Share

WASHINGTON — The Democratic-controlled House is voting Tuesday on a $1.4 trillion government-wide spending package with an unusually large load of unrelated provisions on the must-do legislation.

The package, some 2,313 pages long, was unveiled Monday as lawmakers prepared to wrap up reams of unfinished work against a backdrop of Wednesday’s vote on impeaching President Donald Trump.

The spending legislation would forestall a government shutdown this weekend and give Trump steady funding for his U.S.-Mexico border fence. The year-end package is anchored by a $1.4 trillion spending measure that caps a difficult, months-long battle over spending priorities.

The mammoth measure made public Monday takes a split-the-differences approach that’s a product of divided power in Washington, offering lawmakers of all stripes plenty to vote for — and against. House Speaker Nancy Pelosi, D-Calif., was a driving force, along with administration pragmatists such as Treasury Secretary Steven Mnuchin, who negotiated the summertime budget deal that it implements.

”The president is poised to sign it and to keep the government open,” said top White House adviser Kellyanne Conway.

Retired coal miners and business and labor union opponents of Obama-era taxes on high-cost health plans came away with big wins in weekend negotiations by top congressional leaders and the Trump White House. The bill would also increase the age nationwide for purchasing tobacco products from 18 to 21, and offers business-friendly provisions on export financing, flood insurance and immigrant workers.

The roster of add-ons grew over the weekend to include permanent repeal of a tax on high-cost “Cadillac” health insurance benefits and a hard-won provision to finance health care and pension benefits for about 100,000 retired union coal miners threatened by the insolvency of their pension fund. A tax on medical devices and health insurance plans would also be repealed permanently.

Negotiators Unveiled a Scaled-Back Package of Additional Business Tax Breaks

The deficit tab for the package grew as well — almost $400 billion over 10 years to repeal the three so-called “Obamacare” taxes alone — with a companion package to extend several business-friendly tax breaks still under negotiation. The Obama-era taxes have previously been suspended on a piecemeal basis.

The legislation is laced with provisions reflecting divided power in Washington. Republicans maintained the status quo on several abortion-related battles and on funding for Trump’s border wall. Democrats controlling the House succeeded in winning a 3.1 percent raise for federal civilian employees and the first installment of funding on gun violence research after more than two decades of gun lobby opposition.

Late Monday, negotiators unveiled a scaled-back package of additional business tax breaks, renewing tax breaks for craft brewers and distillers. The so-called tax extenders are a creature of Washington, a heavily lobbied menu of arcane tax breaks that are typically tailored to narrow, often parochial interests like renewable energy, capital depreciation rules, and race horse ownership. But a bigger effort to trade refundable tax credits for the working poor for fixes to the 2017 GOP tax bill didn’t pan out.

The sweeping legislation, introduced as two packages for political and tactical purposes, is part of a major final burst of legislation that’s passing Congress this week despite bitter partisan divisions and Wednesday’s likely impeachment of Trump. Thursday promises a vote on a major rewrite of the North American Free Trade Agreement, while the Senate is about to send Trump the annual defense policy bill for the 59th year in a row.

The core of the spending bill is formed by the 12 annual agency appropriations bills passed by Congress each year. It fills in the details of a bipartisan framework from July that delivered about $100 billion in agency spending increases over the coming two years instead of automatic spending cuts that would have sharply slashed the Pentagon and domestic agencies.

The increase in the tobacco purchasing age to 21 also applies to e-cigarettes and vaping devices and gained momentum after McConnell signed on.

Democrats Secured $425 Million for States to Upgrade Their Election Systems

Other add-ons include a variety of provisions sought by business and labor interests and their lobbyists in Washington.

For business, there’s a seven-year extension of the charter of the Export-Import Bank, which helps finance transactions benefiting U.S. exporters, as well as a renewal of the government’s terrorism risk insurance program. The financially troubled government flood insurance program would be extended through September, as would several visa programs for both skilled and seasonal workers.

Labor won repeal of the so-called Cadillac tax, a 40% tax on high-cost employer health plans, which was originally intended to curb rapidly growing health care spending. But it disproportionately affected high-end plans won under union contracts, and Democratic labor allies had previously succeeded in temporary repeals.

Democrats controlling the House won increased funding for early childhood education and a variety of other domestic programs. They also won higher Medicaid funding for the cash-poor government of Puerto Rico, which is struggling to recover from hurricane devastation and a resulting economic downturn.

While Republicans touted defense hikes and Democrats reeled off numerous increases for domestic programs, most of the provisions of the spending bill enjoy bipartisan support, including increases for medical research, combating the opioid epidemic, and Head Start and childcare grants to states.

Democrats also secured $425 million for states to upgrade their election systems, and they boosted the U.S. Census budget $1.4 billion above Trump’s request. They won smaller increases for the Environmental Protection Agency, renewable energy programs and affordable housing.

Dozens of Democrats Might Vote Against the Border Wall

“We are scaling up funding for priorities that will make our country safer and stronger and help hardworking families get ahead,” said House Appropriations Committee Chairwoman Nita Lowey, D-N.Y.

“Many members of the CHC will vote against it,” said Congressional Hispanic Caucus Chairman Joaquin Castro, D-Texas. “It’s true that there are a lot of good things and Democratic victories in the spending agreement. I think everybody appreciates those. What members of the Hispanic Caucus are concerned with is the wall money, the high level of detention beds, and most of all with the ability of the president to transfer money both to wall and to detention beds in the future.”

Because dozens of Democrats might vote against the border wall, Pelosi is pairing money for the Department of Homeland Security with the almost $700 billion Pentagon budget, which is guaranteed to win GOP votes to offset Democratic defections.

The coal miners’ pension provision, opposed by House GOP conservatives like Minority Leader Kevin McCarthy, R-Calif., had the backing of Trump and powerful Senate GOP Leader McConnell and Trump. Sen. Joe Manchin, D-W.Va., was a dogged force behind the scenes and said the other leaders rolled the House GOP leader, who also lost a behind-the-scenes battle with Pelosi on parochial California issues.

Categories

Epstein Files Hint at His Ties to the Supermodel Naomi Campbell

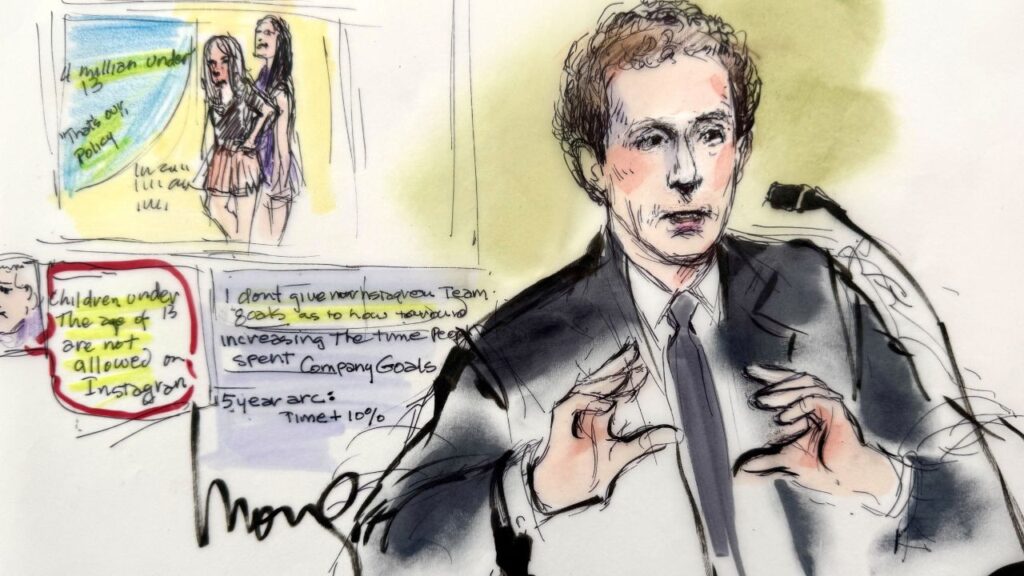

Meta’s Zuckerberg Denies at LA Trial That Instagram Targets Kids