State Farm seeks urgent rate increases, citing financial strain from LA fires and market challenges. (CalMatters/Ted Soqui)

- State Farm seeks emergency rate hikes, citing $1 billion in payouts from recent Los Angeles County fires.

- The insurer requests a 22% increase for homeowners and 15% for renters, on top of pending rate hike requests.

- Consumer Watchdog challenges State Farm's financial claims, questioning why its parent company can't assist.

Share

State Farm, the largest insurer for California homeowners, this week asked the state to approve “emergency” rate increases for insurance policy holders, saying the recent Los Angeles County fires have imperiled its finances.

Levi Sumagaysay

CalMatters

The company wants an average 22% increase for homeowners and 15% for renters on top of rate hikes it requested last year. Those requests — 30% for homeowners, 52% for renters and 36% for condominium owners — have not been granted and are being challenged before the state’s Insurance Department, which is investigating the company’s financial situation.

In a letter dated Feb. 3, State Farm CEO Dan Krause and other executives wrote to Insurance Commissioner Ricardo Lara that the company “needs your urgent assistance in the form of emergency interim approval of additional rate to help avert a dire situation for our customers and the insurance market in the state of California.”

State Farm has received more than 8,700 claims and paid more than $1 billion to its customers in the state as of Feb. 1, the executives said. “We know we will ultimately pay out significantly more, as these fires will collectively be the costliest in the history of the company,” they added.

The company has nearly 3 million policies in the state, including 1 million homeowner policies, the executives said. They mentioned that last year, credit-rating firm AM Best downgraded the credit rating for State Farm General, the California arm of the nationwide State Farm Group, because of its financial picture.

Related Story: LA Neighbors Have Vastly Different Post-Wildfire Rebuilding Options Due to ...

State Farm executives want the interim rates to be effective May 1, and referenced their pending rate requests from last year. Also in their letter, they alluded to both their company’s financial position as well as the state insurance market’s ongoing struggles: “In addition to your other efforts, immediate approval of additional and appropriately supported rate… sends a strong message that the state is serious about reforming its insurance market and allowing insurers to collect sufficient premiums to protect Californians against the risk of loss to their homes.”

Lara’s plan to address insurance availability in the state took effect at the beginning of the year, just days before the L.A.-area fires. It is widely expected to lead to significantly higher premium increases as the state allows insurers to include catastrophe modeling and the cost of reinsurance when setting their rates.

In response to State Farm’s new request, the department is scheduling a meeting of its rate-review experts, State Farm and Consumer Watchdog, which last year challenged the rate increases, insurance department spokesperson Gabriel Sanchez said. Department staff will then make an “urgent formal recommendation for action” to the commissioner, Sanchez said.

Carmen Balber, executive director of Consumer Watchdog, said her group has repeatedly asked State Farm for more information about its finances, including why its parent company can’t “step in” and help its California business. Consumer Watchdog last year accused State Farm General of redirecting profit by buying reinsurance from its parent company, an allegation on which the company would not comment.

About the Author

Levi Sumagaysay covers the California economy for CalMatters with an eye on accountability and equity. She reports on the insurance market, taxes and anything that affects the state’s residents, labor force and economy.

About CalMatters

CalMatters is a nonprofit, nonpartisan newsroom committed to explaining California policy and politics.

RELATED TOPICS:

Categories

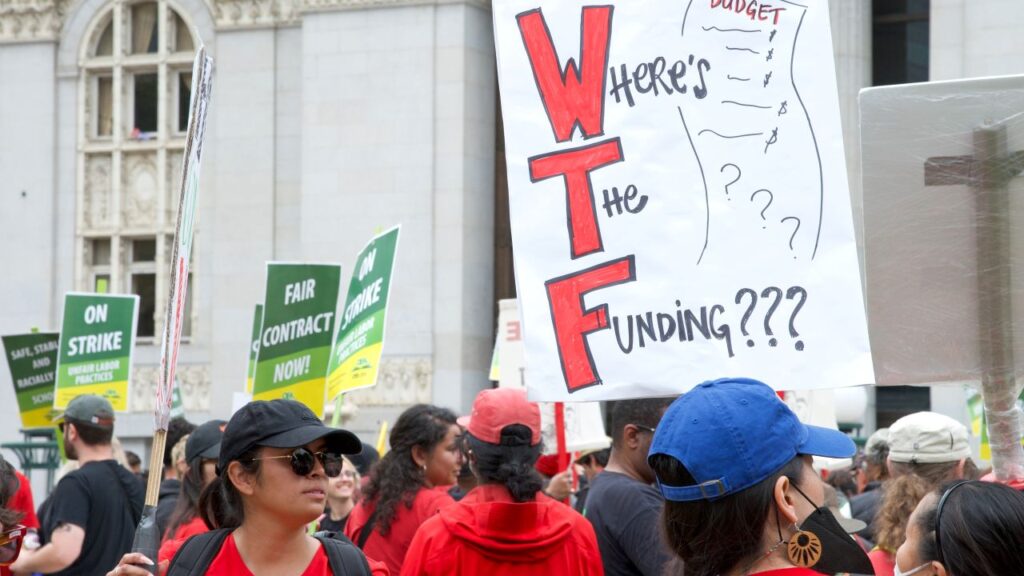

Wave of California Teacher Strikes ‘Is No Coincidence’