The decision to end the Almond Board of California's objective forecast comes after the largest single-day price loss for the nut in recent history. (GV Wire Composite)

- The Almond Board of California decided to end its annual objective almond forecast that comes out in July.

- The last projection, likely off by hundreds of millions of pounds, caused the largest single-day price loss in recent history.

- The forecast has been fairly accurate in the past and having it creates price stability, said one researcher.

Share

|

Getting your Trinity Audio player ready...

|

How much can a single faulty forecast affect a business? For almond farmers in the Central Valley, the Punjabi American Growers Group says it cost growers $1.2 billion “overnight.”

As a result, the Almond Board of California voted in December to end funding for its annual objective forecast. The decision came after many growers said the 2025 report caused the largest one-day price drop in modern times.

Terra Nova Trading in its July market report said the 50 cent overnight drop was the largest they’ve recorded. That sudden 16% price drop was only the tip of the iceberg as the $3.15 price in May would drop to $2.20 by July, said JJ Magdaleno, partner with Terra Nova.

How far off the estimates were from the actual harvest won’t be known until the final count in July 2026. The Punjabi Growers estimate a discrepancy as high as 500 million pounds while Terra Nova calculates 300 million pounds.

Magdaleno attributes the big drop not to a decline in acreage, but rather a drop in production per acre. The drop, Magdaleno said, is likely the culmination of changing economic, political, and environmental conditions.

Those kind of losses elicit major emotional responses, Magdaleno explained. However, eliminating the forecast could make the situation worse as creating stability will be much more difficult in the years to come, he said.

The position reports have a fairly reliable track record, Magdaleno said, and ending the forecast will bring more uncertainty to a market beset by major fluctuations.

“In a time where obviously growers are struggling financially, we want to try and build good consumption,” Magdaleno said. “My fear is this removal will provide another hurdle that could hinder the optimization of demand growth.”

Buyers, Processors Benefit from Overestimations: Sidhu

While the Almond Board will continue its subjective forecast — which uses grower estimations — a spokesperson said too many variables made accurate predictions difficult for the objective forecast, posted in July.

“Feedback from growers, handlers, and other industry stakeholders highlighted ongoing challenges in accurately capturing variables impacting crop forecasting such as larger crop sizes, diverse grower practices, and weather events across California’s production regions,” a spokesperson for the Almond Board told GV Wire.

Incorrect estimations have real-world impacts, however, said Jasbir Sidhu, co-founder of the nonprofit Punjabi American Growers Group, which estimated the $1.2 billion loss. Objections from Punjabi Growers at the Almond Board meeting spurred the decision to cancel the forecast, Sidhu said.

The price collapse went so far as to cause Sidhu to suspect collusion between forecasters and the processors and buyers that benefitted from lower prices.

“The way these reports get used is to benefit the buyers and the processors,” Sidhu said. “When we’re talking about a $4 billion, $5 billion, $6 billion industry, it’s easy with a little bit of overestimating. And when the crop comes in, it’s very easy to say, ‘It was a climate impact.’ ”

At the very least, Sidhu said, the almond industry has become too large and diverse to accurately forecast almond production.

Sidhu praised the decision by the Almond Board to scuttle the forecast.

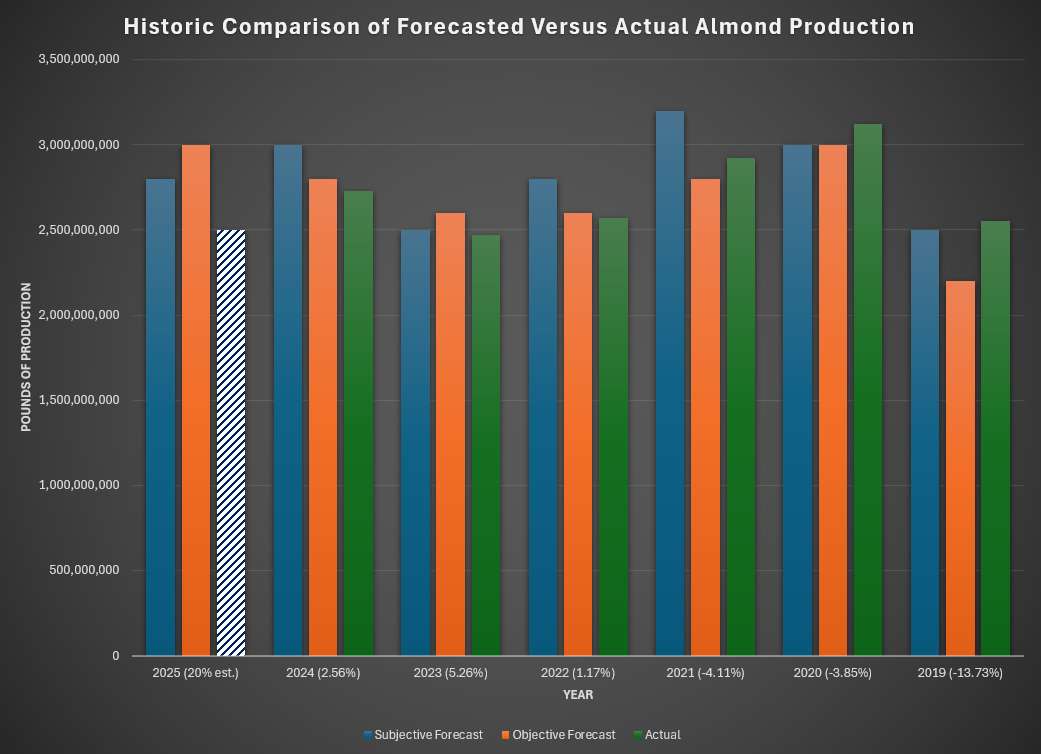

Forecast Had Been Within 5% Since 2020

In the past five years, the objective forecast has been within 5% of actual production, according to Almond Board crop reports. And the 2024 estimation of 2.8 billion pounds was only 2.5% above the actual figure. From 2020 through 2024, the delta between forecast and reality stayed around 5%.

If Sidhu’s 500-million-pound shortfall estimate rings true, there will be a gap of 20%.

Magdaleno attributes the big drop not to a decline in acreage, but a drop in production per acre. Farmers for years have been cutting back on fertilizers and pesticides in response to inflation and tariffs. Pumping restrictions caused by the Sustainable Groundwater Management Act and lower water allocations have likewise made water expensive.

“In the past, most people had enough money to put the water on they needed, to put the fertilizer on they needed, now obviously it’s a lot different,” Magdaleno said.

Those factors came to a head this year and could explain the drastic miscalculation. Terra Nova’s report also cites the massive colony collapse faced this year by beekeepers.

Yield levels were also skewed upward by new plantings in the 2010s. Even though new trees are considered “non-bearing” and aren’t counted in crop reports, they still produce, adding to total production. After the price collapse of 2020, new almond acreage slowed, taking those supplemental figures out of the equation.

“We’re kind of going through an enlightenment phase. That might be a bad phrase, but we’re learning a lot, which I think a lot of growers are having a hard time understanding,” Magdaleno said.

Forecasts Provide Stability: Magdaleno

Having a forecast provides stability for buyers and sellers, Magdaleno said. Terra Nova also deals in cashews around the world. Cashews grow in many poorer countries that don’t have a coordinated approach to production levels.

Because of that, markets tend to be extremely volatile, he said.

“With volatile markets comes caution from buyers. What I mean by that is if you are a retailer trying to figure out what you want to put on the shelves, all you want is stability,” Magdaleno said.

RELATED TOPICS:

Categories

Minnesota Sues Federal Government Over Withheld Medicaid Funds

Fresno Police Arrest 19 in DUI Enforcement Operation