Share

While Fresno police say they have no suspects in the vandalism at Temple Beth Israel, the FBI is assisting in analyzing surveillance video.

Rabbi Rick Winer reported that someone removed the word “Israel” from the temple’s sign leading into the parking lot at its 6622 N. Maroa Ave. location in Fresno. It happened hours after an Oct. 30 community vigil at the temple to remember the victims of the Pittsburgh synagogue attack.

As of Wednesday (Nov. 14), the sign has not been fixed.

“We’re figuring out how to best to affix the letters. We want to do it right,” Winer said.

Chief Jerry Dyer said the vandal left the metal letters attached to a brick wall in the bushes nearby. They found fingerprint evidence and obtained surveillance video.

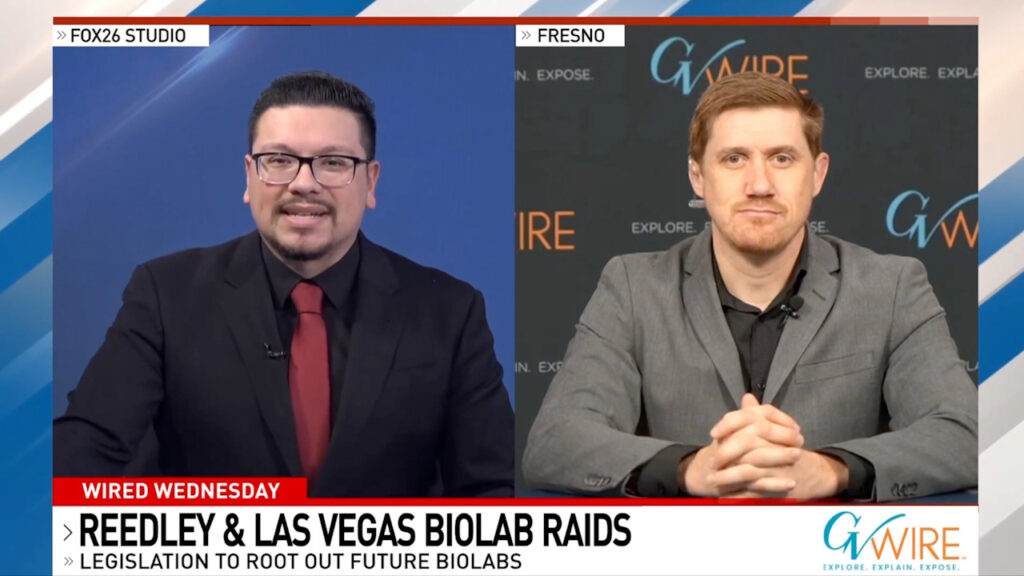

FBI Helping with Video

Federal agents are helping Fresno police enhance surveillance video.

“We had a local FBI agent actually drive a video recorder all the way to Sacramento,” Capt. Burke Farrah said. That video will also be sent to FBI headquarters in Quantico, Va. “We appreciate the support of our federal partners.”

He added that police and the FBI are looking into cellphone calls in the area.

Farrah said they don’t have any video of evidentiary value to release. They continue to recover usable video.

“The only thing that indicates a motive is the fact that the word ‘Israel’ was taken down. Based upon that and the events that transpired in Pittsburgh earlier (that) week, we believe this is a bias motivator and a hate crime,” Farrah added.

Rabbi Thankful

Two weeks after the incident, Winer appreciates the backing of the community.

“People have been really amazing. The outpouring of love and support from the general community has so outweighed the ugliness of the incident. The beauty of the community is more than evident,” Winer said.

RELATED TOPICS:

Categories

Teen Arrested at Visalia Mall After Firearm Report

Tumblr Goes Down for Thousands, Downdetector Reports