Share

A cosmic convergence of events in Washington and Sacramento last week demonstrated how strongly federal and state tax systems are interconnected.

President Joe Biden, it was revealed, will ask Congress this week to nearly double taxes on capital gains of the highest-income taxpayers, on top of an increase in taxes on their ordinary incomes he had proposed earlier to pay for infrastructure improvements.

California’s budget is extraordinarily dependent on those same taxpayers, with the top 1% — about 150,000 tax filers in a state of nearly 40 million — accounting for nearly 50% of the state’s general fund revenues. Much of those revenues from the state’s wealthiest residents come from their capital gains, which have increased sharply in recent years.

Dan Walters

Opinion

Surging Stock Market

Although the state is still coping with a severe recession from COVID-19 shutdowns, the taxable incomes of the state’s most affluent have continued to grow — in part from a surging stock market — and have generated a cornucopia of revenues. The state Department of Finance reported last week that during the first nine months of the 2020-21 fiscal year, revenues are running nearly $17 billion above the budget’s estimates, the vast majority from income taxes on affluent Californians.

Revenue gains are so robust that the Legislature’s budget analyst, Gabe Petek, last week declared that some of the excess money may have to be returned to taxpayersunder the “Gann limit,” a ballot measure passed by voters four decades ago. Moreover, Petek said, “Our analysis suggests the (Gann limit) will be an even more important factor in the state budget in the coming years” as revenues surge beyond the limit’s parameters.

The connection between Biden’s tax proposals and California’s budget is how high-income taxpayers would react should his plans be enacted.

Capital gains are largely discretionary. That is, profits in stocks and other investments only become taxable when they are sold and a sharp increase in federal taxes to 43.4% would encourage wealthy investors to hold them to avoid the new levies, which would also depress state revenues from those gains.

An Exodus of the Wealthy Would Cut Revenues

California has the nation’s highest marginal income tax rate, 13.3%, which is one reason why the state’s revenues have continued to grow during the recession. Raising the top 37% federal tax rate on wages and other ordinary income to 39.6%, as Biden proposes, would push the combined marginal rate on high-income Californians to nearly 53%.

That would increase the financial impetus for the wealthy to flee to states that have low or no income taxes, such as neighboring Nevada and Texas – especially since the last major federal tax overhaul four years ago limited the deduction for state and local taxes to $10,000.

Governors of high-tax states such as California and New York have pleaded with Congress to repeal the $10,000 cap, fearing that an exodus of the wealthy would cut deeply into their revenues. So far, there’s only been a trickle of tax refugees, which is another reason why California’s revenues have been so strong, but a bigger federal tax bite could be a tipping point for some.

Senate Majority Leader Chuck Schumer, who’s from New York, and House Speaker Nancy Pelosi, who’s from California, have insisted that repealing the $10,000 cap be included in any new tax legislation, but doing so would reduce the federal revenues that Biden wants for new infrastructure and education spending.

California politicians often portray the state as a “nation-state” that’s largely independent, but as Biden’s proposals demonstrate, Washington calls the tune on tax policy and California must dance to it.

RELATED TOPICS:

Two Teens Charged in Shooting Death of Caleb Quick

1 day ago

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

1 day ago

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era

1 day ago

Experts Call Kennedy’s Plan to find Autism’s Cause Unrealistic

1 day ago

Trump’s Trip to Saudi Arabia Raises the Prospect of US Nuclear Cooperation With the Kingdom

1 day ago

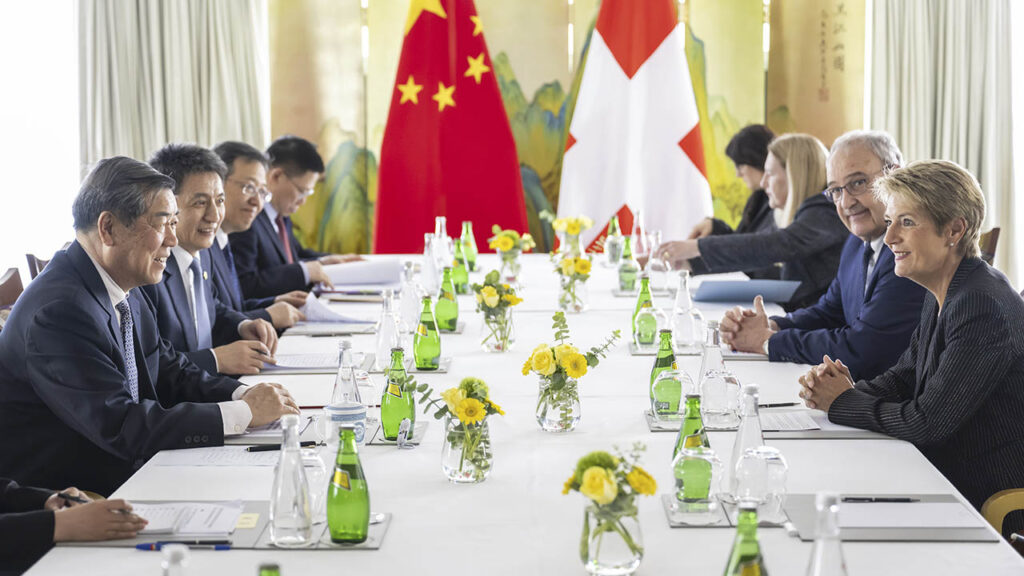

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

Two Teens Charged in Shooting Death of Caleb Quick