Futures-options traders work on the floor at the New York Stock Exchange's NYSE American (AMEX) in New York City, U.S., December 15, 2025. (Reuters/Brendan McDermid)

Share

|

Getting your Trinity Audio player ready...

|

Stock markets in the United States and Europe jumped on Friday after the Supreme Court struck down U.S. President Donald Trump’s tariffs, a key pillar of the adminstration’s economic platform.

Market Reaction:

STOCKS: The S&P 500 rose and was last up 0.6%. Nasdaq rose 1%. European auto shares and U.S.-listed shares of stock markets from South Korea to India rallied.

BONDS: The yields on benchmark U.S. Treasuries rose, with that on 10-year notes up 2 basis points to 4.096%

FOREX: The dollar index weakened slightly and was last down 0.2% at 97.67.

COMMENTS:

Eric Merlis, Co-Head of Global Markets, Citizens, Boston:

“The Supreme Court’s 6–3 ruling against the Trump administration on tariffs sparked an immediate knee jerk rally in the euro. However, the decision stopped short of clarifying eligibility for tariff refunds, leaving a key source of uncertainty intact. Markets now have to balance easing tariff driven inflation pressures against the potential loss of several hundred billion dollars in IEEPA related tariff revenue.”

Rick Meckler, Partner, Cherry Lane Investments, New Vernon, New Jersey:

“While the initial reaction is up, the confusion it’s going to lead to is probably going to keep this market going back and forth over the next couple of days.”

“As far as investors were concerned, tariffs were never a good way to approach policy.”

“In the short term, winners would be the companies that are importing… from retailers to manufacturers who get their parts overseas. There is no shortage of companies that have been impacted by it or have mentioned that it’s a big factor in why they had to raise costs.”

Phil Blancato, Chief Market Strategist at Osaic, New Jersey:

“This court issuance comes only two months before Trump meets with President Xi of China, where tariffs were anticipated to be Trump’s main card for negotiation.

“Immediately following the decision by the high court, equities jumped…Fixed income yields jumped over concerns that the U.S. Treasury is now going to have to pay a significant amount back to U.S. corporations. This would lead to a higher deficit and a potential degradation in credit standards of the United States.

“Lastly, the question of who has paid for the tariffs, U.S. companies, consumers, or foreign exporters, will come to the forefront on who deserves the repayment from the government.”

Chris Beauchamp, Chief Market Analyst at IG Group, London:

“It has good elements to it and slightly less good elements, because it will increase this legendary uncertainty that markets, of course, always fear.”

“You’re looking at, obviously, a whole host of industrial stocks, importers, consumer discretionary that’s going to be importing plenty of stuff from overseas. And that could mean that they will have some relief to bring down prices if and when—as I say, it’s an unclear situation—if and when the tariffs are firmly unwound and the order comes through.”

Tom Graff, Chief Investment Officer at Facet in Phoenix, Maryland:

“The biggest uncertainty was whether the court would address refunds, which they did not. That is going to be the big next fight, with many companies already preparing for litigation.

“Longer-term, there will be two big questions: How does the government replace the tariff revenue? Without it, the deficit will be much higher than current, and this could create significant pressure on Treasury yields.”

Rob Burdett, Head of Multi Manager, Nedgroup Investments, London:

“This ruling has major implications for the limits of US presidential power and the division of power between the legislative branch and the executive branch, but also as a macro catalyst across equities, bonds, currencies and global trade flows. The Supreme Court’s decision on Trump’s tariffs is a major macro event with multi‑asset ramifications.

“For equities, the ruling against the tariffs is widely expected to lift US and global equities. Relief from trade uncertainty may act as a tailwind for cyclicals and import‑dependent sectors such as IT hardware (including semiconductors, although they will most likely be included in sectoral tariffs) retail and industrials.

“In terms of bonds, Treasury yields could rise (more so at the longer end) due to expectations of stronger trade activity and a potential widening of the fiscal deficit (if the historic refunds must be paid).

“The US dollar may soften if tariff refunds increase the deficit and reduce the policy‑tightening impulse from higher import prices. Elsewhere, lower input costs ease pressure on margins, especially for retailers and manufacturers.”

Gennadiy Goldberg, Head of US Rates Strategy, TD Securities, New York:

“The big question for everyone is what exactly happens to refunds and whether this means the government has to refund the tariff revenue and how quickly that happens. And the key source of uncertainty is what the administration does in response.

“They have repeatedly promised that they will impose other tariffs with other statutes that will equilibrate the tariff rates. So I do think that will help limit the market’s response, because what matters for the fixed income market is forward collections of tariffs, even if there is a one-time refund that has to occur because of the decision.”

Mark Hackett, Chief Market Strategist, Nationwide, Philadelphia:

“The immediate algo-driven reaction will be in globally oriented companies that have the greatest tariff exposure, such as global markets, industrials, consumer staples, technology, and health care. Caution is warranted, however, as we have learned since the pandemic, as the initial, emotional reaction is often exaggerated and prone to whipsaws. The expectation of most investors is that the administration has an alternative strategy for tariffs.”

Jeff Leschen, Managing Director, Bramshill Investments, Naples, Florida:

“I think the Trump administration has contingency plans in place. Investors need to be a little more focused and take some time to digest the news. There’s a lot of information we don’t know at this point. I don’t think the ruling derails the trajectory of how things have been going. I don’t expect there will be major revisions to the S&P targets for the year.”

Scott Lincicome, Vice President of General Economics, Cato Institute, Washington:

“The court’s decision is welcome news for American importers, the United States economy, and the rule of law, but there’s much more work to be done. Most immediately, the federal government must refund the tens of billions of dollars in customs duties that it illegally collected from American companies pursuant to an “IEEPA tariff authority” it never actually had.

“Even without IEEPA, other U.S. laws and the Trump administration’s repeated promises all but ensure that much higher tariffs will remain the norm, damaging the economy and foreign relations in the process. Implementing new tariff protection will take a little longer than it did in 2025 and, perhaps, will be a little more predictable. Overall, however, the tariff beatings will continue until Congress reclaims some of its constitutional authority over U.S. trade policy and checks the administration’s worst tariff impulses.”

—

(Reporting by the Global Finance & Markets Breaking News team; compiled by Vidya Ranganathan)

RELATED TOPICS:

Categories

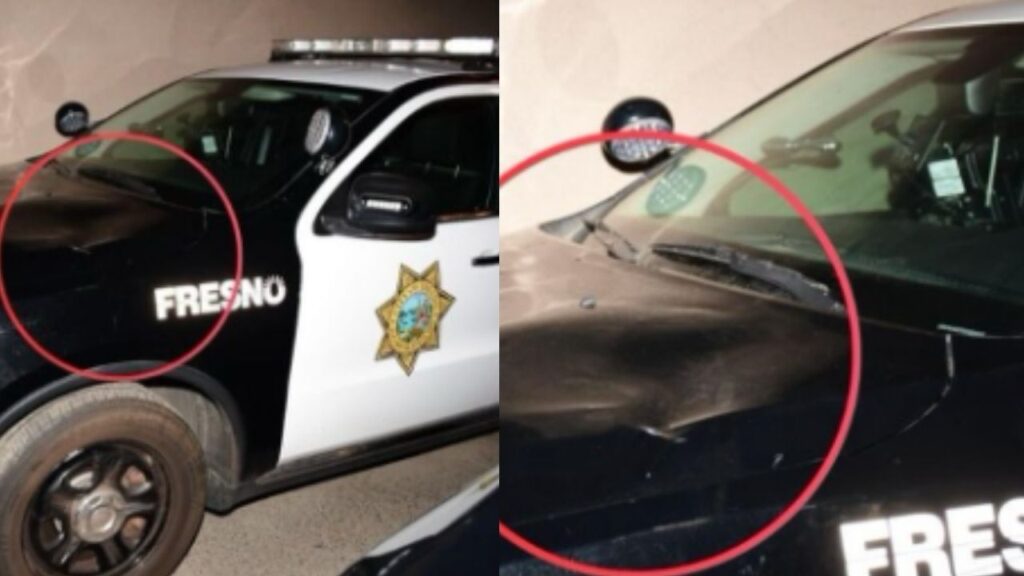

Fresno Police Arrest Three After Patrol Vehicle Vandalized

Ski. Breathe. Shoot. The Wonderful Chaos of Biathlon.

President Acknowledges That He Is Weighing Limited Strike on Iran