Recent LA wildfires test Insurance Commissioner Lara's new premium calculation system amid industry pressures. (CalMatters/Jules Hotz)

- Lara's new regulatory plan aims to stabilize the insurance market amid ongoing wildfire challenges.

- Consumer Watchdog criticizes Lara's approach, accusing him of being too close to the insurance industry.

- The Los Angeles fires underscore the vital role of a healthy insurance market in California's economy.

Share

The timing could not have been better — or worse.

Dan Walters

CalMatters

Opinion

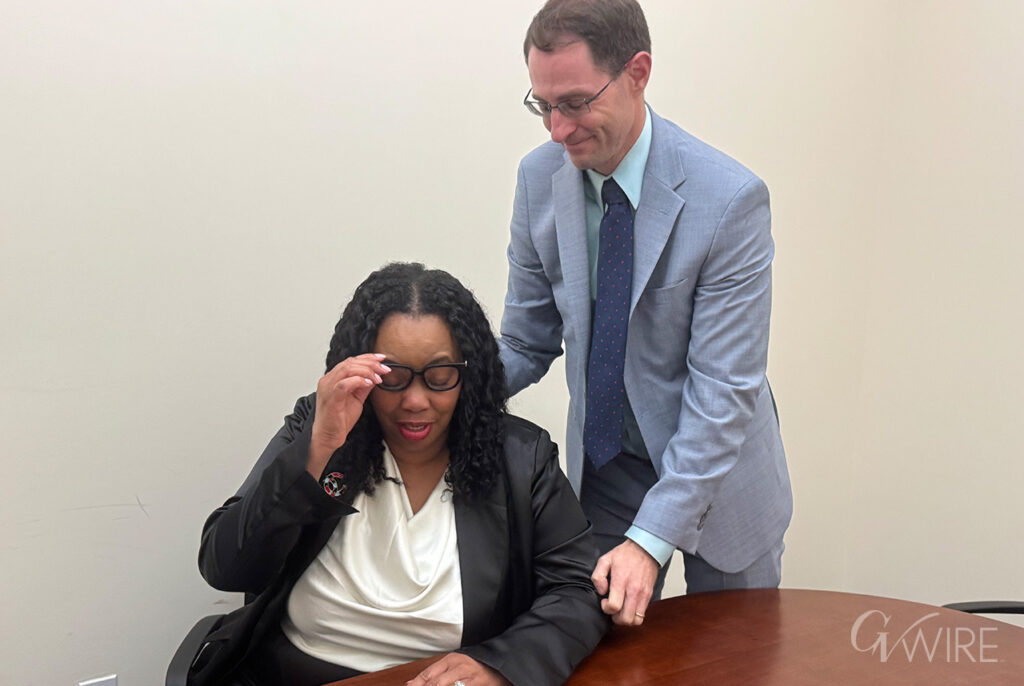

The horrendously destructive and deadly Los Angeles wildfires erupted in January just as Insurance Commissioner Ricardo Lara’s historic and very controversial overhaul of how insurers calculate premiums was taking effect.

On one hand, the disaster drove home the insurance industry’s contention that California’s propensity for such catastrophes creates immense potential losses that cannot be profitably insured without changes in the rate-making system.

However as fire victims inundated insurers with claims, Lara faced pressure to crack down on companies that minimized or delayed settlement payments. Meanwhile, his critics accuse him of being too cozy with the industry he regulates, as a Los Angeles Times article detailed this week.

It is, to put it mildly, a yeasty situation.

Related Story: Southern California Braces for Storm Damage in Wildfire Areas

Lara’s New Regulatory Plan: A Response to Industry Concerns

Lara, a former state legislator who was elected as insurance commissioner in 2018, began drafting his new regulatory plan in response to decisions by major insurers to cut back on policies in California — or even leave the state altogether — because of seemingly endless waves of destructive wildfires.

They contended that California’s long-standing system for calculating premiums, basing them on past experiences, was inadequate. They wanted to include estimates of future exposure, and the costs of obtaining reinsurance to ease their losses, in the process.

Lara incorporated those changes in his plan, but only if insurers were more willing to write policies in fire-prone regions.

“Giving people more choices to protect themselves is how we will solve California’s insurance crisis,” Lara said as he released details of the plan. “For the first time in history we are requiring insurance companies to expand where people need help the most. With our changing climate we can no longer look to the past. We are being innovative and forward-looking to protect Californians’ access to insurance.”

Criticism and Challenges: Consumer Watchdog’s Perspective

It drew sharp criticism from Consumer Watchdog, the Southern California organization that wrote the 1988 ballot measure making the insurance commissioner’s position elective and increasing regulatory powers. The group had been sniping at Lara ever since his election, accusing him of taking campaign money from insurers and not aggressively overseeing their operations.

The group had benefited handsomely from “intervenor fees” in rate-making cases awarded by previous commissioners. Lara has been less generous, although the organization got $643,530 in 2024, 100% of the year’s awards.

Related Story: California Farm Donates Hundreds of Thousands of Eggs to Wildfire Victims, First Responders

Balancing Act: Immediate Responses and Long-Term Stability

The Los Angeles fires have forced Lara to juggle his long-term efforts to stabilize the insurance market with immediate responses to issues arising from the disaster.

Lara authorized insurers to impose assessments on their policyholders to shore up the shaky finances of California’s FAIR plan, a last-ditch system that covers property owners unable to get coverage from the regular market that has seen a huge increase in applications.

However, he refused to immediately approve a request by State Farm, California’s largest insurer, for a 22% emergency rate hike, saying the company had to prove a need.

If nothing else, the Los Angeles fires underscored the absolutely vital role of a healthy insurance market — not only in protecting the investments that Californians have in their homes and businesses, but as a key component in buying and selling of real estate. Lenders simply will not issue mortgages for property that is uninsured.

The insurance commissioner must, of course, protect the interests of consumers, but one of those interests is a healthy insurance market, and a parallel duty is making insurance profitable enough to keep insurers willing to do business in California.

Whether Lara’s rate-making overhaul will fulfill both of those imperatives remains uncertain. He at least deserves credit for trying to fix a dysfunctional system after the Legislature and Gov. Gavin Newsom bowed out and gave him the task.

About the Author

Dan Walters is one of the most decorated and widely syndicated columnists in California history, authoring a column four times a week that offers his view and analysis of the state’s political, economic, social, and demographic trends.

CalMatters is a public interest journalism venture committed to explaining how California’s state Capitol works and why it matters. For more columns by Dan Walters, go to calmatters.org/commentary.

Make Your Voice Heard

GV Wire encourages vigorous debate from people and organizations on local, state, and national issues. Submit your op-ed to bmcewen@gvwire.com for consideration.

RELATED TOPICS:

Categories