The Treasury Department in Washington, Jan. 20, 2023. A nonpartisan group projects that former President Donald Trump’s economic plans would lead to an additional $7.5 trillion in government debt over 10 years, more than twice the $3.5 trillion projected for Vice President Kamala Harris’s plans. (Kenny Holston/The New York Times)

- Investors focus on Trump's policies, projecting increased debt, higher tariffs, and potential inflationary pressures impacting yields.

- Analysts predict a close link between Trump’s rising election odds and the recent increase in 10-year Treasury yields.

- Some worry Trump's potential tax cuts and tariffs could reignite inflation, challenging the Federal Reserve's interest rate decisions.

Share

|

Getting your Trinity Audio player ready...

|

The $28 trillion Treasury market is arguably the most foundational financial market in the world. It’s where the U.S. government auctions its debt to investors who buy and trade that debt, influencing borrowing costs across the globe.

It has also become one of the main places for investors to express their views on the race for the White House.

Vice President Kamala Harris and former President Donald Trump have each pledged tax and spending policies that would most likely increase federal deficits, leading to more government borrowing.

But it is Trump’s proposals — including steep tariffs and extra-large tax cuts — that investors have become focused on, especially as his odds of winning have risen in some betting markets.

Related Story: What Happened When a Barber Told Trump About His $15,000 Electric Bill

Trump’s Policy Draw Higher Estimates of Debt

His policies have drawn higher estimates of government debt from economists. One nonpartisan group, for instance, has projected that Trump’s platform would lead to an additional $7.5 trillion in U.S. Treasury debt issuance over a decade — more than twice its estimate for Harris’ policies.

“Trump wins, you short bonds” — bet that their value will fall and yields will rise further — and “lever up” on stocks, said David Cervantes, the founder of Pinebrook Capital, an asset management firm. He is a believer in what has come to be called the “Trump trade” in finance: a bet that Trump assuming power would boost inflation and interest rates but might also juice corporate earnings in the near term.

The 10-year Treasury yield — the benchmark rate for government borrowing, which in turn affects borrowing for households and businesses — has risen 0.6 percentage points since mid-September, a swift move higher. And Trump’s odds of victory, as reflected by wagers on the betting site Polymarket, have risen over the same period, finally clawing their way back to where they were before Harris emerged as the Democratic nominee.

“There is clearly a close relationship between the two,” said Andrew Brenner, head of international fixed income at National Alliance Securities.

But betting markets aren’t predictive of outcomes. And it is hard to disentangle this explanation for the move in Treasury yields from other influences on interest rates: growth expectations, the latest inflation numbers, the inflation outlook, market expectations about Federal Reserve policy, Fed officials’ own data-dependent policy projections and more.

Yields fell over the summer, when unemployment was ticking higher. Fears of a downturn tend to be correlated with lower yields. Yet that trend appears to have reversed based on recent job data. Warren Pies, a co-founder at 3Fourteen Research, is among those who believe this reversal is primarily responsible for lifting yields.

The most recent rise in longer-term Treasury yields has come as the Fed has begun lowering short-term interest rates. And the Fed’s decision to cut interest rates while the economy is still growing has also raised concern among some investors that a tail wind from lower rates could reignite inflation, necessitating higher interest rates in the future.

Related Story: Harris Calls Trump a Fascist: 6 Takeaways From Her CNN Town Hall

Concerns Intensify if Trump Wins White House and Congress

That concern could intensify should Trump’s Republican Party gain control of both the White House and Congress — opening a path to put his stimulative policies into place with less legislative resistance.

Along with an ambitious set of tax cuts, Trump has repeatedly affirmed his promises to greatly raise tariffs. Many expect that such jacked-up import taxes, when combined with higher deficits, will reignite inflation that the Fed has only recently appeared to tame.

“We would see tariffs as adding to inflationary pressures,” said Mark Dowding, chief investment officer at RBC Global Asset Management. “This may make it more challenging for the Federal Reserve to lower interest rates next year, if Trump prevails.”

And that market shift, in turn, could raise borrowing costs for households and businesses.

If investors respond to more debt issuance in a higher-inflation environment by demanding higher yields, that may also raise benchmark interest rates for the U.S. government.

But even with that elevated supply of incoming government bonds in view, some bond managers view the level of debt as a secondary consideration, not the central one.

“We view supply as a passenger and not a driver of U.S. Treasury yields,” Leslie Falconio, head of taxable fixed-income strategy at UBS Global Wealth Management, said of the prospect of increased issuance of government bonds. “It is growth and inflation that are the primary drivers, not supply.”

Related Story: California Reservoirs Are Flush, but Water Politics May Trump Hydrology

If inflation expectations — which influence the behavior of key bond investors — manage to stay anchored, even with higher tariffs and deficits, the hefty uptick in debt expected in late 2025 may not matter as much as feared.

And for now “inflation expectations are low,” said David Kotok, the chief investment officer at Cumberland Advisors, even though near-term and long-term expectations for government debt growth are soaring. The inflation-adjusted return expected on buying government debt, in the form of bonds, remains “positive and attractive,” he said.

A trade war — potentially driven by tariffs — or another shock, like geopolitical turmoil that sends oil prices soaring, is on his and other investors’ list of worries. Still, in Kotok’s view: “No shock, no debt absorption problem.”

For many fund managers, rising yields at a certain point become too attractive to pass up, especially since Treasurys, which pay bondholders in U.S. dollars, are broadly considered the world’s safest assets.

At current levels, a bit above 4%, Treasury yields on offer to investors are still “a gift from the market gods,” Callie Cox, the chief market strategist at Ritholtz Wealth Management, argues — especially compared with the low rates of the 2010s.

–

This article originally appeared in The New York Times.

By Talmon Joseph Smith and Joe Rennison/Kenny Holston

c. 2024 The New York Times Company

RELATED TOPICS:

Categories

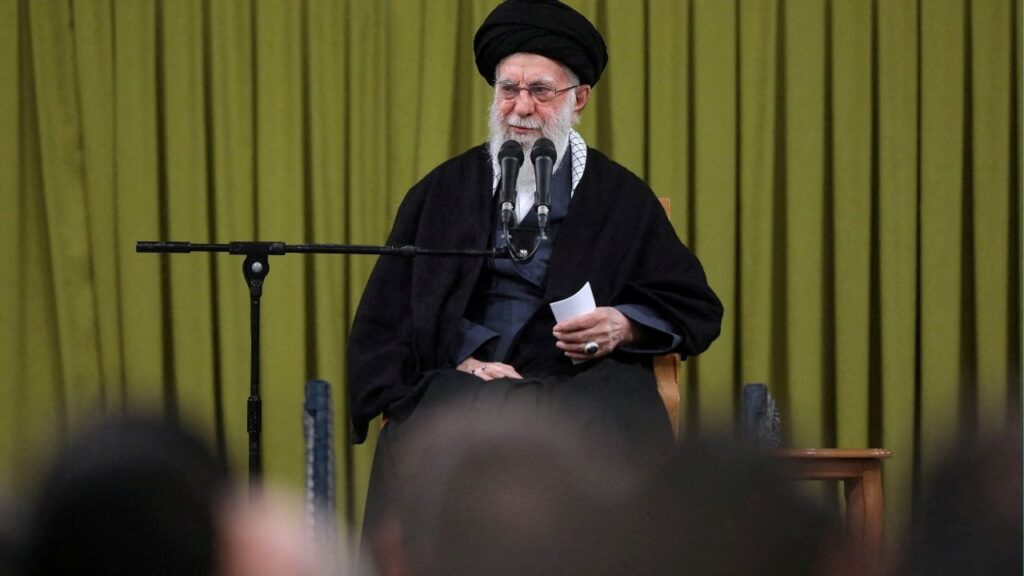

Who Could Take Over for Ayatollah Ali Khamenei?

Why Have You Started This War, Mr. President?