained ground again. Tariffs largely funded the federal government, but Democrats of that era wanted to collect more money from the wealthy by charging an income tax.

In the late 1800s, Democrats, led by William Jennings Bryan, attacked tariffs as a burden on poor Americans. Republicans supported tariffs as a way to protect U.S. industry from foreign competition.

Related Story: US Bond Market Braces for the ‘Trump Trade’ of Large Tariffs and Deficits

“There was a real concern about inequality, just as there is today, as there were great disparities in wealth and poverty in the Gilded Age, and so the income tax was seen as a necessary leveler by its proponents,” said Steven R. Weisman, the author of a book on the history of the income tax in the United States.

Actually creating a federal income tax was ultimately an involved process, requiring the ratification of the 16th amendment in 1913. At first, it was narrowly targeted at wealthy individuals and corporations, but fighting two world wars and creating programs like Social Security was expensive. American policymakers turned to income taxes to pay for those priorities.

–

This article originally appeared in The New York Times.

By Andrew Duehren/Doug Mills

c.2024 The New York Times Company

RELATED TOPICS:

Categories

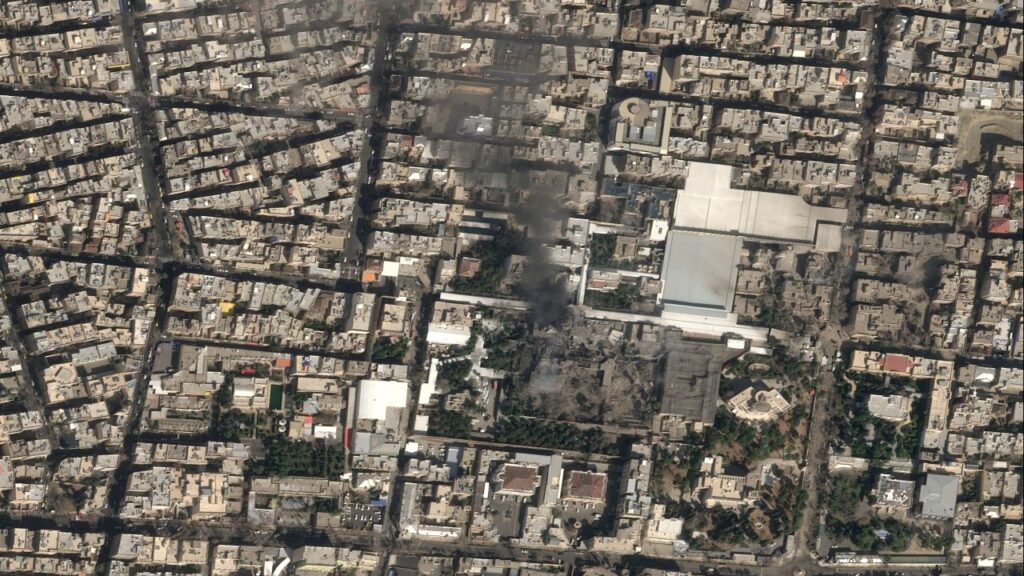

Iran Says Supreme Leader Died During US-Israeli Strikes

Why Have You Started This War, Mr. President?