Understanding the financial impacts of climate change is as simple as checking your insurance policy — and the news isn't good. (GV Wire Composite/David Rodriguez)

- Climate change intensifies extreme weather, escalating risks and costs, causing a 40% surge in insurance prices.

- Policyholders in climate-vulnerable areas like Texas and Florida struggle to afford coverage as politicians resist adapting to extreme weather.

- Increasingly worried homeowners deem long-term commitments to climate change mitigation crucial to address rising costs.

Share

|

Getting your Trinity Audio player ready...

|

You don’t need to be a scientist to understand the harms of climate change. All you need is an insurance policy. And finding affordable insurance is getting harder in the places hit hardest by climate change.

Carly Fabian

Opinion

As climate change increases the intensity and severity of extreme weather, the costs, both financially and in terms of human lives, are rising dramatically. The National Oceanic and Atmospheric Administration predicts an increase in Category 4 and 5 hurricanes. As sea level rise pushes storms farther inland, these storms will become more destructive and expensive. Advances in climate attribution science are also leading to more precise estimates of the costs of climate change. After Hurricane Sandy, scientists attributed $8 billion of the total $60 billion to climate change.

Unfortunately, when your area faces increased risk, your insurance company has little obligation to stick by you, even if you’ve been paying the premiums for years.

In 2023, 398 global natural disaster events created $380 billion in losses, the highest on record. Reinsurance companies, who provide insurance for other insurance companies, have raised prices by nearly 40 percent in the last two years. Those costs are being passed down by primary insurers like Allstate and State Farm, raising premiums and deductibles and reducing coverage.

Related Story: UN Chief Wants a Tax on Profits of Fossil Fuel Companies, Calling Them ...

Decades of denial and delay have proved to be an expensive distraction. While climate change might once have seemed like a far-off environmental threat, more communities are realizing it’s an immediate financial risk. In states like Louisiana and California, policyholders struggle to afford or find coverage as insurers retreat. Florida retirees who thought climate change would be a challenge for their grandkids are finding out that they may need to use their savings to pay for repairs or that climate change might price them out of their homes.

This trend is not limited to big-ticket disasters on the coasts. Sea level rise and more intense rainfall expand flood exposure faster than the government can map it. More frequent smaller events like thunderstorms and hail can and will wreak havoc across the Midwest. Even states like Vermont, which once have seemed like climate havens, are acknowledging that a warmer and wetter climate will lead to higher insurance premiums.

In a new form of climate denial, politicians in Texas and Florida have been acting against the interests of their constituents, attacking insurance companies for even considering sustainability factors in their underwriting and rejecting federal funds to adapt to extreme weather. At the same time, people in areas vulnerable to hurricanes and flooding are increasingly losing access to basic coverage for their homes and need serious policy solutions that account for growing climate risks.

Related Story: Vermont Becomes 1st State to Enact Law Requiring Oil Companies Pay for Damage ...

Higher Premiums Are the Tip of the Iceberg

Higher premiums are also just the tip of the iceberg of the financial risks of climate change. When state-run last-resort insurance programs become overburdened, taxpayers end up footing the bill. A dwindling tax base and a foreclosure crisis in vulnerable areas could create risks for regional banks and spread risk to the broader economy. Without insurance, there is no mortgage market.

Rather than asking whether people believe in climate change, we need to ask whether they understand it and what they plan to do about it. Do they know the risks to their homes and finances? Do politicians understand the economic costs for their constituents and communities? Do regulators understand risks to the entire financial system?

Thankfully, most of the public doesn’t need to be convinced. The majority of homeowners already worry that climate change will impact their homes, and four out of five consider climate risks when buying a home.

Related Story: Anonymous Gifts Are Common. But a Climate Group Says a $10 Million Gift It Got ...

Climate change is not the only factor influencing the rise in rates. In the near term, these homeowners might see some relief if factors like inflation or building costs go down. However, climate change is a growing long-term risk, and meaningfully addressing these costs requires long-term commitments to mitigation and investments in adaptation.

This year’s hurricane predictions should be cause for alarm for homeowners along the Eastern Seaboard and Gulf Coast, even if they avoid a direct hit from storms fueled by climate change. Just a glancing blow on the far side of their state could raise their insurance rates or make coverage unavailable. And those rate hikes will not discriminate between those who believe in the dangers of the climate crisis and those who choose not to.

About the Author

Carly Fabian is an insurance policy advocate with Public Citizen’s Climate Program. She wrote this for InsideSources.com.

Make Your Voice Heard

GV Wire encourages vigorous debate from people and organizations on local, state, and national issues. Submit your op-ed to bmcewen@gvwire.com for consideration.

RELATED TOPICS:

Categories

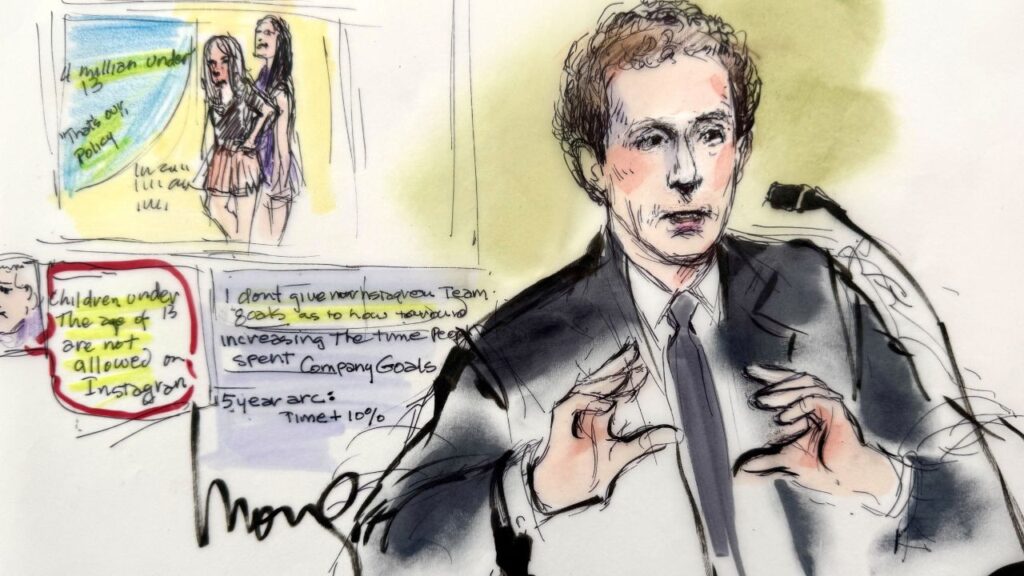

Meta’s Zuckerberg Denies at LA Trial That Instagram Targets Kids

What You Need to Know About Avalanche Safety in the Backcountry