FILE — Shoppers load their purchases outside a Costco in Marina Del Rey, Calif., April 4, 2025. More companies are starting to warn that they will have to pass on higher costs to American consumers, raising prices for products like strollers, mattresses, power tools and cast-iron cookware as the Trump administration’s tariffs take hold. (Mark Abramson/The New York Times)

- President Trump's tariffs on Chinese goods have drastically slowed trade, impacting container ship traffic across the Pacific.

- Experts predict consumers will soon face higher prices and product shortages as the effects of tariffs intensify.

- Disruptions at ports and falling truck sales signal potential economic downturn and recession risks for summer 2025.

Share

When the COVID pandemic hit, factories in China shut down and global shipping traffic slowed. Within a matter of a few weeks, products began disappearing from U.S. store shelves and American firms that depend on foreign materials were going out of business.

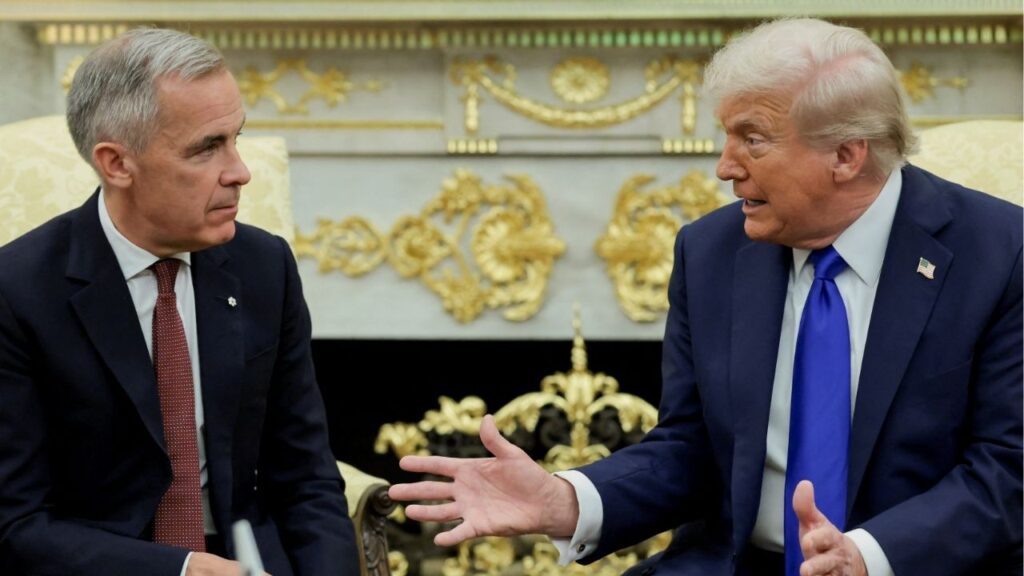

A similar trend is beginning to play out, but this time the catalyst is President Donald Trump’s decision to raise tariffs on Chinese imports to a minimum of 145%, an amount so steep that much of the trade between the United States and China has ground to a halt. Fewer massive container ships have been plying the ocean between Chinese and American ports, and in the coming weeks, far fewer Chinese goods will arrive on American shores.

While high tariffs on Chinese products have been in place since early April, the availability of Chinese products and the price that consumers pay for them has not changed that much. But some companies are now starting to raise their prices. And experts say that the effects will become more and more obvious in the coming weeks, as a tidal wave of change stemming from canceled orders in Chinese factories works its way around the world to the United States.

Impact on Consumers and Prices

The number of massive container ships carrying metal boxes of toys, furniture and other products departing China for the United States plummeted by about one-third in April.

The reason consumers haven’t felt many of the effects yet is because it takes 20 to 40 days for a container ship to travel across the Pacific Ocean. It then takes another one to 10 days for Chinese goods to make their way by train or truck to various cities around the country, economists at Apollo Global Management wrote in a recent report. That means that the higher tariffs on China that went into effect at the beginning of April are just starting to result in a drop in the number of ships arriving at American ports, a trend that should intensify.

By late May or early June, consumers could start to see some empty shelves, and layoffs could occur for retailers and logistics industries. The major effects on the U.S. economy of shutting down trade with China will start to become apparent in the summer of 2025, when the United States might slip into a recession, said Torsten Slok, an economist at Apollo.

“U.S. consumers will within a few weeks see empty shelves in clothing stores, toy stores, hardware stores and retail drugstores, and higher prices of the goods that still are on the shelves,” he said.

Molson Hart, CEO of Viahart, a toy company, wrote on the social platform X: “It’s almost like we’re speeding towards a brick wall but the driver of the car doesn’t see it yet. By the time he does, it’ll be too late to hit the brakes.”

Logistics and Supply Chain Disruptions

The decline in Chinese imports was amplified Friday, when the United States eliminated so-called de minimis treatment for Chinese goods. The rule had allowed products up to $800 to avoid tariffs as long as they are shipped directly to consumers. It has boosted the business model of companies such as Temu and Shein, and it has resulted in a surge of individually addressed packages to the United States, many of which are shipped by air.

Supporters of the change say that this tariff loophole has given Chinese shippers an unfair advantage and hurt American businesses. But the decision to get rid of it is already resulting in higher prices for U.S. consumers. And the change is expected to weigh on airlines and private carriers like FedEx, which have steady business delivering small-dollar goods.

Port workers and logistics companies have been expecting their own disruptions. At the port of Los Angeles, the main entry point for Chinese products arriving in the United States, imports surged in recent months as businesses and consumers tried to stock up on goods in advance of the tariffs coming into effect. But that activity has now started to decline.

The number of containers arriving at the Port of Los Angeles is expected to drop more than 35% this coming week compared with the same period last year, port data shows. Gene Seroka, the port’s executive director, said that a quarter of the ships that had been scheduled for May had canceled because of light volume.

As of about three weeks ago, goods coming into the port from China have been “very few and far between,” Seroka said.

Data shows that sales of heavy trucks have fallen sharply, too, suggesting that companies in the logistics space expect to be moving fewer goods in the future.

Economic Uncertainty and Future Outlook

Trade experts say that companies have stockpiled enough inventory in recent months that, if the White House reverses course soon and significantly drops tariffs on China, much of the pain for the U.S. economy and consumers can be avoided. Data from the Institute for Supply Management shows that U.S. inventories are at their highest level in more than two years.

Gabriel Wildau, a managing director at Teneo, who advises companies on doing business with China, said that the Chinese goods that U.S. retailers had stockpiled in the first three months of the year would give stores some time before they would need to raise prices. But if the situation is not changed quickly, American consumers will feel the impact of trade changes unfold over the next three to six months, he said.

“We’re going to have higher prices and, in some cases, empty shelves,” he said.

Trump officials have admitted that there could be some disruptions for consumers. The president seemed to acknowledge Wednesday that his trade changes could lead to fewer goods and higher prices.

“You know, somebody said, ‘Oh, the shelves are going to be open,’” Trump said from the White House. “Well, maybe the children will have two dolls instead of 30 dolls, you know? And maybe the two dolls will cost a couple of bucks more than they would normally.”

But administration officials have said any pain will be minimal. At a White House briefing Tuesday, Treasury Secretary Scott Bessent said that he did not expect to see supply chain shocks from U.S. tariffs on China. “I think retailers have managed their inventory in front of this,” he said.

Some firms that are in a more fragile financial position have not been able to stockpile and are rapidly being forced out of business. Even if the Trump administration finds a way to reduce its tariffs on China, it’s not clear that the levies will fall enough to meaningfully restart trade.

Many companies say that tariffs above 50% on Chinese imports are enough to stop trade entirely. With tariffs now at a minimum of 145%, and in some cases much higher, that would mean that the Trump administration may have to drop its China tariffs by at least 100 percentage points to meaningfully restart the flow of goods.

Ryan Petersen, CEO of Flexport, a supply chain company, said that, even before the president hiked tariffs on China to 145% in April, the tariffs the Trump administration had put on China were high, at a minimum of 54%.

“The reality is that 54% was already an incredibly high tariff rate,” Petersen said. “It depends on how far they walk it back. If they walk it back to 25%, maybe this all becomes a non-event.”

With so much unclear about where global trade is headed, companies are freezing their plans for expansion and halting new orders.

Data shows that new orders from manufacturers have turned down sharply this year, while companies have trimmed back their plans for capital expenditures. Some major companies have stopped issuing guidance for their sales and profits. Mercedes-Benz on Wednesday suspended its financial forecasts for 2025, as did Stellantis, which makes the Chrysler, Dodge and Jeep brands.

It’s not clear how quickly the current supply chain challenges could be resolved. But during the pandemic, supply chains disruptions took much longer to work their way through the economy than most forecasters had anticipated.

Economists who initially expected price increases to be transitory were surprised at inflationary pressures that lingered for years. Small impacts also had a way of snowballing through supply chains — for example, a disruption in supply from one or two companies making small parts for cars or other machinery could end up stopping a major manufacturing plant, which found it had no alternative for the part.

And when the economy turned back on again after initial pandemic disruptions, the process was not smooth. Americans saw pileups at the ports and shortages of some goods, all of which ultimately contributed to higher prices.

Petersen said that companies that operated container ships had already canceled a quarter of all sailings to the United States from China, and they are rerouting their ships to travel to Southeast Asia and Europe instead. Even if the Trump administration removes its China tariffs and U.S. consumer demand for Chinese products resumes, ships won’t be in the right location immediately to carry the same volume of goods, he said.

“You’ll see high prices, you’ll see delays,” Petersen added. “The longer you wait to make changes, the more severe the shock will be.”

—

This article originally appeared in The New York Times.

By Ana Swanson/Mark Abramson

c. 2025 The New York Times Company

RELATED TOPICS:

Categories