Share

It’s not your grandparents’ — or even your parents ’— higher-ed system. A young Californian of the Baby Boomer generation, bolstered by the post-war economic boom and the state’s investment in public higher education, could often emerge from college with little to no debt and a clear path to a living wage and homeownership.

Felicia Mello

CALmatters

How exactly did college costs get so high, and what are policymakers proposing we do about it? Read on.

(This explainer and other higher education coverage are supported by the College Futures Foundation.)

Once Free, Now a Small Fortune

Public University Tuition Is Way Up

Think free college is a recent idea? It’s right in the University of California’s 1868 charter: “as soon as the income of the University shall permit, admission and tuition shall be free to all residents of the State.”

When California lawmakers created the 1960 Master Plan that would guide the future of the country’s most prestigious public higher education system, residents enrolled at UC were paying just $60 per semester in “incidental fees.”

But beginning in the late 1960s, politicians pushed to increase the amount students contributed to their education. Their stated reasons were both ideological and financial: Ronald Reagan, who as governor prided himself on slashing government spending, said the state should not “subsidize intellectual curiosity.” Later, the dot-com bust in the early aughts prompted tuition increases under both Democratic and Republican administrations.

Undergraduate fees at UC grew at nearly five times the rate of inflation between 1977 and 2018; at the height of the most recent recession, the university raised them by 32% in a single year. California State University tuition has grown by about 900% in the last four decades, adjusted for inflation — and that doesn’t include additional fees imposed by individual campuses.

Higher Ed Spending Tanked During Recession

Like other states, California went hunting for line items to cut after the 2008 financial crisis. Higher education went on a diet: Building maintenance was postponed, faculty taught larger classes, and students paid more. The squeeze continued a decline in per-student spending that had been happening since shortly after the turn of the millennium.

Since the recession, California’s higher ed budget has bounced back more than in other states. For example, the state is spending more per student on community colleges than it ever has.

But that doesn’t mean tuition prices have fallen. They’ve just started to level off — while the cost of living continues to rise.

Private Colleges Have Raised Prices, Too

Nationwide, the average yearly tuition at a private, non-profit college has more than doubled over the last 20 years.

Experts debate what has caused the price hikes at private schools. Some point to high demand — as a college degree became more necessary for economic success — and fancy amenities.

Others argue that growth in federal financial aid actually drives price increases, with colleges pegging their tuition to how much aid is available. That’s more likely to be true at for-profit colleges, which rely heavily on government funding.

Selective non-profit colleges can draw on their endowments to subsidize scholarships, so many students don’t pay the sticker price. Low-income applicants often aren’t aware that this type of aid is available to them at private schools, a phenomenon known as undermatching.

In recent years, as financial strains have led to closures among small liberal-arts colleges, some have tried to stand out by cutting their prices—including Mills College in Oakland, which slashed tuition from $44,765 to $28,765 in 2017, saying it wanted to be more accessible.

Housing Crisis Hasn’t Helped

While collegiate Baby Boomers once could hang up their Grateful Dead posters in affordable apartments close to campus, today’s California college students must try their luck in the country’s most difficult housing market.

At UC, Cal State and community colleges, housing and other non-tuition expenses make up the majority of the cost of attendance.

But state financial aid is largely tied to tuition prices. That’s especially difficult for low-income students at community colleges, who have to pay the same rent as their UC peers, with fewer and smaller grants to help them cover it.

New Demographics, New Challenges

‘Non-Traditional’ Students Are the New Normal

Today’s college students are more ethnically diverse, more likely to come from low-income households and more likely to be the first in their families to attend college than those of 20 years ago. More than one-third are over the age of 25.

That’s great news for building a diverse future leadership of California — but it presents challenges for the state’s financial aid planners. Assumptions that policymakers made in the past — for example, that students can rely on their parents for help with books and transportation — no longer hold up.

Many Lack Reliable Food and Housing

A wave of student surveys in the last few years has found widespread food insecurity and homelessness at California’s public colleges.

There’s some dispute among researchers about the accuracy of estimates produced by surveys like this. Nevertheless, it’s clear that hunger and homelessness are a significant problem on California campuses, part of a national trend that’s probably exacerbated by the state’s high housing costs.

Student Debt Is Growing

Californians hold about a tenth of the nation’s $1.5 trillion in student loan debt, and the total has doubled in the last decade.

Working Can Help Cover Costs …

Students who don’t want to take on debt, or have already maxed out on loans, often increase working hours to fill the gap between their financial aid and the total cost of attendance.

… But Also Can Delay Graduation

Working while in school can actually boost academic performance, studies have found, as long as it’s fewer than 15 hours per week.

But low-income students who work more than that have lower grade point averages and are less likely to graduate in six years than their peers who work fewer hours, according to a report by the ACT Center for Equity in Learning.

That’s important because graduation rates at California State University and community colleges, which serve the bulk of the state’s students, are already less than stellar (though at CSU, they’re on the rise).

With some projections showing California’s economy faces a shortfall of a million college graduates by 2030, more policymakers are arguing the state needs to do something to address the cost of attendance. Agreeing on what to do has been more challenging.

Taking Steps to Help

California Has Generous Financial Aid

Worried about the cost of college? You’re not alone. Voters in a 2019 PACE/USC Rossier poll ranked college affordability as the second-most important education issue for California, behind gun violence in schools. More than half of California adults think community college should be tuition-free.

When it comes to financial aid, California’s already a bigger spender than any other state, doling out $2 billion in grants and scholarships in 2018. The Cal Grant, the state’s major scholarship program, pays up to the full cost of tuition at the University of California and California State University, and just over $9,000 per year at private California colleges, for the neediest students. It’s a “first dollar” scholarship, which means that students can combine it with federal and other grants to save as much as possible.

Community college students whose families earn 150% or less of the federal poverty level can have their fees waived.

But Demand Outpaces Supply

Only students who have recently graduated from high school are entitled to a Cal Grant. Low- to middle-income students must earn at least a 3.0 GPA, while very low-income students can qualify with a 2.0. (Students transferring from a community college to a four-year school have their own, separate, requirements.)

Students who have the right GPA, but have been out of school for more than two years, must apply for what are known as “competitive” Cal Grants. And that’s where things get dicey—because the state only funds a certain number each year.

Some Cal Grants come with a stipend for books and living expenses, but at $1,672, it’s just higher than the average per-year textbook cost, leaving little left over for food and rent.

Pantries and Parking Lots: Meeting Basic Needs

Over the past three years, student activism and a growing body of research have drawn attention to the challenges college students face in meeting basic needs: food, shelter, transportation and mental health.

While colleges have added food pantries and emergency housing beds, lawmakers continue to debate solutions. Proposals range from the ambitious and pricey — overhauling the Cal Grant program to cover the total cost of attendance — to the more modest, like letting homeless students park overnight in community college lots.

Tuition-Free, But Only for Some

“Free college in California,” trumpeted the headlines when Gov. Jerry Brown signed the California College Promise into law in 2017. Well … kinda. The program waives one year of tuition for community college students at participating campuses who are attending for the first time, take a full course load, and haven’t already benefited from the fee waiver offered to very low-income students.

The catch? More than two-thirds of community college students attend part time and don’t qualify. Other eligibility requirements further shrink the pool.

The same dynamic has played out across the country as state legislatures riding the wave of interest in “free college” have created Promise programs, some with bipartisan support.

Restricting “free college” programs to smaller groups of students saves states money, but limits impact. Still, supporters of the California College Promise and similar programs say simply talking about free college encourages low-income students to pursue higher education.

In California, some community colleges have redirected College Promise funds to buy books and meal plans for students who need them.

What Else California Can Do

What Would ‘Free College’ Really Mean?

Sen. Bernie Sanders opened up a national debate on free college when he made it a key issue of his 2016 presidential campaign. Congressional leaders and 2020 presidential candidates have put forward their own college affordability plans. While some are calling for tuition-free college, others have started using the phrase ‘debt-free college.’

How Other Countries Do It

Maybe you’ve seen those charts illustrating how much more Americans spend on health care than people in other industrialized countries. College prices show a similar pattern.

A number of Scandinavian and Eastern European countries, along with France and Germany, allow students to attend college for free, or nearly free, up to the bachelor’s level. Some of those, like Germany, also give students grants to cover living expenses.

Not surprisingly, students in those countries carry less debt than their counterparts in the U.S. The overwhelming majority of Germans, for example, graduate debt-free.

Of course, Europeans generally pay higher taxes than Americans once they graduate into the workforce. And Europe hasn’t entirely stamped out student debt. The average Swedish student loan borrower owes almost $20,000 — mostly due to living expenses accrued while attending one of the country’s tuition-free universities.

In England, recent tuition hikes have left students paying the highest fees of any OECD country. But unlike in the United States, graduates don’t have to start repaying their loans until they’re earning more than about $33,000 a year. Payments are pegged to income, and any balance remaining after 30 years is automatically forgiven.

Paying and Politics

As skeptics invariably point out, there’s no such thing as completely “free” college. Providing education costs money, and those funds have to come from somewhere. Covering the full cost of attendance for every student would require a major investment of resources — Sen. Elizabeth Warren puts the cost of her debt-free college plan at $1.25 trillion. Whether it’s calling for a tax on stock transfers or a surcharge on multimillionaires, backers of free college have typically set their sights on the segment of society that holds the most resources: the wealthy.

Outside of progressive Democratic circles, however, lawmakers in the U.S. have usually balked at soaking the rich. Moderates from both parties at the state and national level have lined up behind less-expensive options such as waiving fees for community college alone. Republicans have pushed for market-friendly solutions such as income-share agreements, which allow students to promise schools or investors a percentage of their future income in exchange for funding their education.

Still, the country is living through a populist moment. And it’s hard to think of a state more likely to take an aggressive approach to the college affordability crisis than California, with its current budget surplus, Democrat-dominated legislature, and history of support for higher education.

Bills to Watch in 2019

This spring, the California Assembly passed a ‘debt-free college’ bill that would enact the biggest expansion of state financial aid in 20 years. If signed into law, AB 1314 would eventually double the amount California spends on grants to students, at an estimated cost of $2 billion. Here are the details on that bill and other key legislation on college costs.

- AB 1314 (Assemblyman Jose Medina of Riverside): Would remake the state’s financial aid system to focus on the full price of attendance — including housing, food and books — not just tuition. It would consolidate the current patchwork of Cal Grant categories into a single grant that would cover a student’s total estimated cost, minus whatever their family can afford to contribute.

- SB 291 (Sen. Connie Leyva of Chino): The other college affordability bill with a big price tag,

- SB 291 would dramatically expand financial aid to community college students, who disproportionately suffer from the way the current system pegs assistance to the price of tuition.

- AB 2 (Assemblyman Miguel Santiago of Los Angeles): Would extend the state’s tuition-free community college plan to waive fees for a second year. As in the current California Promise program, the fee waiver would apply only to first-time, full-time students, who would save about $1,380.

For a full rundown on this year’s college affordability bills, including legislation on student housing, administrator salaries and more, check out our tracker.

Can you make it through college debt-free? Play our new interactive game and find out.

CALmatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.

Two Teens Charged in Shooting Death of Caleb Quick

17 hours ago

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

17 hours ago

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era

17 hours ago

Experts Call Kennedy’s Plan to find Autism’s Cause Unrealistic

17 hours ago

Trump’s Trip to Saudi Arabia Raises the Prospect of US Nuclear Cooperation With the Kingdom

17 hours ago

Oh Ohtani! Dodgers Star Hits 3-Run Homer in Late Rally Victory Over Diamondbacks

18 hours ago

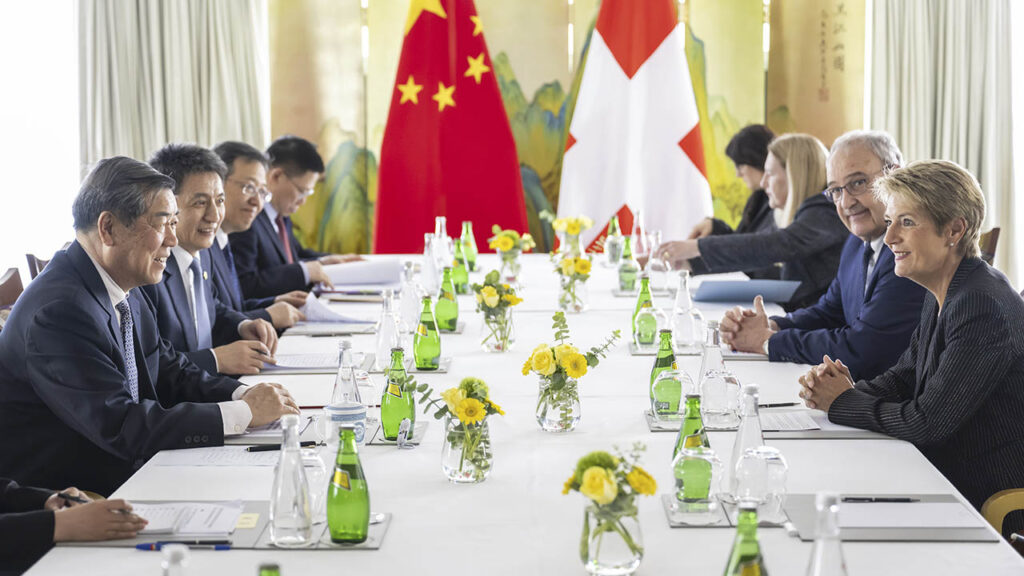

Tariff Talks Begin Between US and Chinese Officials in Geneva

18 hours ago

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

10 hours ago

Categories

US-China Tariff Talks to Continue Sunday, an Official Tells The Associated Press

Two Teens Charged in Shooting Death of Caleb Quick

Soviet-Era Spacecraft Plunges to Earth After 53 Years Stuck in Orbit

Tax the Rich? Slash Spending? Republicans Wrestle With Economic Priorities in the Trump Era