Share

The California Supreme Court has some explaining to do.

by Ben Christopher

CALmatters

San Francisco faces a similar problem, only twice as big. The city recently began collecting two new taxes: a gross receipts levy on commercial landlords to fund childcare services, and a land parcel tax to increase teacher pay. Last June, each received 51 and 61 percent of the vote respectively. The city is being sued twice.

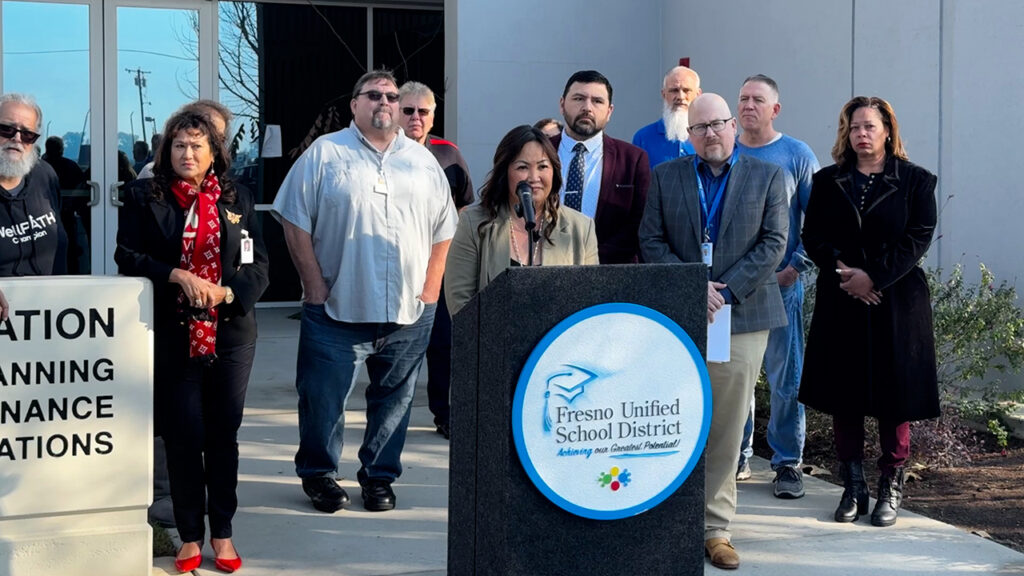

And then there’s Fresno. After 52 percent of voters there opted to increase the city’s sales tax to fund park improvements, city leaders decided to play it safe and do nothing, noting that 52 percent is clearly less than 66. A local nonprofit took them to court for not collecting the new tax.

Sued if you do, sued if you don’t. The reason for all this fiscal confusion: the state’s highest court.

How Many Votes for a New Tax to Become Law?

“It creates havoc for public agencies, it creates all this strange uncertainty for taxpayers and everyone else involved,” said Michael Coleman, an advisor for the League of California Cities, which represents city governments in the Capitol. “This kind of thing fuels cynicism about government.”

Over the last four decades, California voters have passed a series of amendments to the state constitution, all designed to make it harder for governments to tax them and raise new revenue. Proposition 13 from 1978 is the mother of all these tax blockers, but voters and the courts have been going back and forth over the details ever since.

In 1996, voters passed Prop. 218, which clarified that any tax designated for a specific purpose—say, to fund affordable housing—needs two-thirds of the vote to pass. Since then it was widely assumed that this rule applied to all specific taxes—no matter how they find their way onto the ballot.

But a year and a half ago, the state’s Supreme Court threw that into question.

California Cannabis Coalition v City of Upland

The short version of its ruling in California Cannabis Coalition v City of Upland goes something like this:

- 218 requires that any tax imposed by “local government” must be voted on during a regularly scheduled election.

- A cannabis industry trade group argued that that rule doesn’t apply to initiatives put on the ballot by petition of the local citizenry.

- The court agreed, ruling that a ballot measure initiated by organized citizens (in this case, organized pot shops) is not an act of “local government.”

That got the attention of interest groups and public agencies across the state. If citizen initiatives aren’t acts of “local government” when it comes to the timing of an election, does that mean they aren’t subject to Prop. 218’s other rules—namely, that tax measures need two-thirds of the vote to pass? Did the ruling rip a “huge hole in Prop 13 and 218,” as some initially suggested?

The state Supreme Court didn’t say. And when lawyers involved in the Upland case asked for clarification, the justices turned them down.

But the court surely recognized the implication of its ruling, said attorney Kelly Salt, a Prop. 218 expert. Justice Leondra Kruger even warned in her dissent “that the decision would inevitably extend to the voter-approval requirement,” said Salt. “The logic carries over.”

For many legal analysts, the eventual outcome seems clear.

Supreme Court Not Clear on the Issue

“Is there any reasonable way to interpret the tax provision differently than the vote-timing provision?” said Darien Shanske, a law professor at UC Davis. “I would be surprised if any justice thought that there really is much reason to read them differently.”

“You need a two-thirds vote if the voters put it on (the ballot), if the city put it on, or if anybody else put it on.” said Greg McConnell, CEO of the Jobs and Housing Coalition, the group representing Bay Area business interests that is suing Oakland. He added that in the lead-up to the election, even Oakland voter information pamphlet specified that a two-thirds vote was required to pass the tax.

Cities now in legal limbo may have years to wait. San Francisco is collecting those two new taxes, but that money won’t be going to social services or teacher salaries—not yet anyway. It will be parked into “segregated, interest-earning accounts until that litigation risk is cleared,” said a statement from the city’s controller’s office.

“These cases tend to be litigated fairly quickly,” said Michael Colantuono, a lawyer who has represented the League of California Cities. What’s quickly? Probably at least “12 to 18 months,” he said.

Running a Solicitation in the San Francisco Chronicle

San Francisco is trying to speed the process. After the Howard Jarvis Taxpayers Association sued the city for collecting its universal child care tax, the city attorney went out and tried to get itself sued again for enacting the teacher salary measure—even running a solicitation in the San Francisco Chronicle.

The more cases in play, the logic goes, the more likely that one will go to trial—and force the Supreme Court to finally answer the big question.

A third San Francisco ballot measure, a gross receipts tax on local businesses to fund homeless services, also got 61 percent of the vote. The city is still waiting to be sued over that one.

If this seems like an awful lot of meshugas just to answer what should be a fundamental question about California governance, even some of the litigants themselves agree.

“Both legislative bodies and courts could do the people a big favor in being more precise when they pass legislation or issue court decisions,” said Jon Coupal, president of the Howard Jarvis Taxpayers Association. “They decided not to do that. So it’s like ‘thanks a lot, now you’ve just given us five years of litigation.’”

CALmatters.org is a nonprofit, nonpartisan media venture explaining California policies and politics.