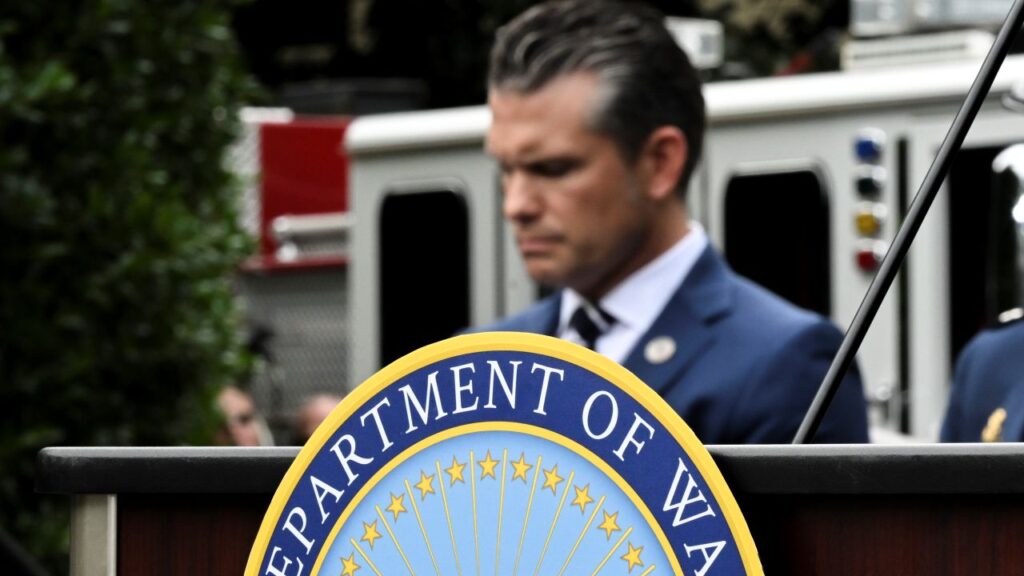

President Donald Trump holds up a signed executive order during a news conference announcing tariffs at the White House in Washington, April 2, 2025. The Supreme Court is set to consider the legality of tariffs the president has invoked emergency powers to place on many trading partners. (Haiyun Jiang/The New York Times)

- Trump administration shifts defense of tariffs, telling Supreme Court revenue is incidental, emphasizing national security and regulatory purposes instead.

- Previously touted as revenue boosters to offset tax cuts, tariffs now defended as tools to influence foreign policy and trade.

- Supreme Court justices express skepticism over administration’s changing rationale, raising questions about the legality of expansive presidential tariff powers.

Share

|

Getting your Trinity Audio player ready...

|

For months, President Donald Trump and his top advisers described tariffs as an economic cure-all, one that would bring in revenue to pay down the national debt, offset tax cuts, support struggling farmers and even provide dividend checks to Americans.

But when the White House’s solicitor general, D. John Sauer, defended Trump’s expansive use of tariffs before the Supreme Court on Wednesday, he expressed a much different view. Despite all the public justifications of the tariffs, Sauer suggested that they were not really about the money at all.

“These are regulatory tariffs,” Sauer said. “They are not revenue-raising tariffs. The fact that they raise revenue is only incidental.”

Job of Congress

At the center of the case is the question of whether Trump overstepped his legal authority by broadly imposing taxes, which is the job of Congress. The Trump administration argued in court that the tariffs were a foreign policy tool that was needed to deal with national security and economic emergencies.

That sudden admission that revenue is secondary represented a sharp reversal for an administration that has repeatedly justified the tariffs as a mechanism for making America rich again.

“When Tariffs cut in, many people’s Income Taxes will be substantially reduced, maybe even completely eliminated,” Trump said in a social media post in April, weeks after unveiling his so-called reciprocal tariffs on most countries around the world. “It will be a BONANZA FOR AMERICA!!!”

As the Trump administration pushed Congress to pass more than $4 trillion in tax cuts over the spring and summer, White House officials made the case that revenue from Trump’s tariffs would offset the cost of the legislation, and they assailed the Congressional Budget Office for failing to account for the import duties.

“Had the CBO conducted an intellectually honest dynamic analysis AND accurately accounted for the Trump tariffs, it would have forecast a massive multitrillion-dollar surplus,” Peter Navarro, the White House trade adviser, wrote in an essay for Fox News in July.

Bessent Large Proponent of Tariffs

Perhaps the biggest proponent of tariffs as a generator of revenue for the federal government has been Treasury Secretary Scott Bessent.

At a White House Cabinet meeting in August, Bessent said he expected that annual tariff revenue could top $500 billion and potentially even go higher.

“So I think we could be on our way, well over half a trillion, maybe towards a trillion-dollar number,” Bessent said. “This administration, your administration, has made a meaningful dent in the budget deficit.”

The Treasury secretary posted a chart on the social platform X in August touting surging tariff income as a “stable, growing source of federal revenue.”

However, as the Supreme Court hearing grew closer, the White House started to change its tenor about tariffs.

In an October news conference at the Treasury Department, Bessent described tariffs as a “surcharge” akin to a fee that a driver would pay to acquire a license.

The White House also walked back the 100% tariffs that it had threatened to impose on China last month in exchange for promises that it would do more to curb fentanyl exports. This buttressed its argument that the threat of tariffs is a national security tool, and not primarily a tax.

“The move to focus on trade agreements and away from revenue is a massive tell,” said Scott Lincicome, the vice president for general economics at the Cato Institute, a libertarian think tank. “You can see the administration is trying to publicly change its arguments and the focus of the tariffs.”

Conservative Supreme Court Justices Skeptical

Some conservative members of the Supreme Court were skeptical of the administration’s rhetorical shift.

“It’s been suggested that the tariffs are responsible for significant reduction in our deficit,” Chief Justice John Roberts said when the case was argued Wednesday. “I would say that’s raising revenue domestically.”

Justice Neil Gorsuch indicated that he understood the legal rationale for the shift. “So revenue-raising tariffs are not foreign affairs, but regulatory tariffs are?” he asked.

The Supreme Court has sometimes overlooked statements from Trump that are at odds with the positions his lawyers have taken in court. In 2018, for instance, in sustaining Trump’s ban on travel from several predominantly Muslim countries, the chief justice discounted Trump’s many assertions about his desire to impose a “Muslim ban.”

On Thursday, Trump again raised the specter of disaster should he lose the case.

“The decision in the Supreme Court would be devastating to our country,” he said during remarks in the Oval Office.

Following the hearing, as the justices begin their deliberations, Trump’s economic advisers reinforced the new rationale for the tariffs.

“The goal of his agenda is bringing back manufacturing and balancing the crisis-level deficits and trade barriers with our global trading partners,” Bessent wrote in a post on X on Wednesday afternoon. “The tariff income is incidental to these urgent goals — not the underlying reason for their application.”

Despite Trump’s sweeping approach to tariffs that imposed levies on allies such as Spain and France on national security grounds, on Thursday morning the president’s top trade negotiator suggested that the White House was mindful of the limitations of his tariff powers.

“The president has never purported to have unlimited authority in this area,” Jamieson Greer, the U.S. trade representative, said on the Fox Business Network. “In fact, his execution of tariffs has limitations — there are certain things you can’t tariff, Congress gets to have a say on all of this.”

—

This article originally appeared in The New York Times.

By Alan Rappeport and Adam Liptak/Haiyun Jiang

c. 2025 The New York Times Company