Share

The old adage of “strike while the iron is hot” is especially applicable to politics.

Something that might be politically impossible at one moment may succeed when circumstances change if advocates for that something move fast enough.

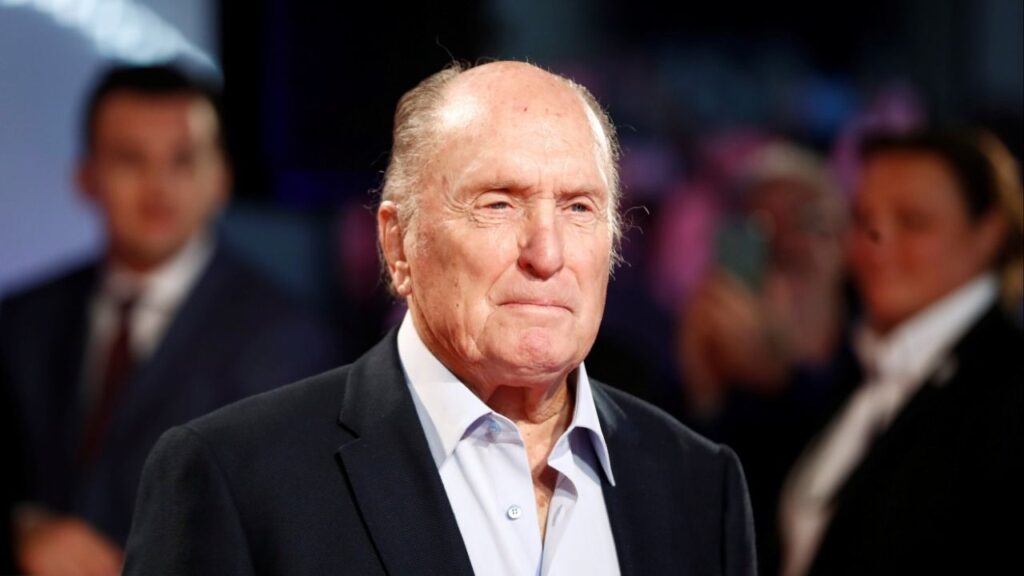

Dan Walters

CALmatters

Opinion

Donald Trump’s improbable presidential win in 2016 underscored the importance of timing one’s moves, and the subsequent turmoil among Democrats may propel relative unknowns into contention next year.

On a more prosaic level, we are seeing the syndrome at work in this year’s session of the California Legislature.

Last year’s election produced two big changes in the Capitol – a new governor in Gavin Newsom and even-larger Democratic supermajorities in the Legislature. The changed circumstances emboldened advocates for causes that had been stalled in previous sessions.

One example, merging national political turmoil and inside-the-Capitol politics, is the legislation that Newsom signed, clearly aimed at Trump, that would bar him from running in California’s presidential primary next year if he didn’t disclose his tax returns.

The Law Currently Allows Private Attorneys to Pursue Fraud Allegations

Newsom’s predecessor, Jerry Brown, vetoed virtually the same bill, but Newsom, evidently seeking to burnish his national political image, declared it a moral imperative.

As the legislative session enters its final days, there are dozens of other measures that in past years either could not win approval or would be vetoed, but are alive and kicking because of changed circumstances.

Two illustrate the syndrome: Assembly Bill 1270 and Assembly Constitutional Amendment 14.

The former, carried by Assemblyman Mark Stone, a Democrat from Santa Cruz, would make a huge change in California’s “false claims” law, which guards against fraud among those doing business with state or local governments.

The law currently allows private attorneys to pursue fraud allegations when local or state prosecutors decline, but specifically exempts tax cases from such private actions. AB 1270 extends the act to tax cases, opening a huge and potentially lucrative field for attorneys.

Proponents, including personal injury attorneys and Attorney General Xavier Becerra, say it will help catch tax-evaders but business groups portray it as a hunting license that would force unsuspecting taxpayers to defend themselves even when tax authorities have cleared them of fraud accusations.

Timing Is, Indeed, Everything

The objective need for such legislation seems scant, since California’s tax collection agencies already have a fearsome reputation for going after those they deem to be avoiding payment.

Consumer Attorneys of California, the political action arm of the plaintiffs’ bar, constantly seeks legislation to open new opportunities for suing and winning judgments, but has been largely thwarted by business and employer groups. It’s clearly hoping that having Newsom in the governor’s office and stronger Democratic majorities will generate a win this time.

ACA 14, meanwhile, is the latest version of long-standing efforts by unions to gain members in the immense University of California system. It would, if passed by the Legislature and then ratified by voters, crack UC’s constitutional autonomy and force it, in effect, to reduce or eliminate contracted-out services and increase its unionized payroll workers. UC estimates that the measure would increase its costs by $172.6 million a year.

As a constitutional amendment, ACA 14 requires two-thirds votes of both legislative houses, which would have been impossible when Democrats held just that many seats. However, with enhanced supermajorities, the measure by Assemblywoman Lorena Gonzalez, a San Diego Democrat who is the unions’ best friend in the Legislature, has cleared the Assembly and is now pending in the Senate.

Timing is, indeed, everything.

CalMatters is a public interest journalism venture committed to explaining how California’s state Capitol works and why it matters. For more stories by Dan Walters, go to calmatters.org/commentary

[activecampaign form=31]

Categories

Xbox Live Down for Thousands of Users, Downdetector Reports

Warner Bros. Discovery Restarts Deal Talks with Paramount

Wall Street Falls as AI Worries Linger; Nvidia, Microsoft Down