Share

NEW YORK — Hembert Figueroa just wanted a taco.

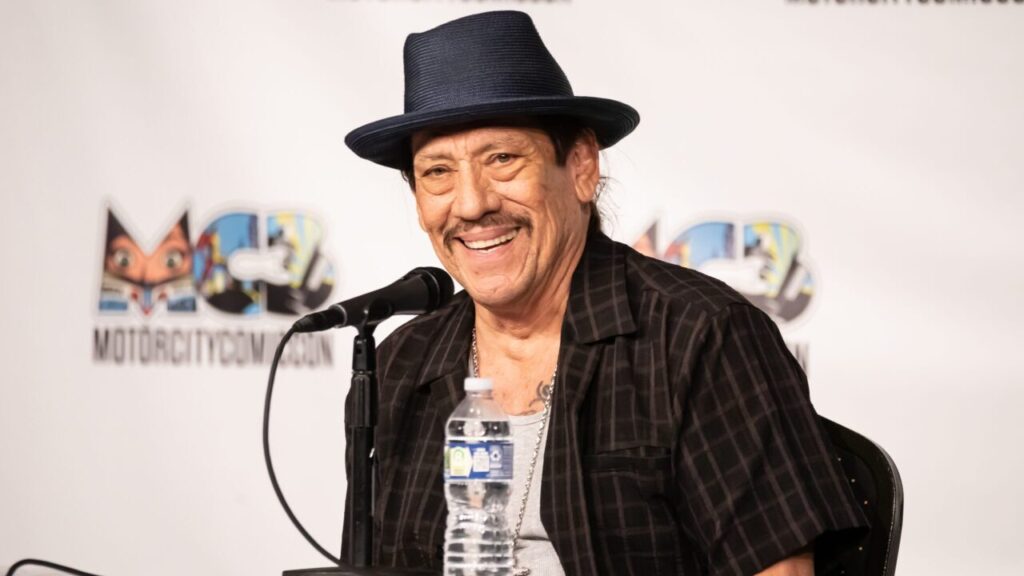

So he was surprised to learn the dollar bills in his pocket were no good at Dos Toros Taqueria in Manhattan, one of a small but growing number of establishments across the U.S. where customers can only pay by card or smartphone.

Cash-free stores are generating a backlash among some activists and liberal-leaning policymakers who say the practice discriminates against people like Figueroa, who either lack bank accounts or rely on cash for many transactions.

Figueroa, an ironworker, had to stand to the side, holding his taco, until a sympathetic cashier helped him find another customer willing to pay for his meal with a card in exchange for cash.

“I had money and I couldn’t pay,” he said.

The issue got some high-profile attention this week when retail giant Amazon bowed to pressure from activists and agreed to accept cash at more than 30 cashless stores, including its Amazon Go convenience stores, which have no cashiers, and its book shops. Amazon declined to say when the change would happen.

There is no federal law that requires stores to accept cash, so lawmakers are working on the issue at the state and city level.

The Practice Could Expand to More Services

Earlier this year, Philadelphia became the first city to ban cashless stores, despite efforts by Amazon to dissuade it. New Jersey passed a statewide ban soon after, and a similar ban is working its way through the New York City Council. Before this year there was only one jurisdiction that required businesses to accept cash: Massachusetts, which passed a law nearly 40 years ago.

Policymakers argue that while cashless enterprises aren’t widespread now, the practice could expand to more services, including some that cater to lower-income people.

Walmart-owned Sam’s Club opened its first cashier-less store in Dallas last year, using technology that allows customers to scan and pay for items with their smartphones. Kroger has installed similar technology in about 400 stores nationwide.

Stadiums in Tampa Bay, Florida, and Atlanta have started to go cashless, or nearly cashless, and the Barclays Center, where the Brooklyn Nets play, is now effectively cashless as well.

Advocates for cashless bans worry technology is moving too fast for the 6.5% of American households — 8.4 million — who do not have a bank account, according to the Federal Deposit Insurance Corporation.

Figueroa is among the much larger group considered “underbanked,” meaning they have a primary bank account but regularly rely on alternative financial services like check cashers. More than 24 million U.S. households are underbanked, according to the FDIC.

Retailers Under Pressure to Cater to Customers With Heightened Expectations

The issue disproportionately affects African-American and Hispanic communities. About 17% of African-American and 14% of Hispanic households have no bank accounts, compared to just 3% of white households, according to the FDIC.

Figueroa, an immigrant from the Dominican Republic, only opened a credit union account two years ago. It took another year to build up enough funds to use his debit card regularly.

He still occasionally relies on a check casher if he needs money quickly, and much of his income comes in cash from his weekend job as a busboy. He has no credit card and no apps on his phone and has only shopped online three times.

Business owners who go cashless say they are following the lead of the majority of customers who are abandoning cash payments. Retailers are under pressure to cater to customers with heightened expectations for fast and seamless service, driven by companies like Amazon, Uber and Grubhub.

Leo Kremer, co-owner of Dos Toros, said the volume of cash transactions at his stores fell from about 50% a decade ago to 15% last year. That made the cost and logistics of handling cash especially onerous. Before going cashless, Dos Toros locations were robbed twice.

Still, Kremer said the company would adjust if legally required to accept cash.

Critics Say Banning Cash-Free Stores Is an Over-Reaction

“There are no bad guys on this issue. Everyone is trying to do the right thing and make sure there are no unintended consequences,” he said.

There are no overall estimates on how many U.S. stores have gone cashless, but it remains a rarity. In New York City, the trend appears to be gaining traction mostly with “fast casual” dining establishments like Dos Toros. Far more common are stores that require a minimum purchase for non-cash payments.

“To call this a trend is a bit of an exaggeration,” said J. Craig Shearman, a spokesman for the National Retail Federation in Washington. “It’s not something the average customer would expect to see at every store at the mall any time soon.”

In testimony to a New York City Council committee, Kremer argued that businesses that “consistently serve the unbanked and underbanked population aren’t going to go cashless. It wouldn’t make sense for them.”

But financial experts who work with low-income people caution against making assumptions about the shopping preferences or buying power of those who rely on cash.

“I’m uncomfortable with the idea that certain people don’t shop here so it’s fine to exclude them,” said Justine Zinkin, CEO of Neighborhood Trust Financial Partners, a financial counseling nonprofit affiliated with the credit union where Figueroa banks.

RELATED TOPICS:

Categories

What to Know About Ilhan Omar, the Lawmaker Attacked in Minnesota