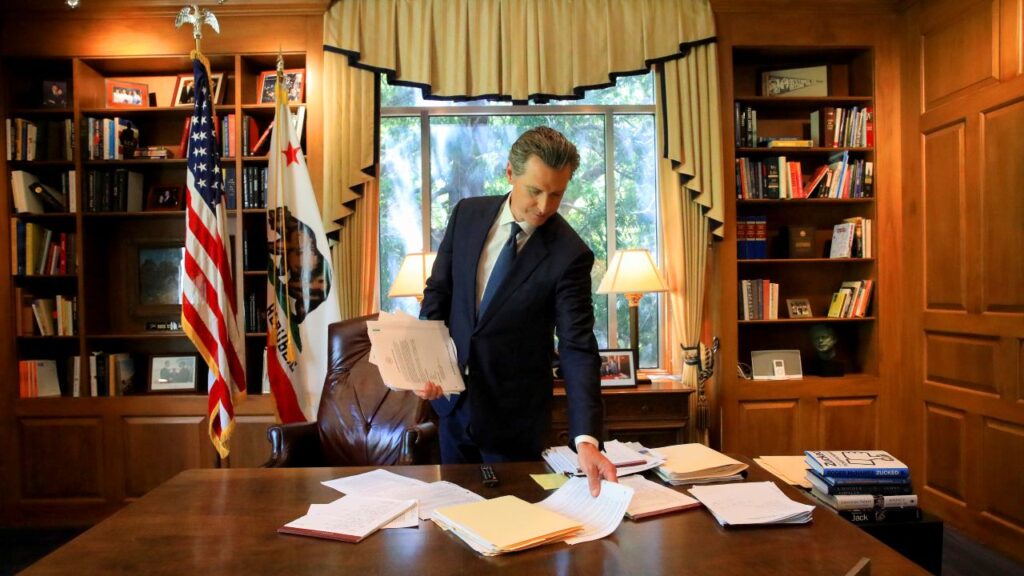

California governor's commitment to financial transparency faces scrutiny as his tax returns remain undisclosed since 2020. (AP File)

- Governor's office promises future access to tax documents but provides no specific timeline for their release.

- Newsom's $9 million Kentfield home purchase brings renewed attention to his personal financial dealings and income sources.

- Previous tax returns showed the Newsoms earned $1.5 million in 2020, with income from government salary and business ventures.

Share

|

Getting your Trinity Audio player ready...

|

Despite pledging to be the first California governor to release his tax returns every year while in office, Gov. Gavin Newsom has yet to make any additional filings public during his second term.

Alexei Koseff

CalMatters

Newsom last disclosed a tax return nearly three years ago, in March 2022, as he was running for re-election. Under a state law, signed by Newsom himself, that requires gubernatorial candidates to release their five most recent income tax returns, the governor shared filings through 2020, when he and wife Jennifer Siebel Newsom earned nearly $1.5 million and paid about $480,000 in taxes.

A spokesperson for Newsom declined to provide CalMatters with any of his tax returns since then. Nathan Click said the governor’s team would organize an opportunity for reporters to review the documents in a controlled setting, as it has in the past, but did not provide a date or respond to any follow-up questions.

Related Story: Gov. Newsom Said No, but California Voters Overwhelmingly Said Yes

New $9 Million Home Purchase Raises Questions

Newsom’s finances have come under renewed scrutiny since media outlets in San Francisco reported late Friday that the governor and his wife recently paid around $9 million for a new home in the Marin County town of Kentfield. The Newsoms revealed over the summer that they planned to move back to the Bay Area from the Sacramento suburbs “to ensure continuity in their childrens’ education.”

Following the publication of this story, the governor’s office clarified that Siebel Newsom had purchased the home using an LLC and no “entities outside of the family” provided financial assistance.

As governor, Newsom receives an annual salary of $234,101, but he also continues to earn income from a wine and entertainment empire that he placed in a blind trust before taking office in 2019. In their tax return for that year, disclosed in 2021, the Newsoms revealed that they had not yet sold their previous home in Kentfield — which was initially placed on the market for nearly $6 million — and were renting it out for $20,000 per month.

Related Story: California Gov. Gavin Newsom Will Spend Part of Week in DC as He Tries to ...

Newsom began releasing his tax returns on the campaign trail in 2017 as he was running for his first term for governor. It resumed a tradition abandoned by his predecessor, former Gov. Jerry Brown, who resisted disclosing his own returns, and was seen as a dig at then-President Donald Trump, whose refusal to make his tax filings public was an enormous political controversy at the time.

Two years later, Newsom signed a bill — previously vetoed by Brown — to keep presidential candidates off the California primary ballot unless they released their tax returns. The California Supreme Court ultimately struck down the law as unconstitutional, though they did maintain a secondary provision that extends the same requirement to gubernatorial candidates in the state.

About the Author

Alexei Koseff covers Gov. Gavin Newsom, the Legislature and California government from Sacramento.

About CalMatters

CalMatters is a nonprofit, nonpartisan newsroom committed to explaining California policy and politics.