Fresno County Assessor/Recorder Paul Dictos interprets SB 2, the Building Homes and Jobs Act, differently than nearly all other assessors. He says he's the only one applying it correctly. (GV Wire Composite)

- Fresno County Assessor-Recorder Paul Dictos says the county has collected more affordable housing funds because of how he interprets a state law.

- Dictos says he might be the only recorder who interprets SB 2, the Building Homes and Jobs Act, as it was intended.

- For land owners selling large amounts of property, the difference can mean tens of thousands of dollars, depending on the location.

Share

|

Getting your Trinity Audio player ready...

|

A unique interpretation of a 2017 California law by assessor-recorder Paul Dictos has meant big money for affordable housing projects in Fresno County. Dictos, however, stands nearly alone among state recorders in how he taxes property transactions.

Nearly 10 years after Senate Bill 2 passed, the state’s recorders still disagree on how to apply a tax intended to raise money for affordable housing. For big land owners, where you live can mean paying either $75 or $75,000.

In most of the state, recorders interpret the law to mean a single $75 charge on property sales suffices the Building Homes and Jobs Act that then-state Sen. Toni Atkins (D-San Diego) said would raise between $200 million to $250 million yearly.

Dictos said under his interpretation, the state would have far more money.

“You probably discounted it, but this is a big thing,” Dictos said. “It affects the money that we are collecting for the affordable housing, and (the state) is not collecting the amount that it should collect.”

How Dictos’ Method Differs

Unlike other assessors, Dictos applies the $75 fee to each piece of property sold, charging thousands to tens of thousands of dollars more to people making large land transactions, especially homebuilders and farmers.

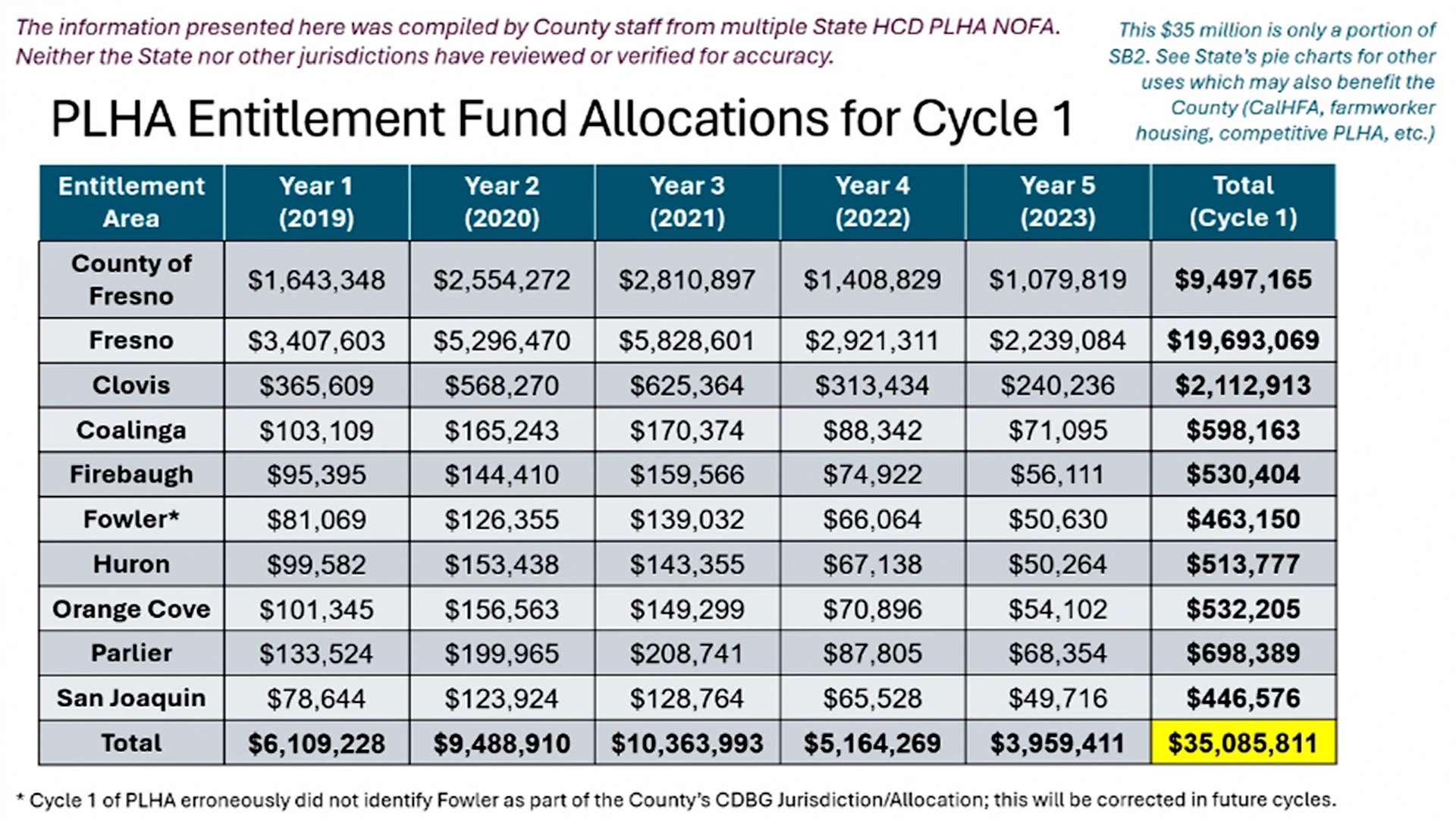

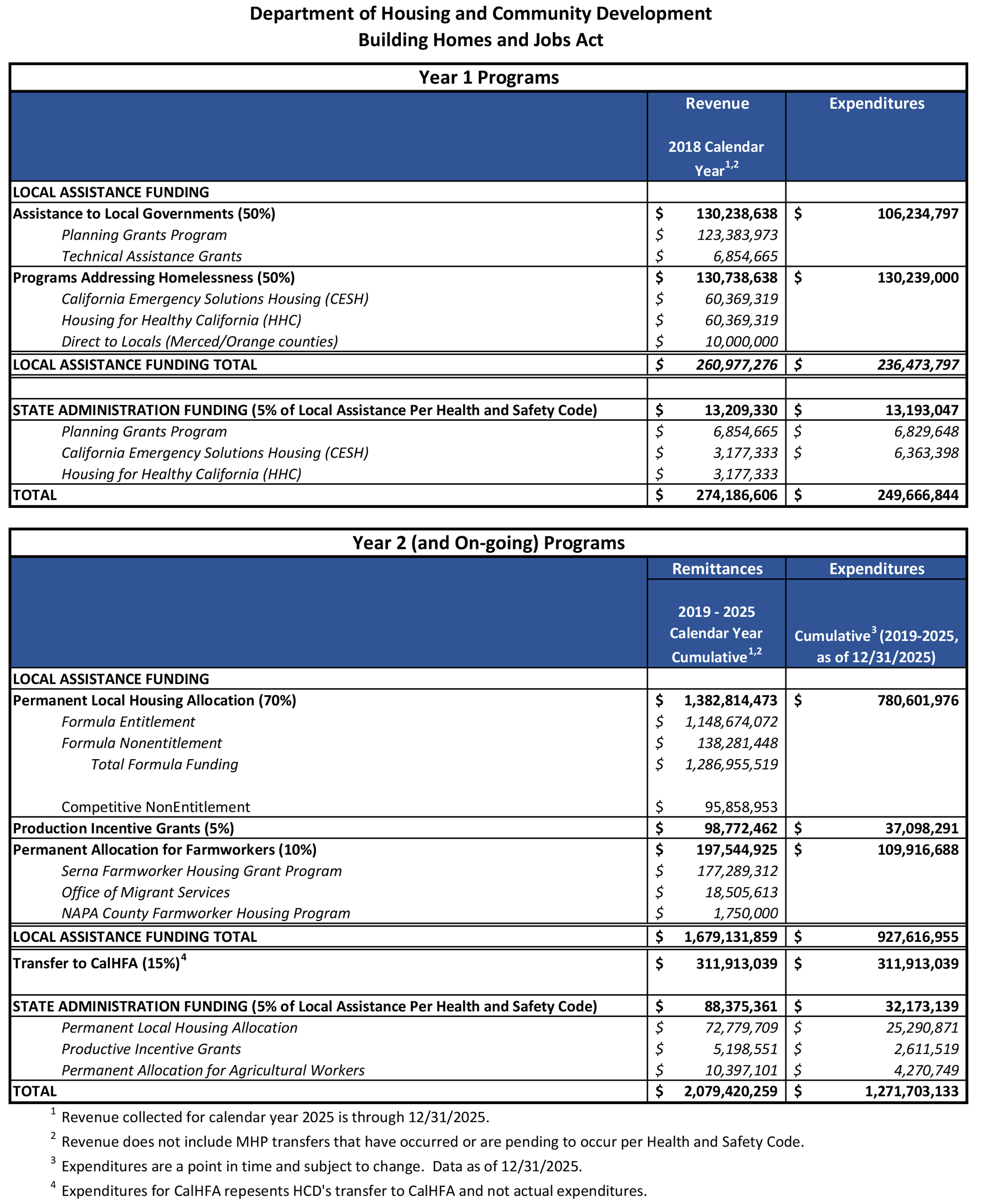

Since being signed by Gov. Jerry Brown the law has collected nearly $2.4 billion and distributed $1.5 billion. Fresno County has collected $35 million thus far, according to data from the state and the county.

Dictos says the state is missing out on millions for affordable housing because of the more lax interpretation.

“I am deeply passionate about affordable housing. As a 23-year-old immigrant with no resources, I was provided with Section 8 housing in the projects on South Lee Avenue,” Dictos told GV Wire.

“My very first experience in Fresno was a hot shower that lasted for an hour; it was the first time in my life I had access to running water. Today, there are many homeless veterans who are looking for that same basic stability and dignity.”

Recorders Warned Lawmakers About Vague Legal Language

At issue is vague legal language that recorders say lawmakers left open to interpretation, said Sutter County Recorder Donna Johnston, who was vice president of the California Recorders Association when SB 2 was written.

At that time, the California Recorders Association went to Atkins to tell her that the bill language wasn’t clear, Johnston said.

“(The) recorders association had many conversations with our legislative folks and personally with me in Senator Atkins’ office about the ambiguities of the legislation which were never resolved,” Johnston told GV Wire.

Recorders don’t have oversight but they can take any piece of legislation and work with their county counsels to interpret it the way they believe the language to be written, Johnston said.

“In any piece of legislation, anything could be interpreted differently, or they work with their county counsel and decide that it may be that their county counsel sees it different ways,” Johnston said.

Dictos said he has been waiting for California Attorney General Rob Bonta or State Controller Malia Cohen to weigh in. Neither the attorney general’s office nor the controller’s office responded to a request for comment.

However, Dictos says the intent of the law is made clear both in the law’s language and when Atkins presented the bill to lawmakers in 2017. The law calls for the $75 fee “per each single transaction per parcel of real property.”

Fresno County Has Sent $54 Million to State Since SB 2 Started

State deficits and contracting budgets have meant reduced funding for homeless shelters. In November 2025, a document circulated amongst the city, the county, and homeless service providers showed more than 300 shelter beds losing funding by June 2026.

The law directs 70% of funds raised to go back to local governments, dividing the rest among statewide farmworker housing (10%), CalHFA “Missing Middle” Housing Development (15%), and incentives to streamline housing (5%) initiatives.

Since its inception, Dictos said he’s sent $54 million to the state. Of that, Fresno County and local cities have received just over $35 million thus far, said Jennifer Kish Kirkpatrick, analyst at Fresno County.

Fresno County has loaned money to affordable housing projects in Mendota, Sanger, and two developments in Reedley. Money collected in 2024 has not been distributed yet. Right now, jurisdictions are working on their 5-year spending proposals. Jurisdictions have five years to utilize the funds. Unspent funding gets taken back and put into a statewide pool for multifamily projects.

Kish Kirkpatrick said Fresno County is working on its plan but still needs the state to publish updated guidelines.

In 2022, Voice of San Diego reported that the state had collected more than $1.6 billion in fees but had only spent 17.7% of funds. More current data shows the state having spent nearly 65% of SB 2 funds.

Kish Kirkpatrick told GV Wire applying for money can be complicated, especially for smaller cities without a dedicated staff. Even after local governments present draft proposals required for funding, the state will often tell cities and counties that the applications need revision.

For this reason, many smaller cities won’t apply for the money, Kish Kirkpatrick said.

One Sentence Gets Three Interpretations

For laypeople, SB 2 language can be complicated, but even experts disagree on what SB 2 means. The main sticking point is when the $75 fee and the $225 maximum applies.

The maximum for SB 2 gets interpreted several different ways. Recorders tend to agree that that maximum applies to the number of official documents attached to a property, whether that be multiple deeds, liens, leases, or a host of other documents.

Fresno County Counsel Douglas Sloan interprets SB 2’s maximum to mean $225 for everything despite the number of documents and the number of parcels, according to a public memo acquired by GV Wire. Requests for comment from Sloan’s office were not returned.

The Tulare County Recorder’s Office interprets the SB 2 maximum to mean the number of documents transacted but says the $75 fee applies to each transaction. Thus, four separate deeds in one transaction for 10 parcels means $225.

Dictos Says Atkins Made It Clear How Law Works

Dictos says the maximum applies to the number of documents but there is not a maximum for each transaction, turning the $225 fee into a multiplier. He said this is clear due to not only language in the law, but also Atkins herself, who said during a hearing it should apply to each parcel.

Dictos said he had conversations with a farmer and with Granville Homes CEO and President/GV Wire Publisher Darius Assemi about SB 2 transactions. Dictos said he told them that the respective fees were $2,000 and $90,000 whereas Tulare County would have only charged up to $225.

“What is $90,000 for Mr. Assemi? What is $2,000 for this farmer?” Dictos said.

Assemi told GV Wire he’s not opposed to SB 2 but wants to make sure money goes to affordable housing.

“I wish this would go to (truly) affordable housing. Not the way the state builds it, which costs two or three times more,” Assemi said. “The key, at the end of the day, is that housing stays as affordable as possible. All these nickel-and-dime fees that ultimately the new homebuyer pays make housing less affordable for our middle-class, hardworking taxpayers in Fresno and Clovis.”

RELATED TOPICS:

Categories

Reddit Goes Down for Thousands of Users, Downdetector Shows