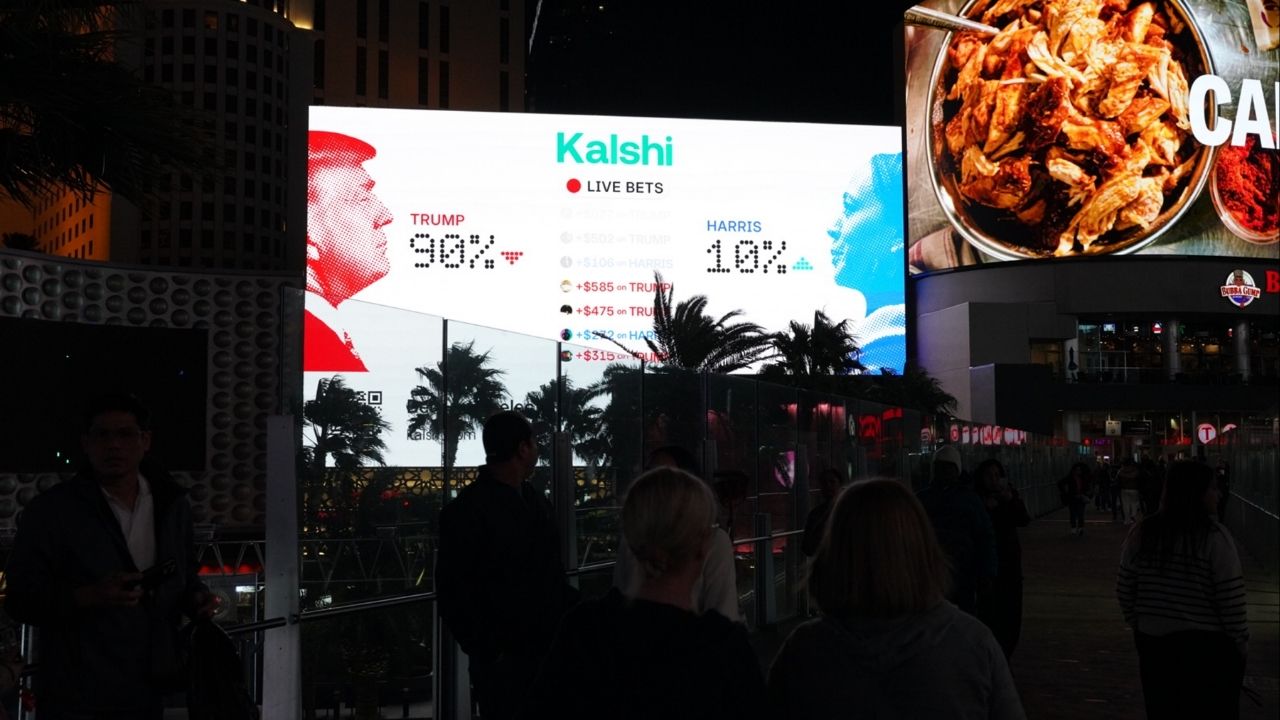

A Kalshi billboard in Las Vegas, Nev., May 19, 2019. The surging popularity of prediction markets helped Kalshi, one of the biggest players in the sector, raise money this fall at a $5 billion valuation. (Marshall Scheuttle/The New York Times)

Share

|

Getting your Trinity Audio player ready...

|

The surging popularity of prediction markets helped Kalshi, one of the biggest players in the sector, raise money this fall at a $5 billion valuation.

Less than two months later, it has collected yet more funds — and more than doubled its valuation.

Kalshi plans to announce Tuesday that it has raised $1 billion at an $11 billion valuation, in its third round of capital this year. The round was led by investment firm Paradigm, an existing backer, and also includes Sequoia Capital, Andreessen Horowitz, Meritech Capital, IVP, ARK Invest, Anthos Capital, CapitalG and Y Combinator.

“We’re in a massive market with a massive opportunity,” Tarek Mansour, the company’s co-founder and CEO, said in an interview. “We have to scale up to rise to that opportunity.”

The move is the latest sign that prediction markets, online platforms where users can bet on political races, the Oscars and more, are big business. The top five platforms now collectively report several billion dollars’ worth of weekly trading volume, according to data provider Dune.

The latest round’s valuation has made Kalshi’s co-founders, Mansour and Luana Lopes Lara, billionaires — on paper, at least: They own 20% to 25% of the company, according to a person with knowledge of its ownership who was not authorized to speak publicly on the matter.

Kalshi has experienced enormous growth over the past year, especially after it began to offer the complex sports bets known as parlays. (Much of the activity on its platform is now tied to sports, according to Rajiv Sethi, a professor at Barnard College who studies prediction markets.)

Kalshi oversaw about $5.8 billion in trading volume last month, a record and up 32% from October, according to The Block, which covers the digital asset industry.

“It’s one of the fastest-growing companies we’ve ever seen,” Matt Huang, a co-founder and managing partner at Paradigm, said in an interview.

Mansour said that the new investment would help Kalshi continue to grow, including by introducing more products and starting business in new international markets. The company is also focused on making more distribution deals with institutions such as brokerages, which allow its contracts to be traded as easily as stocks.

The company is also moving to expand elsewhere: It is expected to announce, for instance, a partnership with CNN, according to a person with knowledge of the arrangement who was not authorized to speak publicly about the matter. A Kalshi spokesperson declined to comment, and a representative for CNN did not immediately respond to a request for comment.

To Kalshi and its backers, there are other opportunities for growth. Huang suggested that some users may use bets on Kalshi as kinds of hedges against risks like weather. They could also help users offset losses from federal government shutdowns, said Ryan Frazier, CEO of Arrived, a real estate investing platform.

Others consider that unlikely: Prediction markets are “not a serious place to do hedging,” with a majority of users likely to just make bets on various events, Sethi said.

But for all of Kalshi’s success, the company faces stiff competition from its chief rival, Polymarket, which recently gained permission to operate in the United States. Both are locked in a fundraising arms race of sorts. In the same week in October, Kalshi announced a $300 million fundraising round, and Polymarket disclosed that it had secured a potentially multibillion-dollar investment from the owner of the New York Stock Exchange.

The success of both platforms — especially in the world of sports betting — has battered the business of more traditional online sports gambling sites like DraftKings and FanDuel. Both those companies are now seeking to get into prediction markets as well.

And prediction markets face increasing legal pressure from state regulators who argue that they have jurisdiction over sports betting on their platforms and also a cut of that money. Kalshi had a legal setback last week when a federal judge ruled that it was subject to Nevada gaming rules, something it has argued against.

Mansour said that the effects of the ruling, which Kalshi plans to appeal, aren’t clear yet. “It’s too early,” he said.

—

This article originally appeared in The New York Times.

By Michael J. de la Merced/Marshall Scheuttle

c. 2025 The New York Times Company

RELATED TOPICS:

Categories