Shoppers at Macy’s in midtown Manhattan on Nov. 21, 2025. The latest Consumer Price Index, released by the Bureau of Labor Statistics on Dec. 18, rose 2.7% from the same time last year. That fell short of the previous 3% pace and was well below economists’ expectations — likely reflecting what they called distortions caused by the government shutdown. (Vincent Alban/The New York Times)

Share

|

Getting your Trinity Audio player ready...

|

U.S. inflation eased in November in what economists said likely reflected distortions caused by the government shutdown, creating an uncertain picture for the Federal Reserve as it simultaneously contends with rising unemployment.

The latest consumer price index, released by the Bureau of Labor Statistics on Thursday, rose 2.7% from the same time last year. That fell short of the previous 3% pace and was well below economists’ expectations for a 3.1% rise.

“Core” inflation, which the central bank tracks as a gauge of underlying inflation since it strips out volatile items like energy and food prices, rose at an annual rate of 2.6%. It last stood at 3.1%.

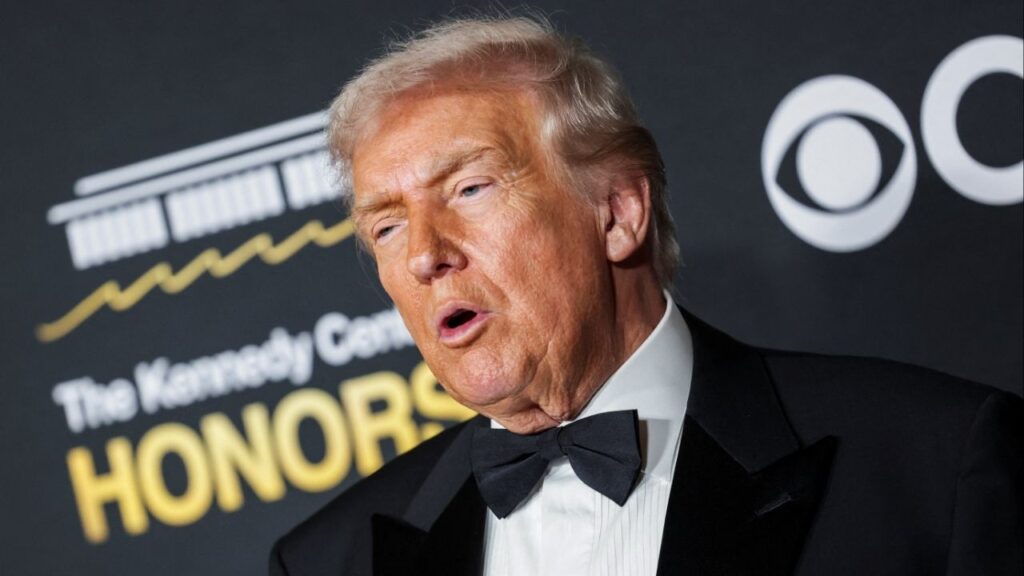

The latest inflation report arrives at a pivotal political moment for the White House. With prices still stubbornly high, voters increasingly say that they are unhappy with President Donald Trump’s handling of the economy and frustrated with the slow pace of improvement, according to recent polls.

Trump has tried to argue that conditions have improved under his watch. He took that message to the American public Wednesday night, insisting in a highly combative speech that inflation is under control, wages are rising and any current turbulence in the economy is the fault of his predecessor, President Joe Biden. “I am bringing those high prices down and bringing them down very fast,” he said.

Kevin A. Hassett, the director of the White House National Economic Council who is seen as a front-runner to be the next Fed chair, described the inflation report Thursday as an “absolute blockbuster,” telling Fox Business that most economists had gotten it wrong in their earlier projections. “I’m not saying we’re going to declare victory yet on the price problem, but this is just an astonishingly good CPI report.”

The White House Council of Economic Advisers also put out a series of social media posts saying that the latest report shows Trump’s policies are working. “This report is clear: Prices are steady and wages are beating inflation,” the CEA said, pointing to groceries, airfares and hotels as some of the areas of improvement.

Both overall and core inflation came in much lower than expected in November. But economists have cautioned against reading too much into the data. The BLS was forced to cancel October’s release, citing complications in collecting the data because of the government shutdown that stretched on for over 40 days. The lack of an October report meant no month-over-month rate was released Thursday for either overall inflation or the hundreds of goods and services that are tracked, resulting in an incomplete picture of how the economy is evolving at a critical juncture for the central bank.

But prices were up 0.2% from September, the equivalent of a 0.1% monthly rate of growth. That’s much slower than the 0.3% pace in recent months.

The shutdown also disrupted data collection for November and economists warned that certain quirks artificially dragged down inflation for that period. For example, all of the November data was collected after the government reopened in mid-November, meaning more of the prices came during “Black Friday” sales than they would in a normal year.

Before the release, Alan Detmeister, a former Fed economist now at UBS, said the report would be a “very poor reflection of reality.”

That echoed a warning from Fed Chair Jerome Powell, who said at a news conference last week that the incoming data this week, which included November’s jobs report, should be viewed with a “skeptical eye.”

Jonathan Hill, head of U.S. inflation strategy at Barclays, said the latest CPI report “should not be taken literally or guide monetary policy.”

He added that the Fed “will and should” wait for December’s data, which will be released in January, to draw conclusions about either the trajectory of inflation or the path forward for interest rates.

Inflation has moved higher this year because of the steep tariffs Trump has imposed on nearly all U.S. trading partners. Businesses managed to blunt some of the initial impact by building up inventories before the tariffs were enacted, which helped to keep inflation overall more contained than economists and policymakers once feared. Many companies chose to absorb the higher costs themselves, resulting in reduced profit margins.

But now that companies have run down their stockpiles or exhausted other ways to sidestep the levies, the question confronting the Fed is how much more tariffs will push up consumer prices in the coming year and at what point inflation will start to fall back toward the central bank’s 2% target.

“It’s really tariffs that are causing most of the inflation overshoot,” Powell said last week after the Fed announced its decision to lower interest rates by a quarter of percentage point for a third-straight meeting.

Powell, who sees tariffs generating only a short-term increase to prices rather than persistently higher inflation, added that he expected the peak impact on everyday goods to hit in the first quarter of 2026.

As of November, furniture and bedding prices were up 3% over the year even as increases for other goods still appeared to be somewhat muted. Prices for appliances increased 0.5% over the year. Prices on apparel rose 0.2%.

Energy prices have risen 4.2% over the past 12 months. The fastest growing subset of that is fuel oil, up 11.2%, while gasoline — the most salient element for consumer psychology — is up only 0.9% over the year.

Another category pushing up inflation has been used cars and trucks, which have been getting more expensive over the past year after declining from their highs during the pandemic. Those prices rose 3.6% over the year. New cars have not risen as much, as automakers have attempted to absorb tariffs rather than passing them along to consumers.

Housing-related costs, which make up about a third of the overall CPI index, increased 3% over the year. Many policymakers at the Fed expected this category to show continued easing this year, helping to bring down overall inflation.

—

This article originally appeared in The New York Times.

By Colby Smith/Vincent Alban

c. 2025 The New York Times Company