The Centers for Medicare & Medicaid Services anticipates 1 million enrollees to lose Medicare Advantage in 2026 after insurers shed programs. (GV Wire Composite)

- Fresno Unified chose a Medicare Advantage program for its health care plan for retirees in 2023.

- That year, contract disputes between payers and providers spiked, with Medicare Advantage programs dropping since.

- Those programs face issues with capped reimbursement rates, high prior authorization demands, and a risky enrollee pool.

Share

|

Getting your Trinity Audio player ready...

|

When the board behind health insurance decisions for Fresno Unified teachers voted to move away from the district’s self-funded model for retirees and to Aetna’s Medicare Advantage plan, they did so at a time Medicare Advantage plans faced upheaval in the marketplace.

In 2023, the Joint Health Management Board switched from the district’s self-funded insurance to Aetna Advantage, saying the plan would save the district $12 million a year.

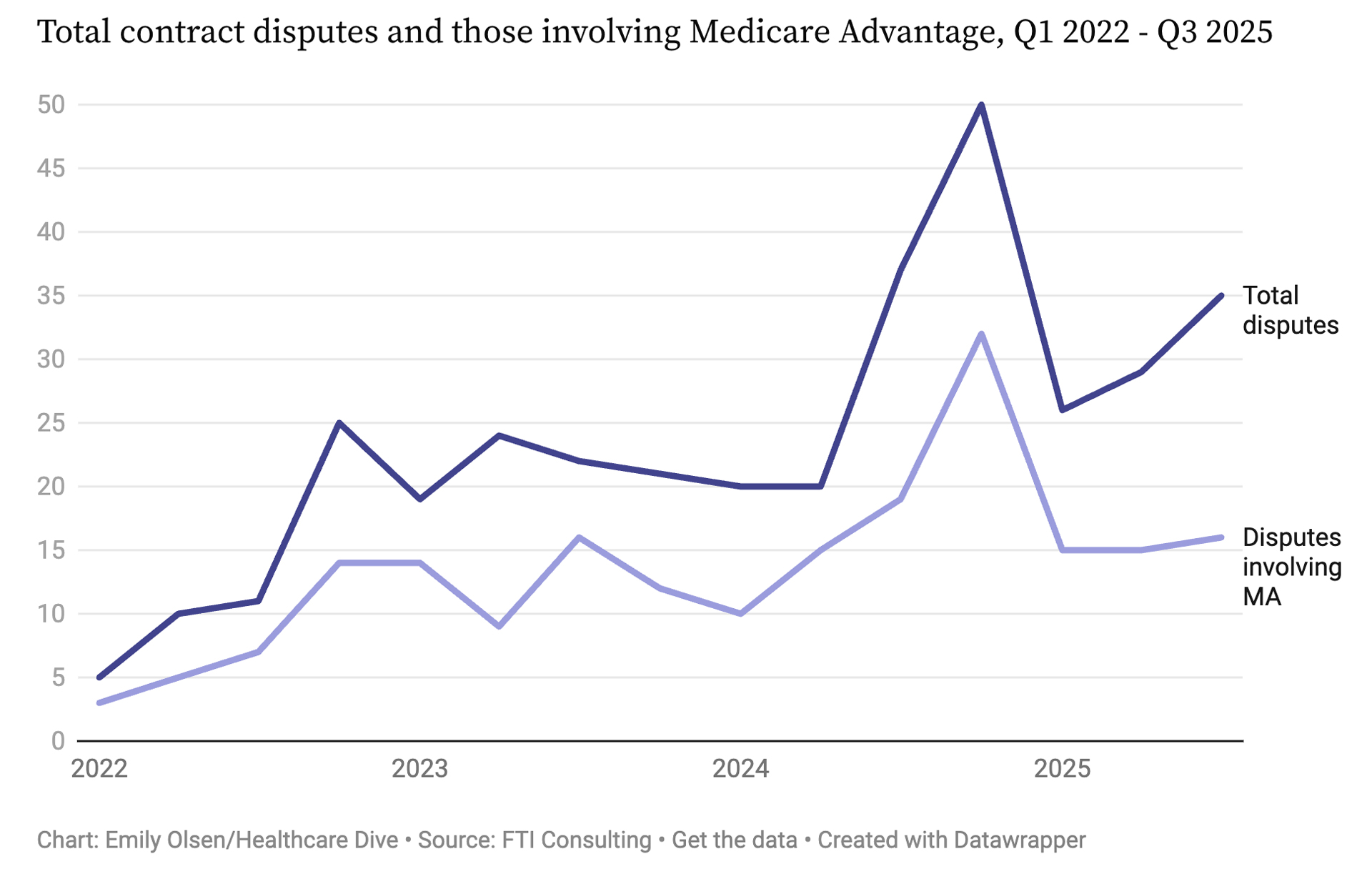

That same year, though, flaws and limitations in Medicare Advantage plans began to show as contract disputes nationwide spiked in 2023, climbing 50% over the year before, becoming an even greater share of insurance disputes, according to Healthcare Dive. Medicare Advantage disputes made up 67% of all disagreements in 2023 compared to 57% the year before.

Related Story: Fresno Unified Retirees Will Have to Wait Until 2027 for New Medicare Option

Since then, public disagreements about insurance plans have only increased with inherent issues surrounding prior authorization, payer mix, and reimbursement rates at the center of the arguments, said Alexandra Rivera-González, assistant professor at UC Merced’s Department of Public Health.

Despite being offered through private companies, significant regulations make elusive a reimbursement rate that payers and providers can agree on. Additionally, unlike standard commercial programs, Medicare Advantage doesn’t have a diverse patient pool of healthy enrollees to dilute insurance payouts.

For regions such as the Central Valley with a provider shortage, the reimbursement problem for providers gets compounded, Rivera-González said.

“How much are they going to be paid because they’re having to put in a lot more work compared to maybe other areas where that’s not so much the case,” Rivera-González said. “They’re pretty much working double, triple, but getting paid the same. A lot of the negotiations fall onto that.”

Fresno County Hit Hardest in California in Lost MA Plans

Medicare Advantage — known as Medicare Part C — has grown dramatically in recent years, enrolling now about 34 million members, or roughly half of people eligible for Medicare. Cracks in the program have begun to show, however, as insurers pull back plan availability.

The Centers for Medicare & Medicaid Services expects Medicare Advantage enrollment to decrease by 1 million beneficiaries this year.

Aetna announced in 2025 that this year the company would cut nearly 10% of its Advantage programs.

“Each year, we assess our ability to meet the health care needs of our members and adjust our plans to ensure they can deliver an excellent and sustainable member experience,” said a spokesperson for Aetna. “For 2026, we decided to stop offering individual Medicare Advantage plans in certain California counties, including in Fresno County.”

UnitedHealthcare, Humana, and Cigna also announced cuts. Minnesota felt cuts hardest as nonprofit UCare announced it would make significant cuts this year.

Fresno County is set to lose the most Advantage plans this year among California counties with a net loss of 11 plans, according to Investopedia.

Value-Based Care Incentivizes Not Taking on Sick Patients

Last year, Aetna switched from a fee-for-service pay model to a “value-based care” model. Aetna said the value-based model pays doctors for treatment results, not based on the number of tests or visits they do.

In a news release, Aetna said the model would fix many problems in health care. The insurer said by focusing on quality, doctors can lower costs for patients.

“Doctors can focus on quality care instead of rushing through appointments,” the release stated. “Employers can offer better health benefits and still manage costs.”

In addition, the fee-for-service model has problems with questionable billing practices.

Kaiser Permanente made national news after it agreed to pay $556 million to settle allegations from the U.S. Justice Department that the provider overbilled approximately $1 billion in Medicare Advantage payments from 2009 to 2018.

A U.S. Senate report likewise accuses UnitedHealth Group of “gaming” Medicare Advantage.

The value-based model also has drawbacks, Rivera-González said. Using the health of a patient as a standard for payment can be hard, especially for older populations with health needs that worsen as they age.

It can also incentivize physicians not taking on sicker patients because their health might not improve.

“If you have a patient who you know is not really going to improve, then is it worth taking that on?” Rivera-González said. “So the value-based care model is kind of another angle as to why these disputes have grown.”

Related Story: Kaiser Permanente to Pay $556 Million in Medicare Advantage Fraud Settlement

Medicare Advantage Prior Authorization Disputes

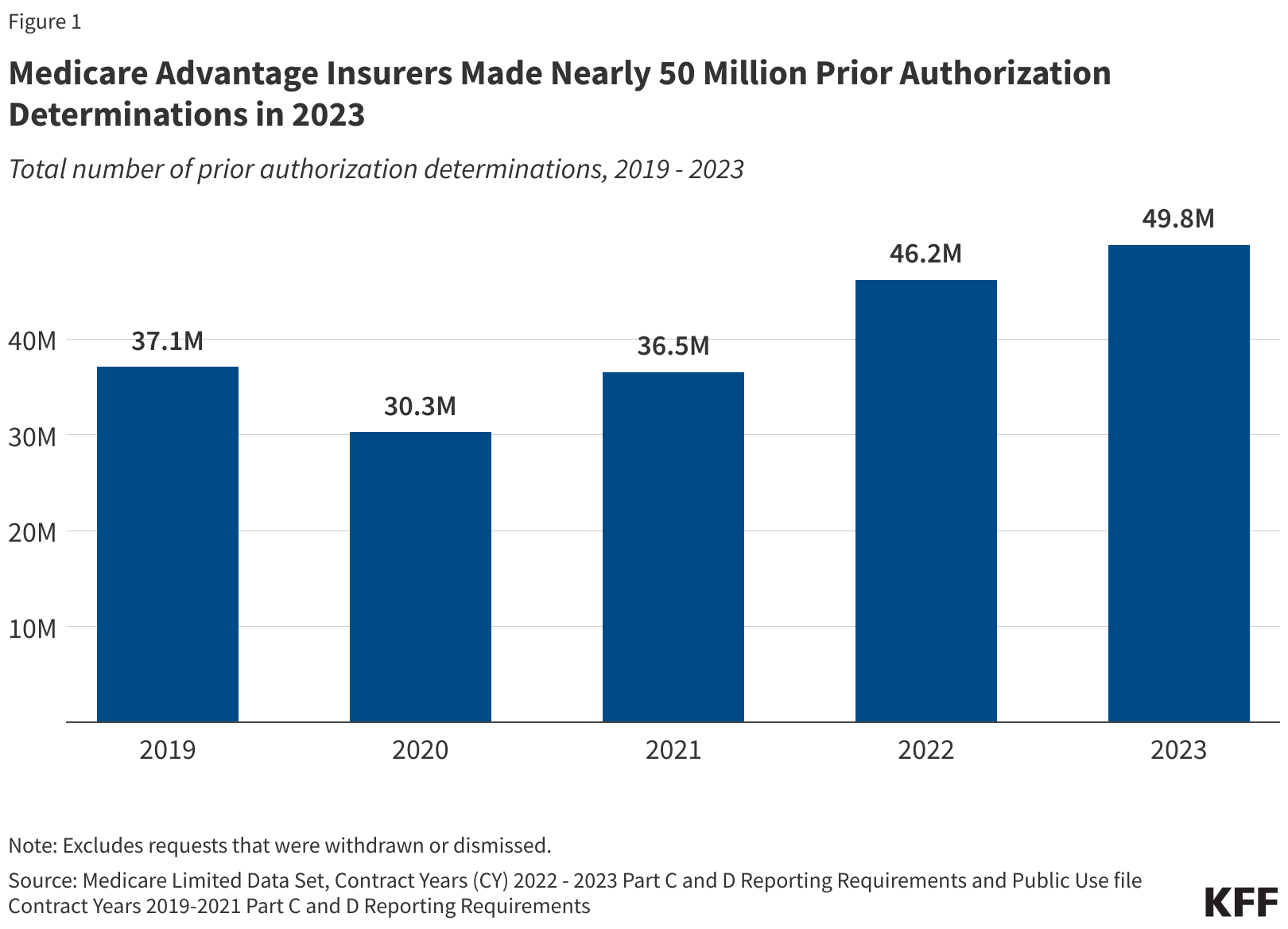

Enrollees in Medicare Advantage also need approval for tests and procedures at a level far greater than those enrolled in Medicare. Despite having a similar number of enrollees in 2023, Medicare Advantage insurers made almost 50 million prior authorization determinations in 2023 compared to 400,000 for Medicare, according to KFF News.

Higher cost services such as inpatient hospital stays, skilled nursing facility stays, and chemotherapy need to get approval compared to Medicare, which only requires prior authorization for certain services.

Medicare did deny requests at a higher level — 28.8% — that year compared to 6.4%, KFF reported. Aetna denied prior authorization requests at a higher level than most insurers, 11%, but also had a higher approval rate after appeal, reversing their decisions in nearly 90% of cases.

Rivera-González said most of those denials come from administrative errors, such as incorrect coding, but for patients awaiting treatment, it can sometimes mean significant delays.

“These are older adults that a lot of times have very complicated health conditions, and so it’s a burden on the patient, it’s a burden on the physician,” Rivera-Gonzalez said.

It’s not just administrative errors that spur disputes, though. Like other businesses, insurers have to consider costs.

Federal regulations cap how much insurers can charge and at the same time, they don’t have a diverse pool of enrollees to diversify their risk. Payers often rely on healthy people paying into the system while drawing less to offset the needs of older populations needing care.

That’s a factor that often comes up in negotiations, Rivera-González said.

“The problem is it’s a really high-risk pool by default because you have older adults with high, chronic comorbidities,” Rivera-González said. “Medicare Advantage plans really try to level that out by charging more or playing with reimbursement rates and things like that because they don’t have many places to make up for it.”