Share

WASHINGTON — The average long-term U.S. mortgage rate ticked down for the third week in a row and have fallen more than a half-point since hitting a 20-year high less than a month ago.

Mortgage buyer Freddie Mac reported Thursday that the average on the benchmark 30-year rate fell to 6.49% from 6.58% last week. A year ago the average rate was 3.11%.

The rate for a 15-year mortgage, popular with those refinancing their homes, edged down to 5.76% from 5.90% last week. It was 2.39% one year ago.

Mortgage rates are still more than double what they were in early January, mirroring a sharp rise in the yield on the 10-year Treasury note. The yield is influenced by a variety of factors, including global demand for U.S. Treasurys and investors’ expectations for future inflation, which heighten the prospect of rising interest rates overall.

The Federal Reserve, which has been hiking its short-term lending rate since March in a bid to crush the highest inflation in decades, raised its rate again early this month by 0.75 percentage points, three times its usual margin, for the fourth time this year. Its key rate now stands in a range of 3.75% to 4%.

Fed Announcement Rallies Stock Market

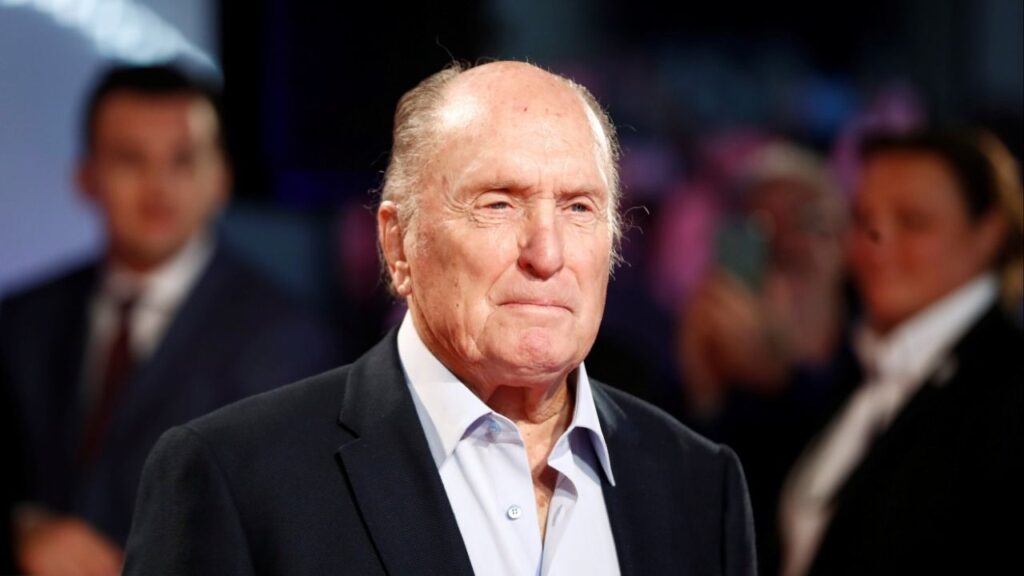

Markets rallied Wednesday after Fed Chair Jerome Powell signaled that the Fed may increase its key interest rate by just a half-point at its December meeting. Rate increases could then fall to a more traditional quarter-point size at its February and March meetings, based on previous Fed forecasts. Powell said the Fed will likely have to keep rates elevated for longer than originally planned, as inflation has eased somewhat but remains way above the central bank’s 2% target.

The sharp rise in mortgage rates this year, combined with still-climbing home prices, have added hundreds of dollars to monthly home loan payments relative to last year, when the average rate on a 30-year mortgage barely got up above 3% much of the time.

That’s created a significant affordability hurdle for many would-be homebuyers, spurring this year’s housing market downturn. Last month, sales of previously occupied U.S. homes fell for the ninth consecutive month, hitting the slowest pre-pandemic annual sales pace in more than 10 years.

RELATED TOPICS:

Categories

What to Know About the Homeland Security Shutdown