Share

Joe Biden’s tax plan is creating concern that it could hamper efforts to address the critical shortage of affordable housing across California.

At issue is a provision that would make it more expensive for many developers to invest in apartments and other commercial projects.

The proposal from the former vice president and Democratic presidential nominee would eliminate a tax option that encourages property owners to reinvest sales proceeds back into the market to help grow the economy.

Exchanges Stimulate Local Economic Activity

Known as 1031 exchanges (named for its section in the tax code) — also called like-kind exchanges — the process allows for deferring capital gains taxes on the sale of an investment property as long as the proceeds are used to purchase another business oriented property.

For instance, an investor today can sell off a warehouse to fund the purchase of an apartment complex. Instead of being taxed on the increased value of the warehouse when it’s sold, the investor can apply 100% of the money generated from the sale toward the newly purchased property. Advocates say the tax saving strategy stimulates real estate transactions and provides a variety of economic benefits to a community.

Strategy Can Lead to More Housing

Among other outcomes, investors can use these exchanges to help fund the development or rehabilitation of apartment complexes to increase housing supply.

Biden’s plan to remove the ‘like kind’ tax deferral option could raise billions in revenue for the treasury. But, a Fresno developer and a tax expert both say it could reduce local investment activity.

Valley Developer Concerned About Impact

Levon Baladjanian, president of local property management firm GSF Properties, is concerned what a 1031 rollback could mean.

“In general, 1031 exchanges are valuable as they increase the transactional activity when properties become unwanted by owners who decide to move into another sector of the market,” Baladjanian said via email.

“Also, for newer investors some properties would not come up for sale as often if there was not the ability to move your equity into another piece of real estate. Assuming the exchange is done properly there is usually no tax implication which is why it is attractive. Take that away and the market would have less transactions, in theory.”

Tax Expert: Change Could “Dampen” Real Estate Investment

Thornton Matheson, senior fellow with the Urban-Brookings Tax Policy Center, helped analyzed Biden’s proposal with her team.

“There likely would be some dampening effect on investment.” — Thornton Matheson, Urban-Brookings Tax Policy Center

“There likely would be some dampening effect on investment.” — Thornton Matheson, Urban-Brookings Tax Policy Center“Biden would increase income and payroll taxes on high-income individuals and increase income taxes on corporations. He would increase federal revenues by $4.0 trillion over the next decade. Under his plan, the highest-income households would see substantially larger tax increases than households in other income groups, both in dollar amounts and as a share of their incomes,” the report summarized.

Biden’s termination of 1031 exchanges would apply to investors with incomes of $400,000 or greater.

“Much of the impact of eliminating the exchange option falls on non-corporate customers,” Thornton said.

Thornton says Biden’s plan could hurt the industry. “There likely would be some dampening effect on investment,” she said.

She acknowledges, though, that some critics feel the tax-free exchange strategy is abused.

Eliminating Option Could Bring In $14B a Year in Tax Revenue

Thornton estimates repealing 1031 exchanges could raise $14 billion a year.

It is part of Biden’s plan to raise $775 billion in revenues over 10 years to help fund his programs such as child care and the elderly.

Where Do Congressional Candidates Stand on Tax Plans?

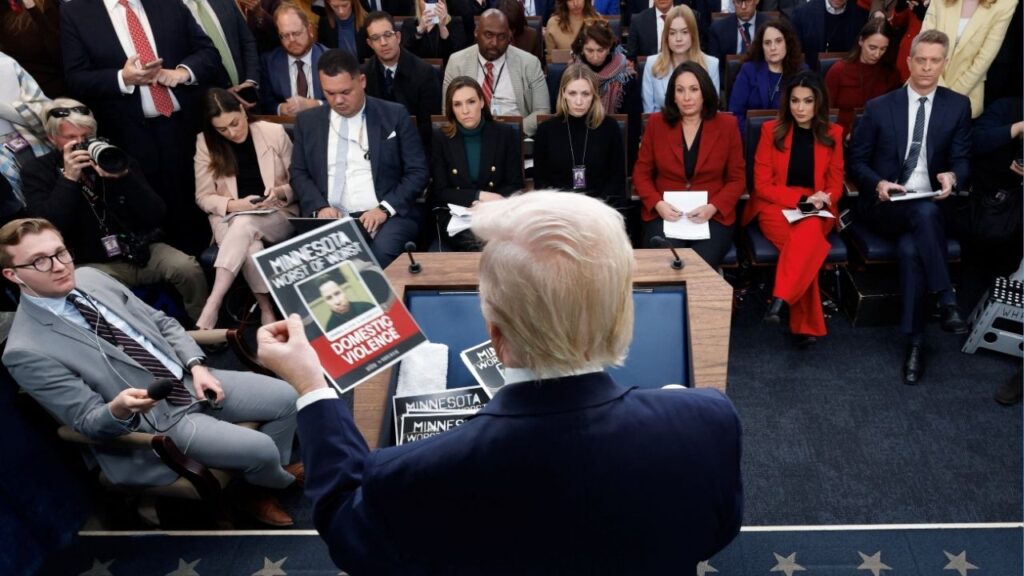

When it comes to the tax plans of President Donald Trump and former vice president Joe Biden, members of the local congressional delegation — and those hoping to replace them — are taking partisan sides.

GV Wire℠ surveyed several congressional candidates about their thoughts on the Trump and Biden tax plans.

Five of the six who are running in a district that includes Fresno County replied. Congressman Devin Nunes (R-Tualre) was the only holdout.

Jim Costa (D), 16th Congressional District (Incumbent)

Kevin Cookingham (R), 16th Congressional District (Challenger)

On the negative side, those living in high tax states such as California, New York and Illinois, now have a cap on the amount one can write off for state and local property taxes. The limit is now $10,000. When this went into effect, we had a mountain cabin and were paying more than $10,000 per year on property taxes so this part of the tax law hurt us. Overall, we came out ahead but we were a bit frustrated with the cap on real estate deductions for taxes.

I have heard from the left for years that the rich need to pay their fair share of taxes. The IRS states that the top one percent of earners pay more taxes than the lower ninety percent combined. I believe that is more than their fair share. Also, the more the corporations pay in taxes, the less employees they can hire. I would much rather they pay less in taxes and provide a living wage to more Americans.”

For Cookingham’s full response, click here.

TJ Cox (D), 21st Congressional District (Incumbent)

David Valadao (R), 21st Congressional District (Challenger)

Phil Arballo - 22nd Congressional District (Challenger)

What we need is a tax plan that puts partisan politics aside and helps those who need it most. What does that look like in the Valley? A plan that provides relief to low-income workers, small business owners, and working families, all of whom have taken the brunt of the economic blowback from the pandemic while the wealthy have gone unscathed. That is what I will fight for when I get to Congress.”