Disney's Q1 earnings exceed expectations, boosted by 'Moana 2' success, while streaming services show mixed results. (AP/Scott A Garfitt)

- Disney's Q1 profit soars to $2.55 billion, driven by 'Moana 2' success and strong entertainment segment performance.

- Disney+ sees slight subscriber dip, but company remains optimistic about streaming growth despite price increases.

- Theme park division reports flat operating income, with international parks showing 28% growth in operating income.

Share

NEW YORK — Disney easily topped first-quarter expectations thanks in part to the box office smash “Moana 2.”

There were some oversized expectations for the animated film but “Moana 2”, originally intended as a series for the company’s streaming service before it was produced for the big screen — blew predictions out of the water. Its five-day opening set a new record for Thanksgiving moviegoing.

The Walt Disney Co. earned $2.55 billion, or $1.40 per share, for the period ended Dec. 28. The Burbank, California-based company earned $1.91 billion, or $1.04 per share, in the prior-year period.

Stripping out one-time charges and benefits, earnings were $1.76 per share, which is 32 cents better than Wall Street was expecting, according to analysts surveyed by Zacks Investment Research.

Revenue rose 5% to $24.69 billion, a bit better than analysts had projected.

Related Story: ‘Moana 2’ Cruises to Another Record Weekend and $600 Million Globally

Strong Performance in Entertainment and Content Sales

Revenue in Disney’s Entertainment segment increased 9%. Revenue for content sales/licensing and Other jumped 34% due to the strong performance of “Moana 2.”

CEO Bob Iger and Chief Financial Officer Hugh Johnston said in a prepared remarks that the Moana film franchise demonstrates the strong connection that audiences have with Disney’s stories and characters and further validates the company’s strategy of investing in popular intellectual property.

Streaming Services Show Mixed Results

Disney’s direct-to-consumer business, which includes Disney+ and Hulu, reported quarterly operating income of $293 million compared with an operating loss of $138 million a year ago. Revenue increased 9% to $6.07 billion.

The Disney+ streaming service had a 1% increase in paid subscribers domestically, which includes the U.S. and Canada. But there was a 2% drop internationally, which excludes Disney+ HotStar. Total paid subscribers for Disney+ dipped 1% in the quarter. Disney also said that it had 125 million Disney+ subscribers in the quarter, a slight decline from the fourth quarter. It had 178 million Disney+ and Hulu subscriptions for the quarter, an increase of 900,000 subscribers from the previous quarter.

Iger said during Disney’s conference call that the company is actually very pleased with its subscriber growth for Disney+ and Hulu, particularly because it raised prices.

“Disney’s earnings beat underscores the success of its cost-cutting initiatives and resilient performance in parks and studios, offsetting headwinds in streaming,” Jesse Cohen, senior analyst at Investing.com, said in an emailed statement. “However, the surprising loss of Disney+ subscribers—the first decline since its 2019 launch—raises red flags about saturation in a crowded market and the trade-offs of its pricing strategy.”

Related Story: ‘Sonic 3’ and ‘Mufasa’ Battle for No. 1 at the Holiday ...

Theme Parks and Experiences Division Performance

The Experiences division, which includes six global theme parks, its cruise line, merchandise and videogame licensing, reported operating income was basically flat at $3.11 billion. Operating income fell 5% at domestic parks, as hurricanes caused Walt Disney World in Orlando, Florida to close for a day and canceled a cruise. Operating income rose 28% for international parks and Experiences.

Looking ahead, Disney said that it foresees a modest decline in Disney+ subscribers in the second quarter when compared with the first quarter. The company still anticipates high-single digit adjusted earnings per share growth for fiscal 2025.

Shares climbed about 1% in morning trading Wednesday.

RELATED TOPICS:

Categories

US Brings Dozens of Foreign Military Chiefs to Washington

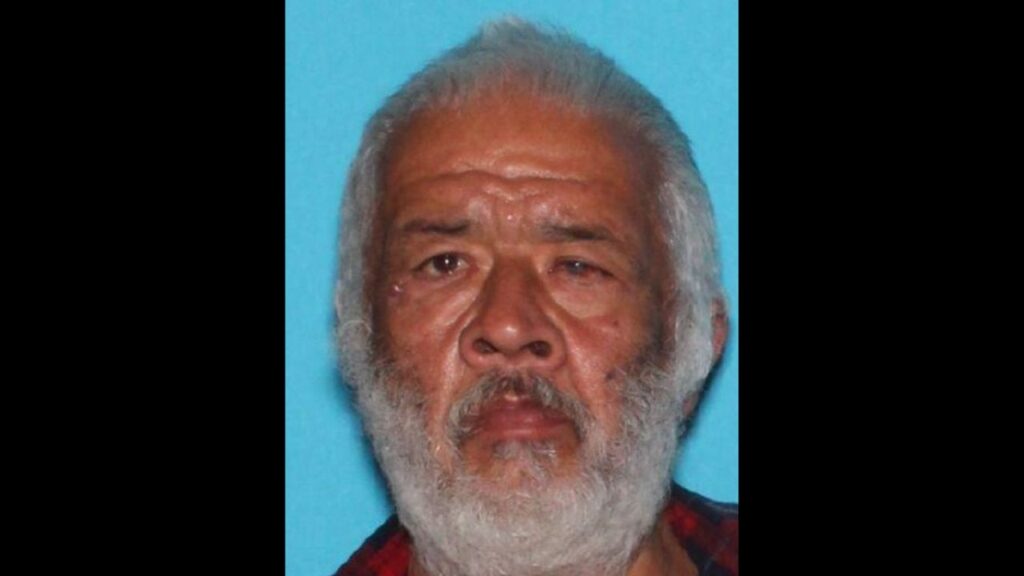

Fresno County Authorities Search for Family of Deceased Man

Two Boys, 8 and 9, Die After Falling Through Ice in Oklahoma