Share

WASHINGTON — The Trump administration has unveiled its plan for ending government control of Fannie Mae and Freddie Mac, the two giant mortgage finance companies that nearly collapsed in the financial crisis 11 years ago and were bailed out at a total cost to taxpayers of $187 billion.

While not prominently in the public eye, the two companies perform a critical role in the housing market. Together they guarantee roughly half of the $10 trillion U.S. home loan market.

Fannie and Freddie, operating under so-called government conservatorships, have become profitable again in the years since the 2008 rescue and have repaid their bailouts in full to the Treasury.

The administration initially looked to Congress for legislation to overhaul the housing finance system and return the companies to private shareholders. But Congress hasn’t acted, and now officials say they will take administrative action for the core change, ending the Fannie and Freddie conservatorships.

The new plan would make the companies privately owned yet government “sponsored” companies again. Their profits would no longer go to the Treasury but would be used to build up their capital bases as a cushion against possible future losses.

What Are Fannie Mae and Freddie Mac and What Do They Do?

Before the Great Depression of the 1930s, financing for mortgages was mainly provided by life insurance companies, banks and thrifts, with little government support. Fannie was created in 1938 to buy loans issued by the Federal Housing Administration. Freddie was established in 1989.

They are called government-sponsored enterprises. Before they were taken over in 2008, they were private companies but still enjoyed an implicit guarantee that the government would step in and rescue them if they failed. That’s what happened after the collapse of the housing market and the wave of mortgage defaults.

The companies don’t make home loans. They buy them from banks and other lenders, and bundle them into securities, guarantee them against default and sell them to investors. Because the companies are under government control, investors are eager to snap up the “safe” securities.

And because Fannie and Freddie stand behind nearly half of U.S. home loans, they’re important to homeowners and potential buyers though people may not see their footprint.

Why Does the Trump Administration Want to End Government Control?

Administration officials say the government should have only a limited role in housing finance, and that the current system leaves taxpayers exposed to potential bailouts again. Some lawmakers, both Republicans and Democrats, agree with that view.

The administration’s proposed overhaul of housing finance “will protect taxpayers and help Americans who want to buy a home,” Treasury Secretary Steven Mnuchin said in a statement. “An effective and efficient federal housing finance system will also meaningfully contribute to the continued economic growth under this administration.”

What Is the Administration Proposing?

There are nitty-gritty details of housing finance in the plan, but the central change is ending the conservatorships. Officials haven’t given a timeline for the administrative action.

Mark Calabria, the director of the FHFA, indicated recently that it wouldn’t be any time soon, and likely after 2020. Some conditions will have to be met for the companies to be “ready to exit,” he said. They include ensuring the companies have sufficient capital to operate, and to continue on their own in the event of a severe economic downturn.

Other changes outlined in the plan would have to be approved by Congress. They include replacing Fannie and Freddie’s affordable housing goals with more “tailored support” for first-time homebuyers and low- and moderate-income borrowers.

Are There Concerns With the New Approach?

Some critics have expressed concern that the new capital requirements for the companies could cause them to increase their fees for guaranteeing mortgages, potentially raising borrowing costs for homebuyers.

“President Trump’s housing plan will make mortgages more expensive and harder to get,” Brown said in a statement.

Administration officials acknowledge it’s hard to predict what the impact on borrowing costs would be. But they maintain that by removing government restrictions, the plan would likely expand the supply of mortgages and possibly lower costs.

Two Teens Charged in Shooting Death of Caleb Quick

1 day ago

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

1 day ago

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era

1 day ago

Experts Call Kennedy’s Plan to find Autism’s Cause Unrealistic

2 days ago

Trump’s Trip to Saudi Arabia Raises the Prospect of US Nuclear Cooperation With the Kingdom

2 days ago

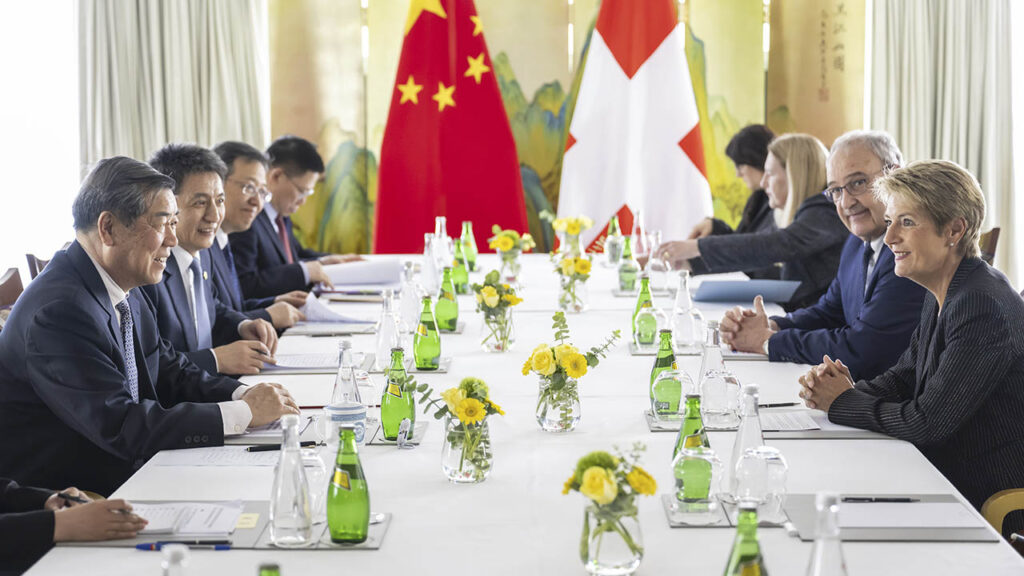

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

Two Teens Charged in Shooting Death of Caleb Quick