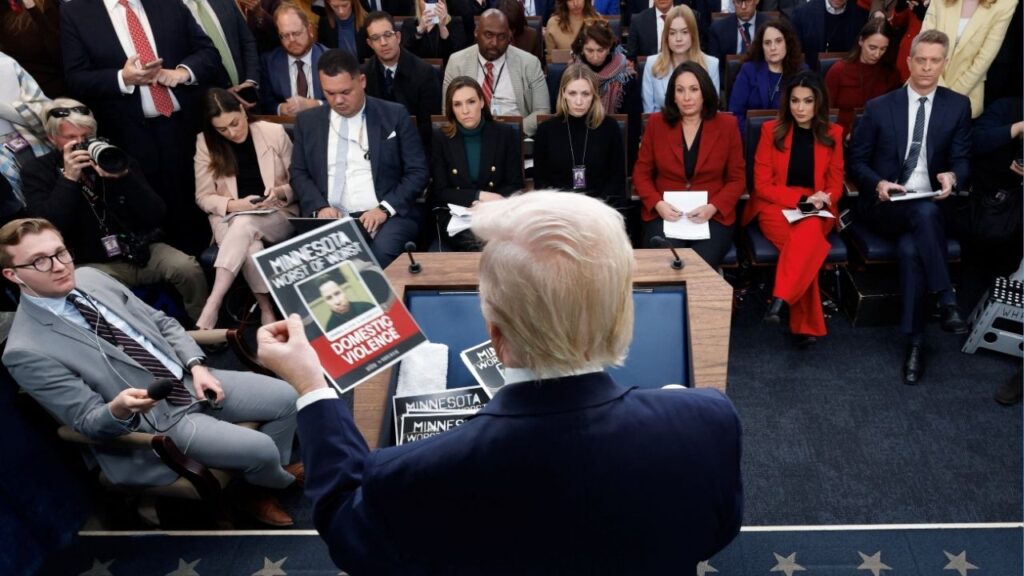

California's Insurance Commissioner Ricardo Lara is reforming the state's home insurance market to address rising premiums and policy cancellations. (CalMatters/Anne Wernikoff)

- Ricardo Lara, California Insurance Commissioner, has proposed two rules to tackle the state's home insurance crisis.

- The first rule simplifies rate reviews, the second permits insurers to use catastrophe modeling for premiums.

- Homeowners, consumer groups, and ex-insurance commissioners have voiced concerns over new regulations.

Share

|

Getting your Trinity Audio player ready...

|

With more California homeowners just discovering their insurance policies are getting canceled — and hundreds of thousands of others stuck with a pricey option of last resort — state Insurance Commissioner Ricardo Lara’s efforts to fix the home insurance market can’t come quickly enough.

Levi Sumagaysay

CalMatters

Lara has introduced two main regulations, with more to come. The first, unveiled last month, aims to streamline rate reviews. State law gives the Insurance Department the power to approve or deny insurers’ requests to raise premiums. Insurance companies complain the process has been holding up the increases they seek as a result of what they say are increased costs due to rising climate-change risks and inflation.

The second regulation will let insurers use catastrophe modeling — which combines historical data with projected risk and losses — along with other factors when setting their premiums. California is the last state to allow for catastrophe modeling.

“We’re undertaking the state’s largest insurance reform,” Lara said during a press conference earlier this month. “We can no longer look solely to the past to guide us to the future.”

He said catastrophe modeling will lead to “more reliable rates,” “greater insurance availability” and “safer communities,” because he said it would further encourage and reward wildfire mitigation by homeowners and communities. Insurance Department spokesperson Michael Soller said success will mean fewer homeowners needing to turn to the FAIR Plan, the state-mandated insurer of last resort.

Insurance Industry Backs Lara’s Proposals

Insurance trade groups, which stand to benefit most from the new regulations, agree with Lara’s support for catastrophe modeling and support his so-called sustainable insurance strategy. So do fire chiefs, to an extent. But almost everyone else — homeowners, consumer groups and former insurance commissioners — has lingering concerns.

U.S. Rep. John Garamendi, a Democrat representing parts of Solano and Contra Costa counties, had two stints as state insurance commissioner in the mid-1990s and early 2000s. He says the insurance market is “in chaos” — and that Lara should be holding public hearings and demanding insurance company executives testify to explain to Californians why their premiums are rising.

“One of the critical things a commissioner does is to analyze the market and provide the public with information,” Garamendi said in an interview with CalMatters. “(Lara) didn’t use his power to control the industry and second, to inform Californians.”

The criticism drew a retort from Soller: “Commissioner Lara is fixing decades-long neglected issues that have led to this crisis. He is focused on safeguarding the integrity of the state’s insurance market, not second-guessing from predecessors who had their chance and failed to act.”

Dave Winnacker, chief of the East Bay’s Moraga-Orinda Fire District, said the upsides of catastrophe modeling include being able to credit what homeowners, communities, and governments do to lessen wildfire risk. That includes being able to account for the numbers and proximity of firefighters in certain areas, Winnacker said.

“Depending on where you are in a state, and that’s tied to population density, the number of firefighters available could affect the outcome (of a wildfire),” he said, adding that catastrophe models should reflect that.

He also said he and other fire chiefs are working to ensure the interests of consumers, fire professionals, insurers, and the state are aligned. Insurers may not know what homeowners, communities and local fire departments are doing to reduce wildfire risk. One idea: a database to share that information.

Related Story: How Will California Respond to Home Insurance Market Meltdown?

“There is no future in which we can price our way out of this crisis with just premiums,” Winnacker said, adding that everyone needs to work together.

Dave Jones, the state insurance commissioner for eight years before Lara took over in 2019, said he is “trying to avoid looking over the shoulder of my successor.”

Jones is now director of the Climate Risk Initiative Center for Law, Energy & the Environment at UC Berkeley School of Law. He said it is good for consumers that the catastrophe-modeling regulation could take forest management into consideration. But he said he’s not sure Lara’s actions will be sufficient.

What’s Ahead?

Before the end of the year, Lara is also expected to issue a regulation that will allow insurers to factor reinsurance costs into their rates. Reinsurance is insurance for insurance companies in the event of large payouts. That plus the other new regulations may “help in the short to mid term,” giving insurance companies the ability to raise premiums, Jones told CalMatters.

But he said those actions may “ultimately be overwhelmed by our failure to stop the fossil-fuel industry, which is contributing to rising temperatures” and therefore insurance losses.

Jones also pointed out that Florida has long allowed insurers to use catastrophe modeling and has let them factor in reinsurance costs in their rates — yet its insurance market is in worse shape than California’s.

“Florida has done what insurers are asking for,” Jones said. Yet “Florida’s rates are three or four times the national average.”

Mark Friedlander, spokesperson for the Insurance Information Institute, an industry group, confirmed that the group estimates that Florida’s average home insurance premium was $6,000, or three-and-a-half times the national average, in 2023.

In addition, Jones said Florida’s version of California’s last-resort FAIR Plan — called the Citizens Property Insurance Corp. because it’s funded with a surcharge on policyholders — has more than 1 million policies. California’s growing FAIR Plan, run by a pool of insurers, has 373,000 policies, its president told state lawmakers recently.

“That raises the question,” Jones said. “Giving insurers (higher rates) and shifting the burden to all Californians… whether that’s going to be enough in the face of growing background risk associated with climate change.”

“There is no future in which we can price our way out of this crisis with just premiums.”

DAVE WINNACKER, CHIEF OF THE EAST BAY’S MORAGA-ORINDA FIRE DISTRICT

Higher Premiums Not Enough for State Farm in Some Cases

Meanwhile, last week State Farm said that it is not renewing policies for 30,000 California homeowners, as well as refusing to cover all commercial apartments by not renewing 42,000 of those policies.

This is happening despite California approving State Farm’s requests to levy double-digit premium increases last year.

“One of our roles as the insurance regulator is to hold insurance companies accountable for their words and deeds,” said Soller, the Insurance Department spokesperson. “State Farm General’s decision… raises serious questions about its financial situation — questions the company must answer to regulators.”

State Farm spokesperson Sevag Sarkissian would not comment beyond the statement the company put on its website last week, which read in part: “This decision was not made lightly and only after careful analysis of State Farm General’s financial health, which continues to be impacted by inflation, catastrophe exposure, reinsurance costs, and the limitations of working within decades-old insurance regulations.”

Sarkissian also referred CalMatters to the Personal Insurance Federation of California, which counts State Farm as a member. The industry group’s president, Rex Frazier, said in an email last week that allowing insurers to use catastrophe modeling would help with insurance availability. Yet in its statement, State Farm acknowledged the actions Lara is taking to try to fix the insurance availability and affordability crisis in California, even as it announced its decision not to renew tens of thousands of homeowners.

“If a big chunk of your insurance rate is behind a ‘black box,’ then that’s not what the voters passed.”

CARMEN BALBER, EXECUTIVE DIRECTOR OF CONSUMER WATCHDOG

Joyce Kaufman, a retiree in June Lake in Mono County, recently got a notice of non-renewal for her homeowners insurance with Farmers, which she said she and her husband were dreading but expecting.

“I’m not really sure what the state’s trying to do, both at the commissioner and legislative level,” Kaufman said. And losing the ability to renew her policy is affecting her other insurance needs, she said. As her broker helps look for an alternative, her auto premium is now going up about $300 a year because it will no longer be bundled with home insurance.

As the new regulations give insurance companies what they had asked for, one part of Lara’s strategy — which he first laid out last year after an executive order by the governor — is conspicuously missing. Lara had said insurance companies would be required “to commit to writing at least 85 percent of their statewide market share in wildfire-distressed underserved areas.”

That provision is nowhere in the text of Lara’s unveiled regulations so far — an omission not lost on consumer groups or former commissioner Jones.

“Where is that 85 percent?” asked Carmen Balber, executive director of Consumer Watchdog. Soller, the Insurance Department’s spokesperson, said that part of the commissioner’s strategy is coming.

Balber also said she is concerned that the catastrophe-modeling regulation “appears to not comply with the transparency requirements of Prop. 103,” the voter-approved law that regulates the insurance industry.

According to the text of the regulation on catastrophe modeling, the public will be able to take part in reviewing catastrophe models before they’re deemed acceptable. But anyone who helps review the models will be required to sign a nondisclosure agreement.

“If a big chunk of your insurance rate is behind a ‘black box,’ then that’s not what the voters passed,” when they passed Proposition 103 in 1988, Balber said. “At the end of the day, if the commissioner passes something that hides something behind closed doors, we’ll have to consider challenging it.”

About the Author

Levi Sumagaysay covers the economy for CalMatters. Previously, she was a senior reporter who covered worker issues, the gig economy, inequality and corporate accountability for MarketWatch. She also was a longtime reporter and tech and business editor at the Mercury News. She is based in the Bay Area.LaNaisha Edwards is the California member engagement associate for Crime Survivors for Safety and Justice, the nation’s largest network of survivors of crime. She wrote this for , a nonprofit, nonpartisan newsroom committed to explaining California policy and politics.

Make Your Voice Heard

GV Wire encourages vigorous debate from people and organizations on local, state, and national issues. Submit your op-ed to bmcewen@gvwire.com for consideration.